Wild’s Winter Portfolios 2024: end to run of double-digit gains

These portfolios have a strong history of outperformance and positive returns, but last winter was one to forget. Lee Wild rounds up the past six months and all the big movers.

8th May 2025 13:37

by Lee Wild from interactive investor

These winter portfolios had a fantastic start to life all the way back in 2014, and they outperformed their benchmark index for five years. If profits were reinvested, the higher risk aggressive portfolio almost doubled in value on a total return basis. But Covid put a spanner in the works, and performance has been more mixed and volatile in the six years since.

There were chunky losses in 2019-20 and 2021-22, separated by a solid year in between, then significant gains in each of the next two years. And now the winter just gone has been a disappointing one.

- Invest with ii: Open a Stocks & Shares ISA | Top ISA Funds | ISA Offers & Cashback

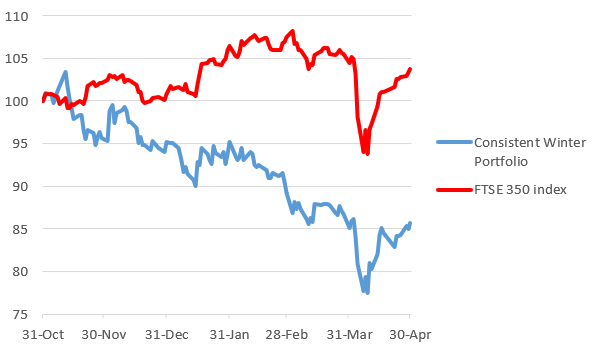

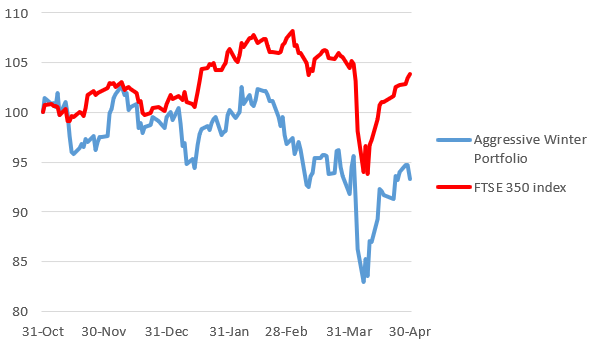

Wild’s Consistent Winter Portfolio 2024-25, made up of the five FTSE 350 companies that have risen the most winters (1 November to 30 April) over the past decade, typically generates more reliable returns. But it fell 14.4% this time, or 13.7% when you include dividend income. Wild’s Aggressive Winter Portfolio, where constituents must have risen at least 80% of winters over the past decade, fell 6.7%, or 5.7% with dividends, while the FTSE 350 index rose by 3.8% and 5.8% respectively. That said, it’s only the third negative winter performance in the 11 years we’ve run the portfolios.

Of the major indices, it was the German Dax that stood out this winter, surging nearly 18% as a massive investment programme looks likely to grow the domestic economy. In the UK, it was the FTSE 100 that stood out, adding 4.7% over the six months. Given the FTSE 250 index fell 2.5%, it is clearly UK blue-chips that put a rocket under the winter portfolio FTSE 350 benchmark index. Elsewhere, the Japanese Nikkei fell 7.8%, the Nasdaq Composite tech index lost 3.6%, the Dow Jones 2.6% and the broader S&P 500 around 2.4%.

It would be easy if I could just blame President Trump for the turmoil. A whirlwind first 100 days shook the global trading system to the core, crashing stock markets which then staged a partial recovery. But honestly, the winter portfolios didn’t start well as investors considered the consequences of the UK Budget. And apart from an improvement in the month to mid-February and bounce from the Trump crash low, it was a difficult six-month strategy. In fact, both consistent and aggressive portfolios were in positive territory for April - up 0.6% and 1.6% respectively compared with a 0.7% decline for the FTSE 350.

- Investment outlook as US/China force world to pick sides

- Ian Cowie: signs this one’s a winner from Trump’s tariffs

Could we have done anything different? Well, no. These are data-driven portfolios based on 10-year performance between close of play 31 October and 30 April each year. They pick themselves. Once they’re in, that’s it for the winter; we don’t touch them.

It means the five constituents of the consistent portfolio had each risen at least nine winters out of the past 10. Safestore Holdings Ordinary Shares (LSE:SAFE) had a perfect record, rising every winter for an average return of 13.1%. The portfolio’s 10-year average return was 15.7% compared with 4.7% for the FTSE 350.

The aggressive portfolio averaged a 20.8% return over the past 10 winters, which included engineering contractor Keller Group (LSE:KLR), which averaged 20.6% from nine positive winters over the past decade. But it’s almost impossible to predict how events will pan out over the six-month period. Apart from Trump, we’ve had profit warnings, missed production targets and profit taking, while even solid constituent companies have been held back by a period of broader pessimism.

Wild’s Consistent Winter Portfolio 2024-25

Past performance is not a guide to future performance.

That Hilton Food Group (LSE:HFG) is this year’s best consistent performer with a 1.2% loss tells you everything you need to know. The food packaging firm has a strong history of outperformance going back over a decade, and last August completed a full recovery from a serious profit warning in September 2022. But, as is common in these situations, the share price lacked a big enough catalyst to drive further gains above stiff resistance at around 960p.

Keller joined the winter portfolio after an amazing summer and 12-month rally worth over 140%. I mentioned in October that the engineering contractor was trading at a record high and could soon “run out of steam”. Well, it did, and despite this being a high-quality business, the shares fell 13.2%.

- Share Sleuth: two shares suffering from Trump’s tariffs

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Electronic components company discoverIE Group (LSE:DSCV) has always been a choppy performer but has done very well in nine of the past 10 winters. Unfortunately, it fell 14.2% this time. Safestore had the best track record of all five stocks in this basket but was one of the worst performers this year – falling 22.2%, or 19.7% if you factor in a generous dividend. The provider of self-storage is currently trading at a 2025 high, but a partial recovery came too late for this winter’s portfolio.

Finally, precision instrumentation expert Spectris (LSE:SXS) gets the wooden spoon. It lost the portfolio 20.5% following underwhelming results and a big fall during the Trump sell-off. It was a far cry from as recently as February when the shares were up 22% for this winter portfolio.

Wild’s Aggressive Winter Portfolio 2024-25

Past performance is not a guide to future performance.

PPHE Hotel Group Ltd (LSE:PPH) gets top billing in this round-up given it’s the only constituent in either portfolio to register a profit this winter. After falling 18% over the summer, the hospitality real estate company kicked off the winter with a strong Q3 trading update. The shares have been volatile, but they finished with a 1.5% gain including the interim dividend. It could have been even better had the clock stopped on 2 January when the shares were up over 14%.

Morgan Sindall Group (LSE:MGNS) ended the six months down 5.6%, or 3.2% including a decent dividend. Again, it could have been very different had the construction and regeneration company not rallied over 20% just a week before the winter began. Annual profits would be “significantly ahead” of previous expectations, it said. The positive response meant a much higher starting point for the portfolio.

Shares in copper miner Antofagasta (LSE:ANTO) were up 12% mid-March but ended the winter down 5.7% amid concerns about US tariffs. Any impact on the global economy would likely affect demand for commodities like copper.

After trading up as much as 18% in February near a record high, private equity investment firm Intermediate Capital Group (LSE:ICG) ended the winter down 9%, or 7.7% on a total return basis. Profit taking was already underway before Trump’s tariffs dumped the shares to December 2023 prices.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.