Important information: As investment values can go down as well as up, you may not get back all the money you invest. Currency changes affect international investments, and this can decrease their value in sterling. If you’re unsure if an investment account is right for you, please speak to an authorised financial adviser. Tax treatment depends on your individual circumstances and may be subject to change in the future. Please note images displayed are for illustrative purposes only.

interactive investor has published its latest instalment of the ii Index, providing data and insights on how the everyday retail investor is performing and positioning their portfolios in this ever-changing market. The ii Index covers all accounts across ISA, Trading Account, and SIPP.

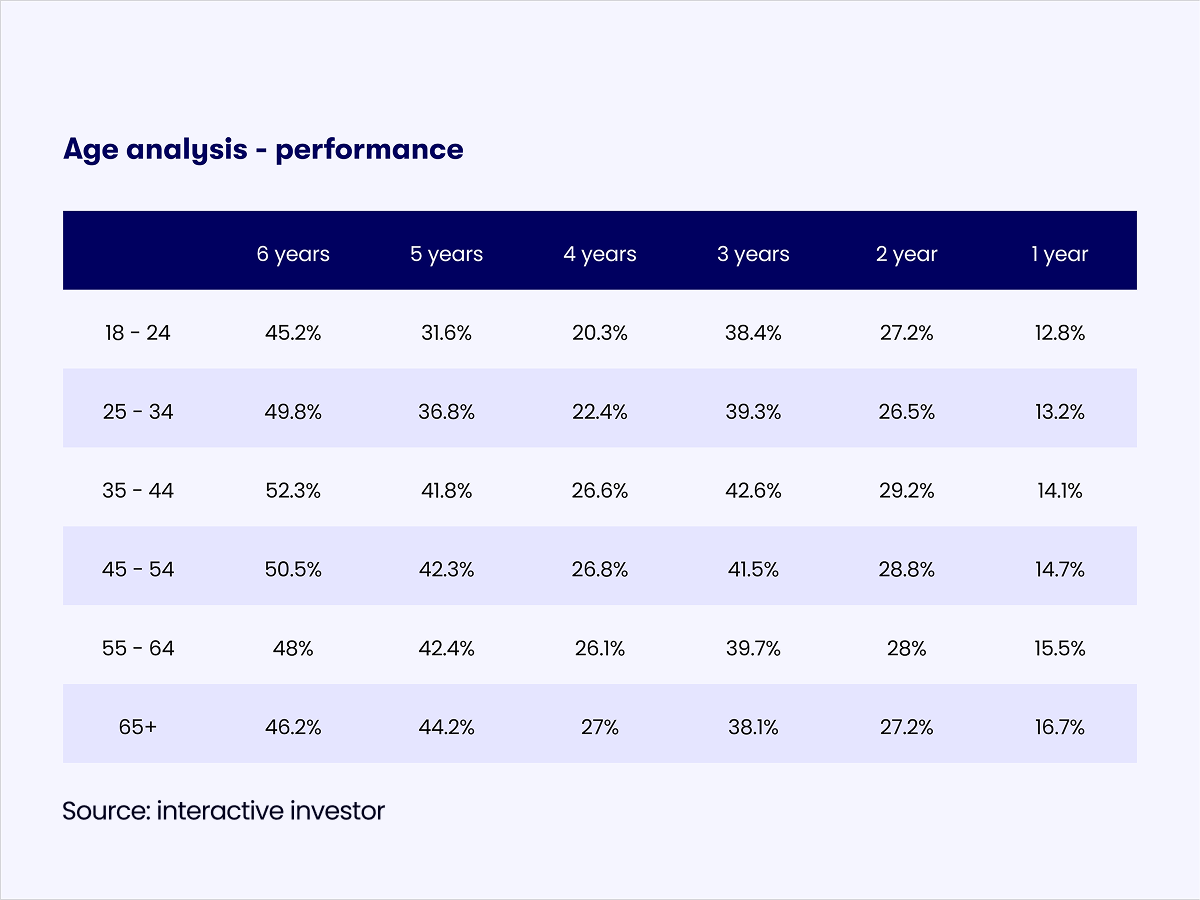

The latest iteration tracks 6 years of data, which shows that the average ii investor has seen their portfolio grow by 47.7% — beating the aggregated performance of funds in the IA Mixed Investment 40-85% Shares sector (38.5%).

The sector can be a useful comparator for private investor portfolios, given its mix of bonds, cash, and shares.

“interactive investor customers consistently demonstrate their ability to hold their nerve and stay invested.

This disciplined approach isn’t always easy when we see markets go through its inevitable peaks and troughs, so this is admirable; a true masterclass in retail investment."

Camilla Esmund, Senior PR Manager

Those aged 35-44 outperformed the most of all the age groups, retuning 52.3% over the six years of tracking this data.

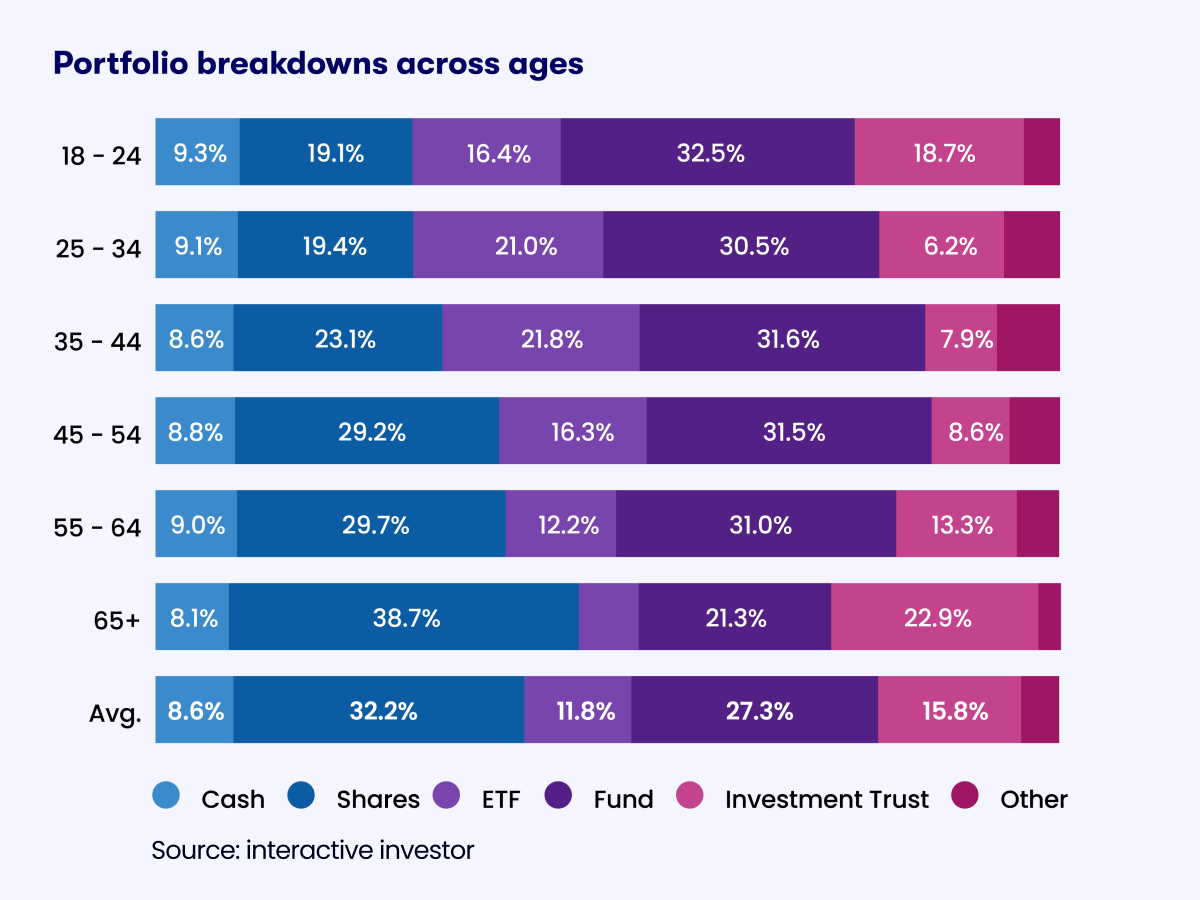

Of all the age ranges, their portfolios tend to have the highest weightings to ETFs and bonds. This age group still has lots of time for their portfolios to grow and benefit from compounding.

ETFs have consistently grown in popularity across the last few years, and the last quarter proved the same – particularly with those aged 35-44 – with their 21% allocation in Q3 2025 rising up to 22% in Q4.

The gap between ii’s youngest and oldest investors buying direct stocks also continues to grow – with those aged 18-24 only allocating 19% to equities, versus those 65+, who allocate 39%.

Investment trusts have slightly dwindled in popularity since the last index – for example those 65+, who tend to have a higher weighting to trusts, have lowered their weighting from 24% to 23%.

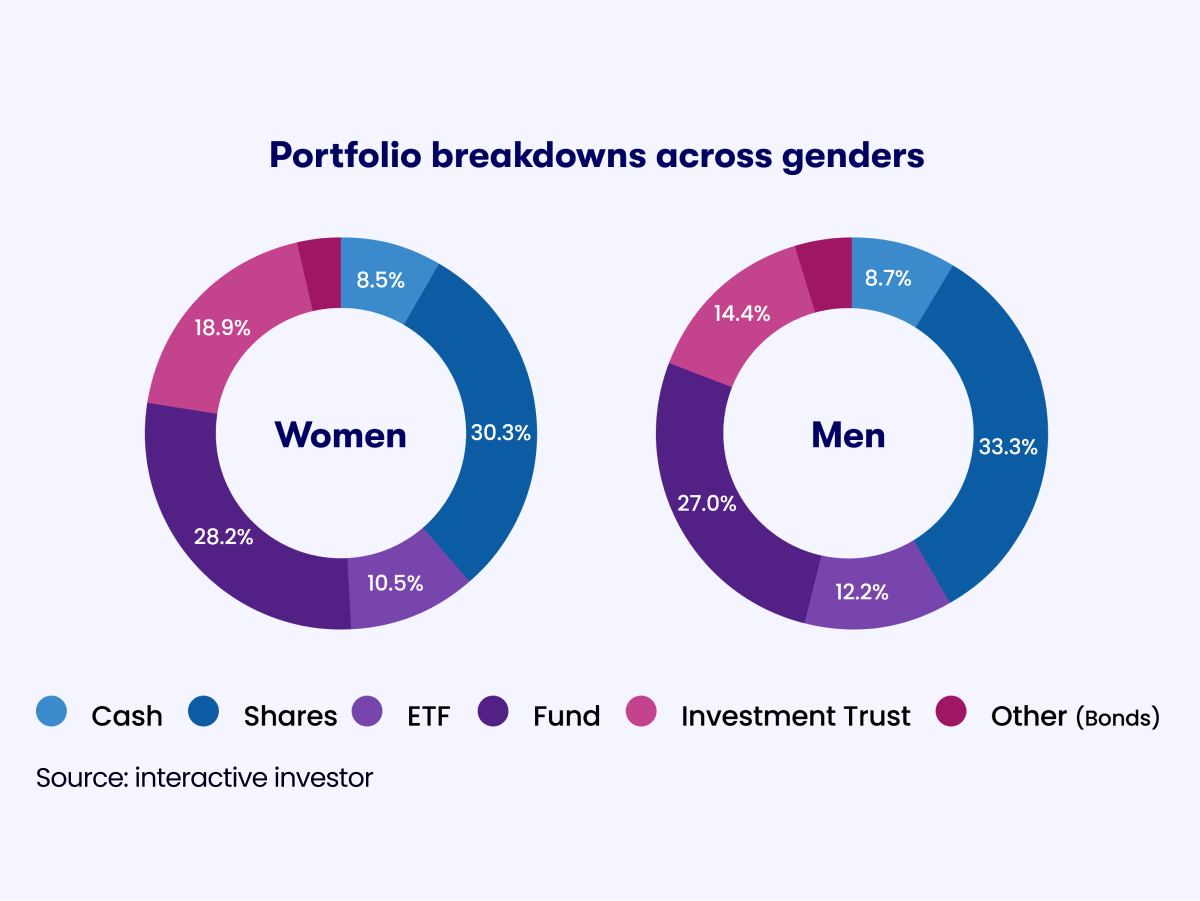

Men and women on interactive investor both have diversified and balanced portfolios. There are a minor differences when it comes to how men and women invest on our platform.

Men have a slightly higher weighting to equities (35% versus 31%), where women will tend to allocate more to investment trusts (20% versus 15%).

interactive investor’s fund experts take a deep dive into retail investment trends.

In this iteration of the ii Index, the team delve into Japan, US equities and diversifying from the so-called ‘Magnificent 7’, and UK investment grade corporate bonds.

View or download previous instalments of the ii Index.

If you would like to speak to one of our spokespeople or if you would like bespoke content from our expert writers, please contact:

Saffron Wainwright

PR Manager

Email: saffron.wainwright@ii.co.uk