Share Sleuth: two shares suffering from Trump’s tariffs

Richard Beddard’s losing some sleep about the geopolitical realignment many companies are grappling with in response to Donald Trump’s trade war. He highlights two shares that have been impacted.

7th May 2025 11:13

by Richard Beddard from interactive investor

In May, I didn’t have the time or inclination to trade. That was partly because I was on holiday, and the rest of the time I have been catching up with events since the US government introduced a tariff regime that is disrupting international trade.

It has been particularly consequential for some of the portfolio’s constituents.

- Learn with ii: ISA Investment Ideas | Top ISA Funds | Buy US Shares in UK ISA

4Imprint: trade woes

Chief among those impacted is 4imprint Group (LSE:FOUR), the direct marketer of promotional goods. Its share price has more than halved since the end of January, less than two weeks after President Trump was inaugurated.

Notes: “b” indicates an addition to the portfolio, “s” indicates a partial sale of the portfolio’s holding. Past performance is not a guide to future performance.

4Imprint earns 98% of its revenue in North America. Sixty per cent of total revenue is derived from products imported from China, which are subject to the most punitive tariffs.

Passing on the cost of tariffs will reduce demand for promotional products at the same time as customers are reducing promotional activity due to the weakening US economy. Absorbing the cost will hurt profit.

The only completely safe haven from US tariffs is the US itself. Although it is 4Imprint’s second-largest country of manufacture, products from the US accounted for only 14% of revenue in 2024.

- Stockwatch: time to buy a slice of this FTSE 250 share again?

- Insider: directors buy at FTSE 250 firm and high-flying Haleon

4Imprint must be re-considering its Chinese supply chain even though this would be costly. The company’s annual general meeting is later this month, so we may hear more then. I plan to be there.

I rate the business and its chief executive highly and Share Sleuth only has a 2% holding. Adding the shares during a previous crisis, the pandemic, worked well for Share Sleuth. But I will not be trading the shares until I’m more confident 4Imprint can prosper despite the ructions in international trade.

Focusrite: what’s normal?

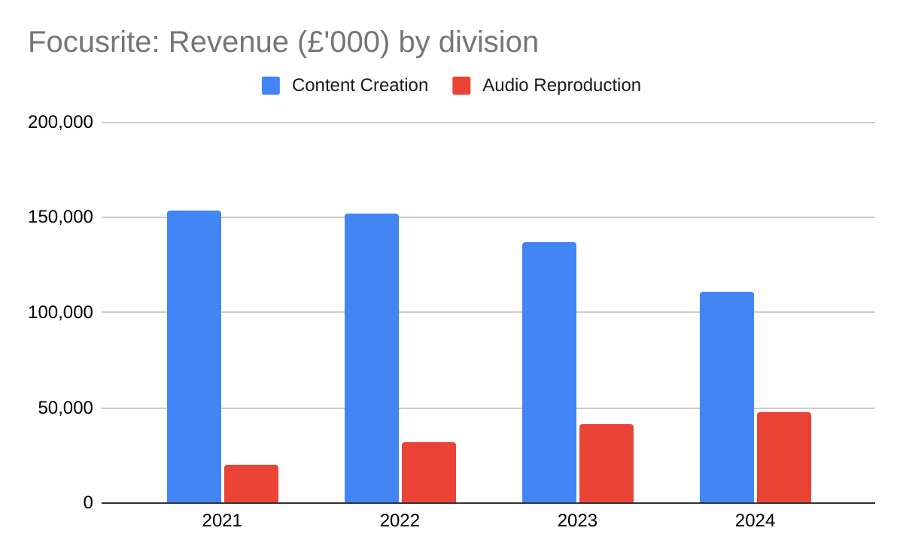

When Focusrite (LSE:TUNE) announced results for the six months to February a couple of weeks ago, it reported that demand for products in its Content Creation division had returned. Content Creation designs equipment for making and recording music and audio. The Focusrite Scarlett digital audio interface is a very popular product.

The division was responsible for 70% of total revenue in the year to August 2024 and it grew revenue 10% compared to the first half of 2024. Half the growth was exceptional though, the result of distributors and retailers building up stock in the US to mitigate potential tariffs and price increases.

Content Creation experienced a boom during the pandemic. Since then, Focusrite has consistently said demand from end users is outperforming the market but since many purchases have been satisfied out of intermediaries’ stock, revenue has been falling.

Comparisons with before the pandemic are tricky because the Content Creation division has been bolstered by acquisitions. The original Focusrite business remains the biggest component, and its revenue of £60 million in 2024 was £2 million below what it achieved in 2019. The other business that predates the pandemic is Novation, which makes keyboards, synthesisers and grooveboxes. It also slightly underperformed 2019, and in 2024.

Source: Focusrite annual reports.

The opposite scenario has played out in the smaller second division, Audio Reproduction, which is one business, Martin Audio, that sells sound systems to music venues. Acquired in 2019, Martin Audio contracted during the pandemic because music venues were shut much of the time. Revenue has almost quadrupled since 2021, but revenue contracted by 5% in the first half of 2025 marking the end of that boom.

Focusrite has a complicated manufacturing footprint. Some of its most popular products such as Scarlett are predominantly outsourced to contract manufacturers in China, and also Malaysia. Some acquired brands like Adam Audio, Martin Audio and Sequential, manufacture locally in Germany, the UK and the US though.

- Shares for the future: new scoring splits my Decision Engine

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Although Focusrite earned nearly 40% of revenue in North America in 2024, the half-year results revealed that only about 10% of group revenue is subject to the most punitive tariffs under the current regime. These are products made in China and sold in the US.

The company says it is relocating product ranges and has contingency plans to address tariff escalation, while recognising the inherent uncertainty.

Rising costs and aggressive competition meant profit was substantially lower in the first half of the year to February 2025 than it was in the comparable period in 2024, but Focusrite anticipates profit at the EBITDA level of between £24.5 million and £26 million for the full year.

That is similar to adjusted EBITDA in the year to August 2024. After-tax return on operating capital that year was 14%, much lower than shareholders have become accustomed to but no disaster. I fear we will reach the bottom in terms of return on capital in 2025.

I’m hesitating about increasing the portfolio’s holding from its current level of 1.5% towards the 6% its score warrants.

My head is telling me to be brave, but I also feel cowardly because the situation is so changeable and Focusrite has yet to convincingly turn the corner.

Addressing recent underperformance

Thanks to SW, a reader who mailed me in response to an article in which I proposed to rejig my scoring algorithm (subsequently rejigged) to help me address Share Sleuth’s poor performance in recent years.

They made a profound point, that my process of scoring companies depends in part on their performance in terms of revenue, profit, and cash flow in the past. Past resilience gives me confidence that businesses will adapt to the future.

SW thinks the past may be less relevant given the challenges companies face today. I’m losing some sleep about the geopolitical realignment 4Imprint and Focusrite and many other companies are grappling with, technological disruption (principally artificial intelligence) and the creeping threat of climate change.

The world is a less predictable place than it was in the first 10 years of Share Sleuth and managing the portfolio was less stressful.

The purpose of studying the past is to gain clues about how well companies might adapt to the future. I do not just evaluate the numbers, but also how firms make money (their capabilities), what could stop them (the risks) and how they are addressing the risks (their strategies). These provide me with a steer on the future.

I doubt this approach is flawed in principle, but I’m wondering about my implementation. Establishing a company’s financial track record is relatively easy, evaluating the business less so. I fear I’ve been blasé about some risks and credulous about some strategies.

Improving will require diligence, and a change to my routine, which has hitherto favoured examining a business once a year and forgetting about it in-between. I got away with that when things were more stable. When events are coming thick and fast, I feel the need to be more flexible.

I cannot say how my articles will change because I’m slowly iterating my way to more flexibility, but I’ll explain what I’m doing as I try things out.

Share Sleuth performance

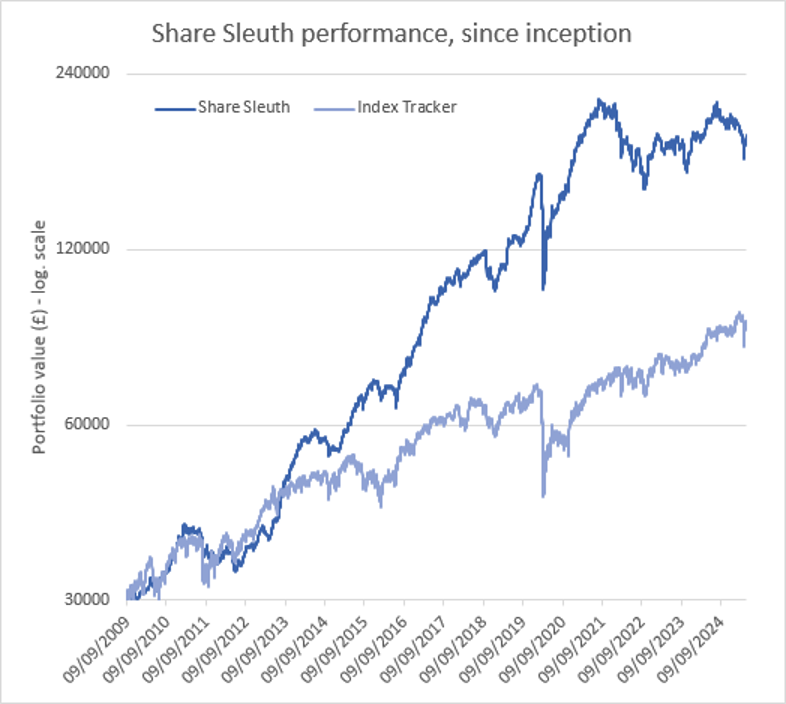

At the close on Friday 2 May, Share Sleuth was worth £189,244, 531% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £90,632, an increase of 202%.

Past performance is not a guide to future performance.

After dividends paid during the month from Thorpe (F W) (LSE:TFW), Goodwin (LSE:GDWN), Quartix Technologies (LSE:QTX), and Renishaw (LSE:RSW), Share Sleuth’s cash pile is £17,135. That is 9% of the portfolio’s total value, which is unusually high.

The minimum trade size, 2.5% of the portfolio’s value, is £4,731.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 17,135 | ||||

Shares | 172,108 | ||||

Since 9 September 2009 | 30,000 | 189,244 | 531 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,018 | -11 |

ANP | Anpario | 1,124 | 4,057 | 4,805 | 18 |

BMY | Bloomsbury | 845 | 3,203 | 5,121 | 60 |

BNZL | Bunzl | 201 | 4,714 | 4,784 | 1 |

CHH | Churchill China | 1,495 | 17,228 | 8,110 | -53 |

CHRT | Cohort | 861 | 2,813 | 12,088 | 330 |

DWHT | Dewhurst | 938 | 6,754 | 8,911 | 32 |

FOUR | 4Imprint | 116 | 2,251 | 3,718 | 65 |

GAW | Games Workshop | 66 | 4,116 | 10,210 | 148 |

GDWN | Goodwin | 133 | 3,112 | 8,911 | 186 |

HWDN | Howden Joinery | 1,476 | 10,371 | 11,690 | 13 |

JET2 | Jet2 | 456 | 250 | 7,597 | 2,939 |

LTHM | James Latham | 1,150 | 14,437 | 12,018 | -17 |

MACF | Macfarlane | 3,533 | 5,005 | 3,568 | -29 |

OXIG | Oxford Instruments | 241 | 5,043 | 4,189 | -17 |

PRV | Porvair | 906 | 4,999 | 6,795 | 36 |

QTX | Quartix | 3,285 | 7,296 | 7,326 | 0 |

RNWH | Renew Holdings | 689 | 4,902 | 5,367 | 9 |

RSW | Renishaw | 234 | 6,227 | 5,347 | -14 |

RWS | RWS | 2,790 | 9,199 | 2,048 | -78 |

SCT | Softcat | 326 | 4,992 | 5,591 | 12 |

SOLI | Solid State | 5,009 | 6,033 | 9,517 | 58 |

TET | Treatt | 763 | 1,082 | 1,946 | 80 |

TFW | Thorpe (F W) | 4,362 | 9,711 | 13,086 | 35 |

TUNE | Focusrite | 2,020 | 14,128 | 2,828 | -80 |

VCT | Victrex | 292 | 6,432 | 2,520 | -61 |

Notes

No trades in April

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £189,244 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £90,632 today

Objective: To beat the index tracker handsomely over five-year periods

Source: ShareScope, close on Friday 2 May 2025.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the shares in the Share Sleuth portfolio.

For more on the Share Sleuth portfolio, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.