The unknown fund upstaging tech in June

Although the technology sector was the leading Investment Association sector in June, the best-performing individual fund came from the Specialist sector.

7th July 2025 14:31

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

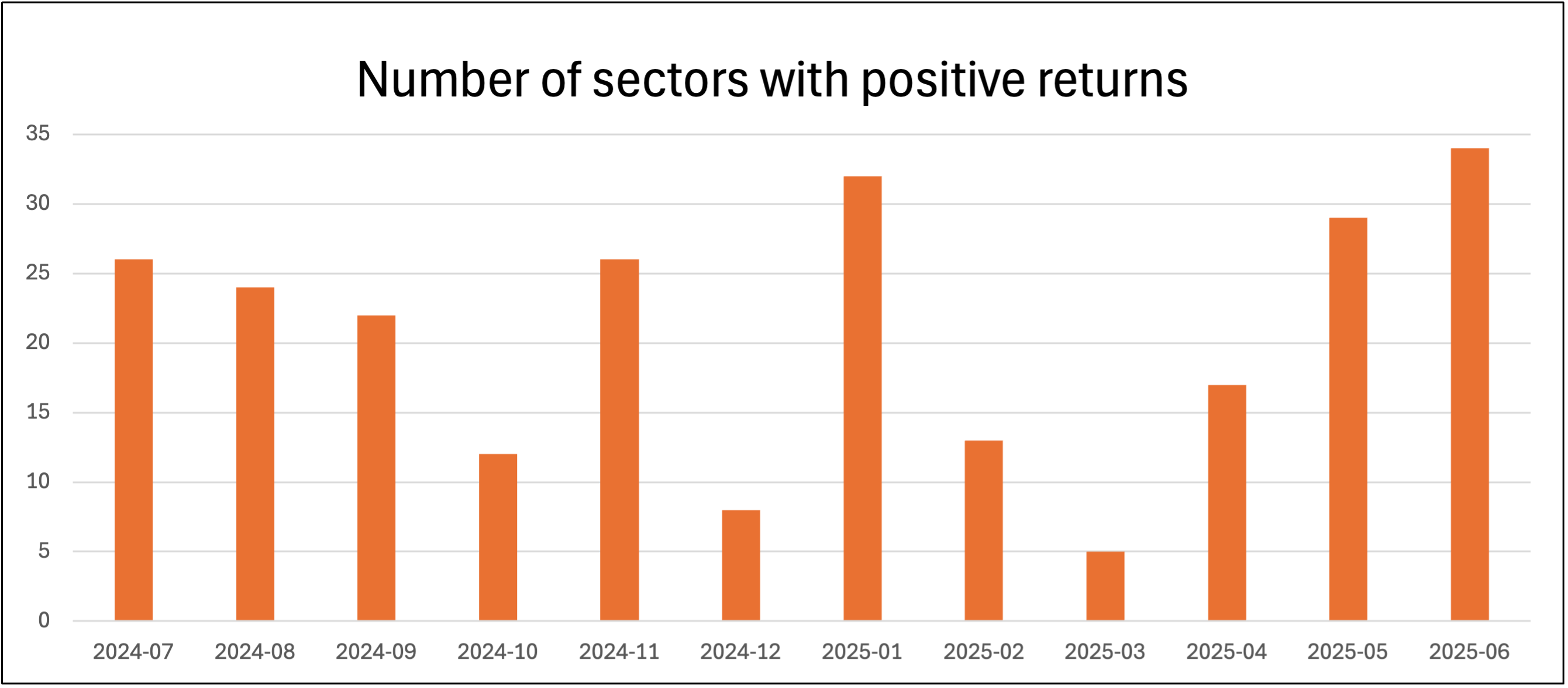

Over the past few months, the total number of sectors making gains has been steadily increasing.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

Past performance is not a guide to future performance.

Only five of the 34 sectors that we regularly monitor rose in March, which was the worst result for a long time. April was better, with 17 sectors making gains, and by May that number had increased to 29. June was the best month that we have seen for over a year, with all sectors posting positive returns.

That said, the leading sectors have not done quite as well as they did in May, when Technology & Technology Innovation topped the table with a return of 8.8%, followed by UK Smaller Companies, which gained 7.3%. Two other sectors also rose by more than 6%. In June, the Technology & Technology Innovation sector held on to the top spot, but with a slightly lower return of 6.5%. No other sectors gained more than 4%, with Global Emerging Markets next in line, up 3.8%.

Five out of our top 10 funds came from the Technology & Technology Innovation sector in June, all of which also featured in the May shortlist. However, the strongest performer in June was Barings Korea, from the Specialist sector.

Saltydog’s top 10 funds in June

| Fund | Investment Association sector | Monthly return |

| Barings Korea | Specialist | 19.4 |

| Polar Capital Global Technology | Technology & Technology Innovation | 12.3 |

| Liontrust Global Technology | Technology & Technology Innovation | 11.3 |

| Polar Capital PLC-Artificial Intelligence | Global | 9.2 |

| Pictet - Robotics | Technology & Technology Innovation | 8.7 |

| TM Stonehage Fleming Opportunities | UK All Companies | 8.5 |

| WS Blue Whale Growth | Global | 8.4 |

| BGF World Technology | Technology & Technology Innovation | 8.1 |

| Polar Capital Smart Energy | Specialist | 7.8 |

| L&G Global Technology Index | Technology & Technology Innovation | 7.7 |

Source: Morningstar. Past performance is not a guide to future performance.

Barings has a long and complex history going back to 1762. It started life as a merchant trading company, founded in London by Sir Francis Baring and his brother John, sons of a German wool trader. In the UK, it's perhaps best remembered for the dramatic collapse of Barings Bank in 1995, triggered by unauthorised derivatives trading by Nick Leeson in its Singapore office. However, the asset management arm survived, was acquired by the Massachusetts Mutual Life Insurance Company (MassMutual), and has since rebuilt its reputation as a respected global investment house.

In particular, it has carved out a reputation for managing funds in more niche or targeted sectors and regions, including a number of country-specific strategies. Earlier this year, we highlighted the Barings German Growth fund, which was the best-performing fund in 2025 at the time, and still features in our Ocean Liner portfolio.

The Barings Korea fund aims to achieve capital growth by investing at least 70% of its assets in equities and equity-related securities of companies that are either incorporated in South Korea, conduct most of their business in Korea, or are listed on Korean stock exchanges. Its objective is to outperform the Korea Composite Stock Price Index (KOSPI) over a rolling five-year period, after fees.

South Korea is the fourth-largest economy in Asia and ranks 13th globally by nominal GDP. It is a highly industrialised, export-led nation with a reputation for technological innovation, efficient infrastructure, and advanced manufacturing. However, its stock market can be volatile.

- Key trends and top-performing funds so far in 2025

- 10 hottest ISA shares, funds and trusts: week ended 4 July 2025

After a slow start to the year, sentiment towards Korean equities appears to be improving. Exports have begun to recover, the global interest rate environment is more stable, and the recent strength in semiconductor demand has benefited some of Korea’s largest listed companies. The Barings Korea fund has taken advantage of these developments.

The fund currently has around 25% invested in technology companies and 20% in industrials, with additional exposure to financials, consumer cyclicals, and healthcare. Its two largest holdings are SK Hynix and Samsung Electronics Co Ltd DR (LSE:SMSN), two of Korea’s most important and globally competitive companies.

SK Hynix is a major manufacturer of memory semiconductors, including DRAM (Dynamic Random Access Memory)and NAND flash products, and a key supplier to global tech giants. In recent months, it has emerged as a critical player in the AI hardware supply chain. In fact, it is now the world’s largest supplier of high-bandwidth memory (HBM), with around 70% market share.

In the first three months of this year, SK Hynix reported a 158% year-on-year rise in operating profit, reaching 7.44 trillion won (£3.7 billion), on revenue of 17.64 trillion won (£8.8 billion). The surge was driven by demand for AI-optimised memory used in data centres and by major clients such as Nvidia. SK Hynix is part of the SK Group and is involved in the development of Korea’s largest AI data centre in partnership with Amazon Web Services.

Samsung Electronics, the country’s largest company, is another global tech leader with a broad portfolio spanning smartphones, semiconductors, consumer electronics, and display technologies. In the first quarter of 2025, Samsung reported quarterly revenue of 79.14 trillion won (approximately £42.5 billion), driven by strong sales of its Galaxy S25 smartphones and a rebound in its Device Solutions (semiconductor) division.

- Why I voted against Scottish Mortgage’s dividend payment

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Samsung remains the world’s largest smartphone manufacturer and the global leader in TV sales for the 19th year running. It is also a major supplier of memory chips, processors, OLED panels, and other advanced components used across the technology sector.

While many fund managers continue to focus heavily on the big US names such as Apple Inc (NASDAQ:AAPL), NVIDIA Corp (NASDAQ:NVDA), and Microsoft Corp (NASDAQ:MSFT), there are major players in other parts of the world that are integral to the global technology ecosystem. Companies such as Taiwan Semiconductor Manufacturing Co Ltd ADR (NYSE:TSM), ASML Holding NV (EURONEXT:ASML) in the Netherlands, Huawei and MediaTek in Asia, and Infineon Technologies AG (XETRA:IFX) and STMicroelectronics NV (EURONEXT:STMPA) in Europe, show that global technology leadership extends beyond Silicon Valley.

The recent success of the Barings Korea fund is a timely reminder that South Korea, and companies such as SK Hynix and Samsung Electronics, also belong on that list. They may not always dominate headlines, but they play a critical role in the world’s digital infrastructure and have recently delivered exceptional returns for investors.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com