Wild’s Winter Portfolios 2022-23: why it paid to be aggressive this winter

19th May 2023 14:13

by Lee Wild from interactive investor

Both the winter portfolios generated impressive returns, but the higher-risk approach won this time, thrashing the stock market and performing twice as well as the consistent portfolio.

It seems like only yesterday that we kicked off the ninth season of winter portfolios. So much has happened in the past six months, and a handful of persistent influences on global stock market behaviour continue to dominate.

In the sixth and final month of this year’s Wild’s Winter Portfolios it was the banking crisis that continued to cast a cloud, over its epicentre on Wall Street more than anywhere else. Add that to ongoing concerns about inflation, central bank interest rate policy, the economy and corporate earnings, and it’s a wonder any progress at all was made in April.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

But progress there was, and the FTSE 100, FTSE 350 and All-Share index all rallied 3% or more over the month. The FTSE 250 index was not far behind.

In the six months between the end of October when we launched our pair of seasonal portfolios and the end of April, the FTSE 100 rose 10.9% and the All-Share 10.5%. The FTSE 350, which we use as the benchmark index for the portfolios, ended the winter up 10.6%.

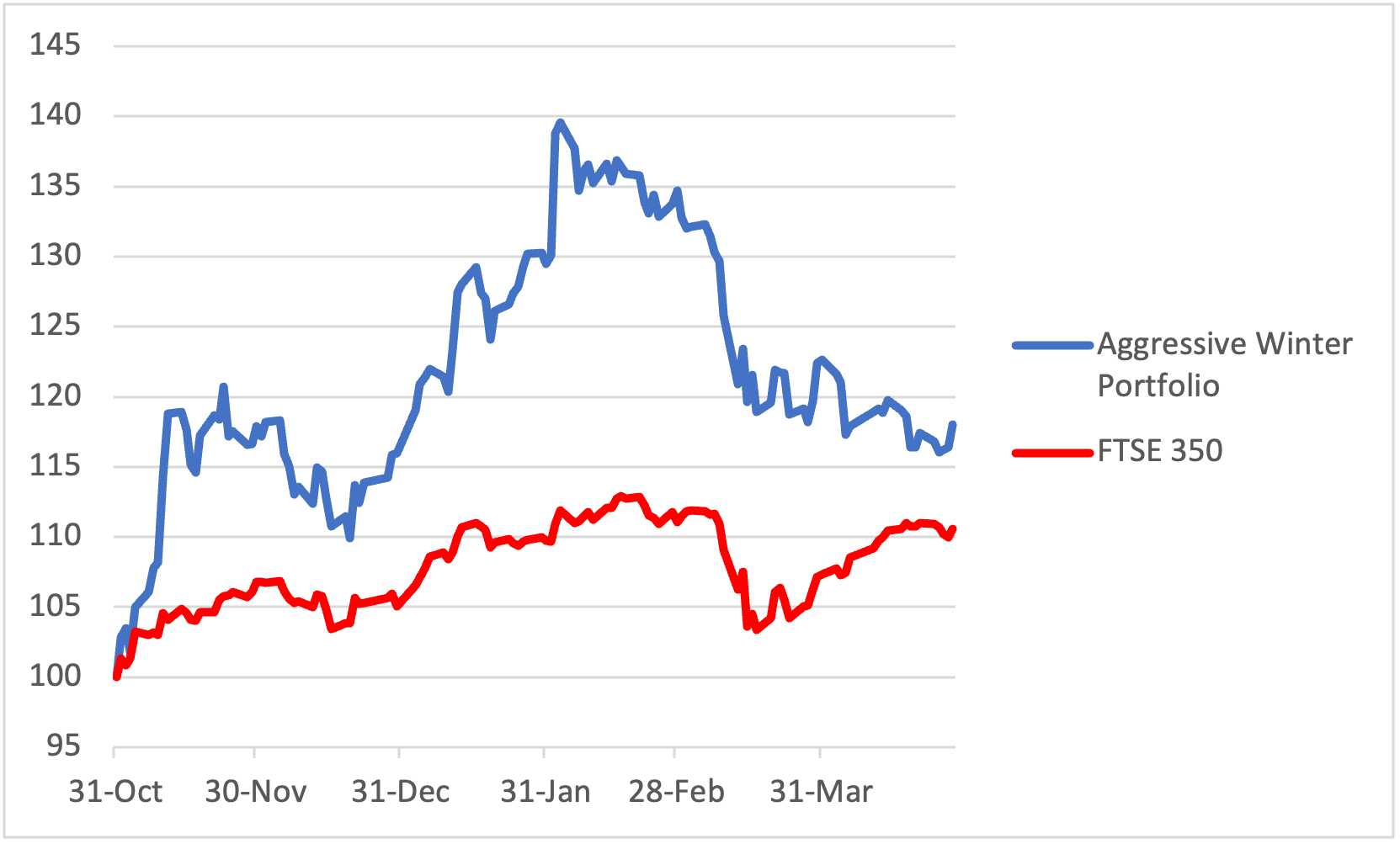

That’s a great performance, but Wild’s Aggressive Winter Portfolio did even better. The basket of five shares, which relaxes entry requirements slightly in favour of higher potential returns, ended the strategy with an 18% profit, although it had been up as much as 39% in early February.

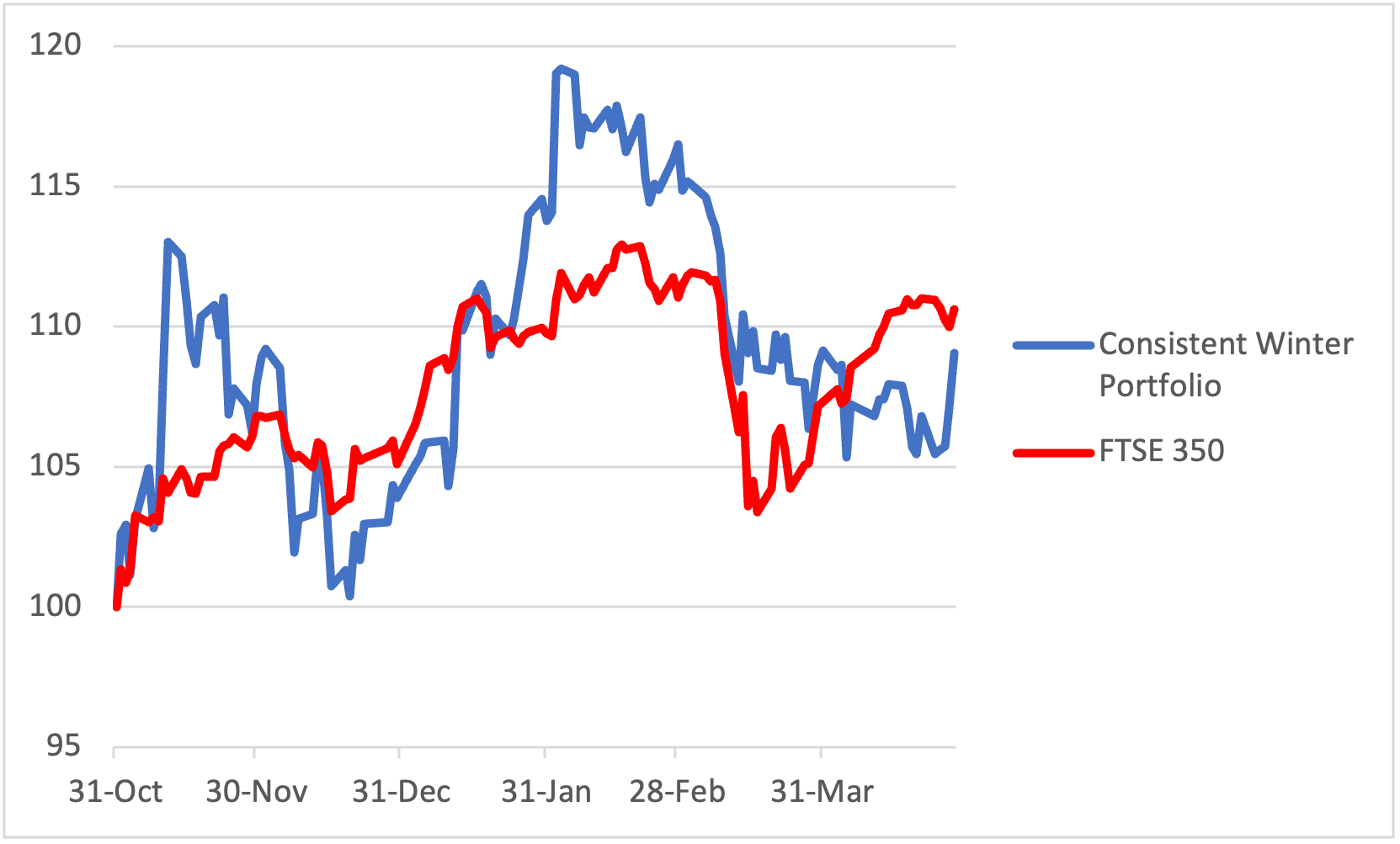

Wild’s Consistent Winter Portfolio, which includes the five FTSE 350 stocks which have risen the most winters in the past decade, had been up 19% at the halfway stage before drifting back. It ended the six-month period up a very creditable 9.1%.

Wild’s Consistent Winter Portfolio 2022-2023

Past performance is not a guide to future performance.

As a reminder, three companies appeared in both this year’s data-driven winter portfolios - Safestore Holdings Ordinary Shares (LSE:SAFE), Liontrust Asset Management (LSE:LIO) and discoverIE Group (LSE:DSCV). All of them delivered respectable single-digit percentage gains.

Electronic components firm Discoverie was best of the trio and second-best of all the stocks in this year’s portfolios. It had a roller coaster six months, and after surging 9.6% in April it ended the period with a profit of 13.4%.

It reported strong growth in half-year sales, then served up better-than-expected third quarter results. Discoverie, which makes customised electronics for industrial use, added that it is on track to deliver full-year underlying earnings ahead of expectations.

After a poor third-quarter share price performance, self-storage firm Safestore enjoyed a four-month recovery rally that only ended in February. It still gave us a 9.7% profit despite slower-than-expected first-quarter growth, as levels of demand remain stable and rates paid by new customers are still growing.

Asset manager Liontrust was the big disappointment, but the winter had started so positively. By the middle of November its share price was up over 40%, then recovered from a retreat to trade up over 50% in February. The shares were up 26% as recently as mid-March, but difficult markets and concerns about fund outflows triggered a 14.4% decline in March and 15.9% drop in April. The shares ended with a 0.7% gain.

- 10 great UK shares that Warren Buffett would pick

- Stockwatch: is it time to buy this share on a 9% yield?

The remaining two stocks both ended with double-digit profit. After a decent start to the winter, London Stock Exchange Group (LSE:LSEG) spent much of the time between December and March in the red. Its financial results have been good, but concerns about a stock overhang kept a lid on any potential upside. The problem can be traced back to the acquisition of Refinitiv in 2021. Significant shareholders Blackstone and Thomson Reuters exited a lock-in period, so have been able to sell large quantities of stock. Offloading $2 billion of LSE shares in March removed some of the overhang, and LSE shares rallied over 12% to the end of April, finishing the winter with a 10.3% profit.

Finally, food packaging business Hilton Food Group (LSE:HFG) was perhaps the biggest surprise. It had already issued a profits warning in September but made it into the consistent portfolio because of its strong track record of winter gains. It issued a second warning in November, but business has been positive since and the undervalued shares ended the seasonal strategy up 11.1%

Wild’s Aggressive Winter Portfolio 2022-2023

Past performance is not a guide to future performance.

With three stocks appearing in both this year’s portfolios, there’s just two left to cover. And they’ve both had a spectacular winter, just in very different ways.

JD Sports Fashion (LSE:JD.) has been by far the best performer not just this winter but in any of the nine years we’ve run these portfolios. Within two weeks of launch, JD shares were up over 20%. At their peak in February, they were up 91.9% before ending the season with a profit of 65.2%.

- Insider: director thinks future’s bright for this high-yield stock

- ii view: JD Sports shares tumble despite £10bn of sales

The tracksuits-to-trainers retail chain had a great January after confirming strong trading over Christmas. Revenue in the six weeks to 31 December grew more than 20% and management predicted annual profits would be at the top end of expectations. Chair Andy Higginson also bought £240,000 of JD shares at just above 150p each.

Finally, financial services giant Investec (LSE:INVP) was as disappointing as Liontrust. Both have been affected by the malaise in financial markets and fund outflows, which wiped out most of Investec’s winter returns. After ending the first month up 18% and adding over 24% by mid-February, heightened concerns about the global economy, inflation and interest rates meant investors lost interest. Investec shares ended the winter strategy with a 1% gain.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.