Winners and losers as FTSE 100 dives again

As the Lloyds insurance market warned of a $200 billion hit, there were some big stock moves both ways.

14th May 2020 13:01

by Graeme Evans from interactive investor

As the Lloyds insurance market warned of a $200 billion hit, there were some big stock moves both ways.

Investors backing a V-shaped recovery for sectors and stocks worst hit by Covid-19 were looking on nervously today, amid more dire warnings over the economic shocks still to come.

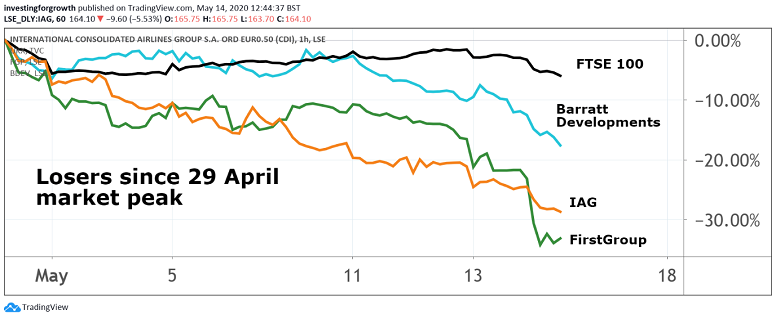

The second risk-off session in a row wiped another 2.5% from the FTSE 100 index, with the top-flight now back where it was 10 days ago at below 5,750. Stocks savaged in the immediate aftermath of the pandemic were back under pressure, with catering giant Compass Group (LSE:CPG) down 4%, BA owner International Airlines Group 5% lower and InterContinental Hotels (LSE:IHG) off 4%.

Comments out of Washington were again the trigger for the sell-off, with US Federal Reserve chair Jerome Powell's warning of an extended period of weak economic growth, raising fears about whether the current stimulus will offset rising unemployment and corporate failures.

The reality check extended to key UK industries, with housebuilders further set back by a survey from the Royal Institute of Chartered Surveyors predicting that it will take at least nine months for sales levels to return to where they were before the crisis.

Having just yesterday been buoyed by the reopening of England's house market, shares in builders Taylor Wimpey (LSE:TW.) fell 4% and Barratt Developments (LSE:BDEV) dipped 3% to 463.5p. Persimmon (LSE:PSN), which is planning to reopen sales sites in England from tomorrow, fell 5%.

This was despite the blue-chip company also reporting that 65% of its construction capacity had now been restored, with cancellation levels among customers in line with historic trends.

Source: TradingView. Past performance is not a guide to future performance.

Transport companies were also heading in the wrong direction as the pressure of getting Britain and other countries back to work continued to be felt. Citigroup switched its “buy” rating on Stagecoach (LSE:SGC) to a ‘sell’, with its price target plummeting to just 49p from 200p.

The shares slumped 10% to 53p, while sentiment was also impacted at National Express (LSE:NEX) after Jefferies cut its price target to 380p but still kept the coach operator on its ‘buy’ list. Shares fell 9% to 182.2p, while FirstGroup (LSE:FGP) tumbled 12% to 47.7p and Go-Ahead (LSE:GOG) dropped 7% to 1,064p.

Insurers also struggled after the Lloyd's of London insurance market put a figure of up to US$4.3 billion on paying out Covid-19 related claims, such as for event cancellations or property cover. That could mean the pandemic ends up being as costly as the 9/11 terrorist attacks or the 2017 hurricane season, which resulted in a hit of about $4.8 billion.

Lloyd's (LSE:LLOY) added that it expects the total financial blow to the insurance industry to be around $200 billion, including the impact of investment losses. Shares in Hiscox (LSE:HSX) and Beazley (LSE:BEZ) - both participants in the Lloyd's market - fell by more than 4%.

Today's session was also notable for Aston Martin Lagonda (LSE:AML) shares trading at a new low of 30p, having joined the market at 1,900p about 18 months ago. Shopping centre owner Hammerson (LSE:HMSO) also reached a nadir of 42p, having dropped another 5%.

Good news

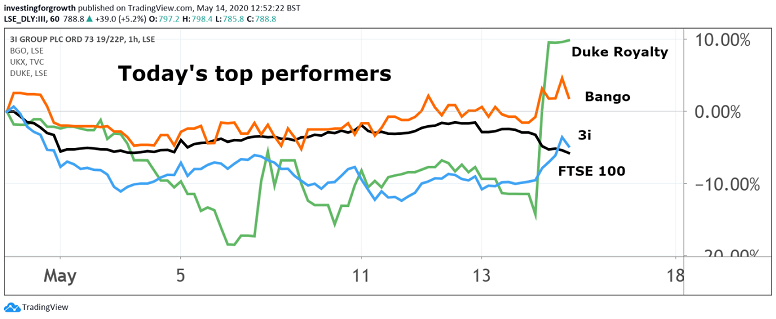

There were some pockets of good news, with shares in private equity group 3i (LSE:III) up 5% after it became one of the few blue-chip stocks in the crisis to protect its total dividend for 2019/20 trading. The award includes a final dividend of 17.5p for payment on 17 July.

The group reported a resilient performance for the year to March, with a return of £253 million or 3% on opening shareholders’ funds. The pandemic has impacted travel, retail and automotive portfolio companies, but those in medical technology, personal care products, e-commerce and other specialty manufacturers are experiencing strong demand.

CEO Simon Borrows said:

“We have been cautious investors for some years and have maintained a strong balance sheet since our restructuring in 2012. This conservative approach will help us to navigate the challenging months ahead.”

Watches of Switzerland was another strong performer after reporting that demand for luxury watches had remained strong, with online sales ahead of its expectations to offset the closure of all stores in the UK and United States. The shares ticked 2% higher to 224p, although they had been as high as 238p in early trading.

Source: TradingView. Past performance is not a guide to future performance.

The mobile internet payments platform Bango (LSE:BGO) added another 3% after announcing a multi-year platform agreement with a major global telecoms provider worth at least £1.5 million. At 124p, the AIM-listed stock has recovered from 62p in mid-March to above its starting point for 2020.

Duke Royalty (LSE:DUKE), which provides financing solutions to private companies that are in need of capital but whose owners wish to maintain equity control of their business, was another AIM-listed stock on the front foot.

Shares jumped 25% to 24p after it said it would still pay a paper dividend (one paid in shares) instead of its normal cash dividend.

Revenues received in April totalled over £600,000, with this level expected to be maintained through the quarter to June. While this is below the £1 million cash receipts of March, Duke pointed out that the reduction has not been waived or lost by the company.

CEO Neil Johnson said: "While we face an unexpected business environment, royalty companies are designed to withstand downside economic shocks.

“Duke Royalty benefits from both low operating costs and senior security in our investments, while limiting the downside adjustment in any given year.”

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.