Wild’s Winter Portfolios 2023-24: massive outperformance by consistent stocks

After a stellar start to the winter, these seasonal portfolios are consolidating gains despite unhelpful markets. Here’s a round-up of all the action.

11th March 2024 10:43

by Lee Wild from interactive investor

UK stocks have had little to shout about in recent months. Even Jeremy Hunt’s new British ISA failed to trigger much more than a brief ripple of excitement in domestic investments.

Last month, the FTSE 350 ended marginally lower while overseas markets raced higher – China added over 9%, Japan nearly 8% and the Nasdaq Composite tech index a further 6%. Germany and France jumped 4.6% and 3.5% respectively.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Despite encouraging corporate results from some of the country’s largest companies and a wave of takeover bids for British firms such as Currys (LSE:CURY) and DS Smith (LSE:SMDS), much of the enthusiasm was diluted by problems elsewhere, leaving the FTSE 350 index down 0.2% in February.

Merchant bank Close Brothers Group (LSE:CBG) plunged after ditching the dividend amid a probe into historical motor finance commission arrangements. Other stocks down 20% or more included PZ Cussons (LSE:PZC) which cut profit forecasts and the dividend, Genus (LSE:GNS) also warned on profits, while St James's Place (LSE:STJ) set aside hundreds of millions of pounds to cover potential customer complaints.

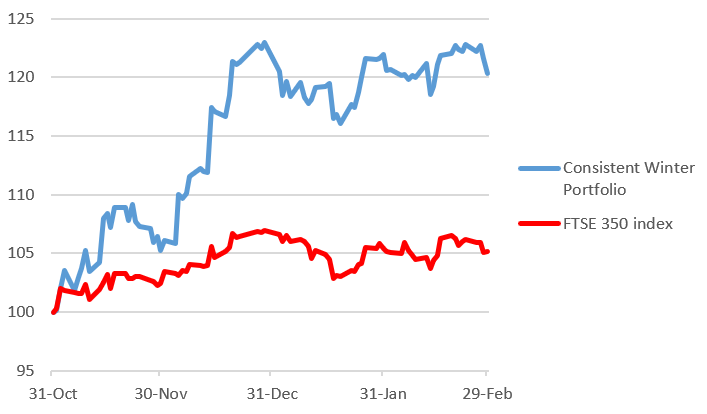

Wild’s Winter Portfolios were not immune from the negativity. The basket of five FTSE 350 companies that have risen the most winters (1 November to 30 April) over the past decade, slipped 1.3% in February. However, at the end of month four of the six-month strategy, the consistent portfolio is still up 20.3%.

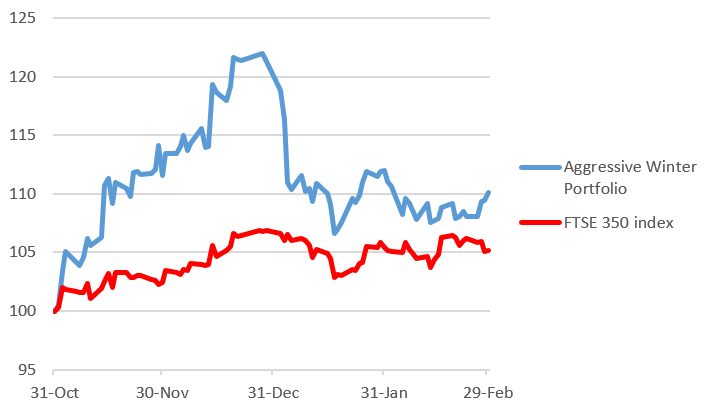

We relax the entry criteria slightly for Wild’s Aggressive Winter Portfolio, giving up some consistency in return for potentially bigger profits. However, all constituents must have risen in at least 80% of winters over the past decade. The higher risk portfolio gave up 1.6% last month but is still up 10.1% overall. That compares with FTSE 350 gains of 5.2% so far this winter.

You can find more information about the “consistent” and “aggressive” portfolios on our Winter Portfolio page.

Wild’s Consistent Winter Portfolio 2023-24

Past performance is not a guide to future performance.

Three of the five consistent winter stocks managed to post gains last month. Top performer was InterContinental Hotels Group (LSE:IHG), continuing its amazing bull run that’s seen its shares rally 44.2% since the end of October. An 11.7% surge in February was partially driven by encouraging annual results and optimism about growth in demand for travel and hotel rooms.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- 10 shares to give you a £10,000 annual income in 2024

Liontrust Asset Management (LSE:LIO) is on the up, too, adding 2.2% for the month to take its winter profit to 14.5%. Since reaching a low in December, the shares have begun to price in expectations of interest rate cuts later this year and a more optimistic view of investment markets.

There were no fresh updates from Hilton Food Group (LSE:HFG), either, but clearly the shares are benefiting from positivity generated by January’s confident trading update. From a technical trading perspective, it looks like the share price is trying to “fill the gap” between the current level and price before the major profit warning in September 2022.

Unfortunately, good work done by this trio was undone by hefty losses at discoverIE Group (LSE:DSCV) (down 14.4%) and Safestore Holdings Ordinary Shares (LSE:SAFE) (down 7.7%).

Electronics components firm Discoverie issued a decent update early Feb, but a lot of good news had been factored into the share price ahead of the report. A little air has come out since, but they’re still up 8.8% this winter.

Safestore issued a first-quarter trading update a few weeks ago that showed a decline in revenue for the three months ended 31 January. The self-storage firm also talked of “challenging economic conditions”. The market didn’t like it, but the shares have stabilised now and are up 11.9% so far this winter.

Wild’s Aggressive Winter Portfolio 2023-24

Past performance is not a guide to future performance.

Losses at Safestore last month weighed on both portfolios as the share appears in each one. It was joined by two other fallers in February.

First is Hill & Smith (LSE:HILS), the infrastructure products business that has had a strong winter. Its shares are not far off a record high despite dropping 3.2% over the past month. They have struggled to make a move above 1,900p stick in the past, and it looks like the same thing is happening here. A catalyst is needed to give them an extra boost - perhaps annual results due Tuesday 12 March?

Engineering contractor Keller Group (LSE:KLR) eased 1% in February. There was no news, although investors were clearly keeping their powder dry ahead of final results due on 5 March.

While revenue was little changed from the previous year at £2.97 billion, the business reported record numbers, with underlying operating profit 80% higher than the five-year average, profit margin above 6% for the first time in eight years and return on capital employed (ROCE) at 22.8%, a 15-year high.

The share price is up over 14% since the results at levels not seen since 2021. Up 11.6% during the winter period to the end of February, the shares are now 29% higher when you factor in reaction to the figures.

Construction and regeneration firm Morgan Sindall Group (LSE:MGNS) had another month of reasonable gains; a 3.5% return boosts winter portfolio profits to 24.7%. Full-year results on 22 February documented a record year including a 6% increase in adjusted profit before tax and 13% hike in the annual dividend.

“While there remains some uncertainty in the wider economy, reducing inflation and the prospect of lower interest rates provides a backdrop of confidence for the year ahead,” said chief executive John Morgan. “We are well-positioned for the future and on track to deliver a result for 2024 which is in line with our current expectations."

And finally, sports clothing retailer JD Sports Fashion (LSE:JD.) continued its recovery from an ugly profits warning in January. After hitting a low of 103p early in the month, the share price ended the period at 118p, just 0.7% above where it had started Feb. The shares have now narrowed losses this winter to a more modest 7.5% compared with as much as 18% just a few weeks ago.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.