10 retail stocks resisting the high street gloom

It's a graveyard full of household names, but evidence proves stock-pickers can do well in this sector.

6th November 2019 13:58

by Ben Hobson from Stockopedia

It's a graveyard full of household names, but evidence proves stock-pickers can do well in this sector.

Britain's retail sector has given us some strong share price performances in recent years - ranging from the likes of ASOS (LSE:ASC) and Boohoo (LSE:BOO) to JD Sports (LSE:JD.), WH Smith (LSE:SMWH)and even B&M (LSE:BME). But it's also given us a few slow-burning failures.

For those companies that have adapted and positioned themselves to cash-in on changing consumer trends, the results have been impressive. But for those that were outmaneuvered, out-competed or just too outdated in the face of shifting buying patterns, it's been a blood bath.

News this week that the baby goods chain Mothercare (LSE:MTC) is putting its UK business into administration is surprising in some ways, but not others. For many years Mothercare was a right of passage for young families. It's a British brand held in high esteem and about which many have a lot of affection. But in the age of the internet, that isn't enough. While Mothercare was well-loved, fewer and fewer new parents ever considered shopping there.

As a result, Mothercare has spent years fighting for its survival. Competition from supermarkets and online retailers has been ferocious in the babycare market. It was hamstrung by its large, out-of-town stores and didn't offer the easy online shopping and rapid deliveries demanded by its internet-savvy demographic. Hints earlier this year that it might be turning a corner turned out to be a mirage.

In Mothercare's international business, where it just supplies goods to franchised stores, things haven't been as bad. Its solid, well-respected brand has done better abroad than at home, and this is now the focus of what's left. Efforts to reinvigorate the international side of Mothercare are underway. However, as an investment, it's very much in the kind of distressed territory where you'll only find hardened value investors.

Another retailer facing crunch decisions this past week has been Carpetright (LSE:CPR). As a specialist in floorcoverings, Carpetright is different to Mothercare but there are some similarities. As it stands, the firm seems to think its best chance of survival lies in its biggest debt provider taking it private - something that would crystallise the collapse for equity holders.

Like Mothercare, Carpetright has been on the ropes for a while. Lacklustre consumer demand and the emergence of a predatory and well financed competitor - Tapi - has made life difficult. For investors, the future for this stock looks threadbare to say the least.

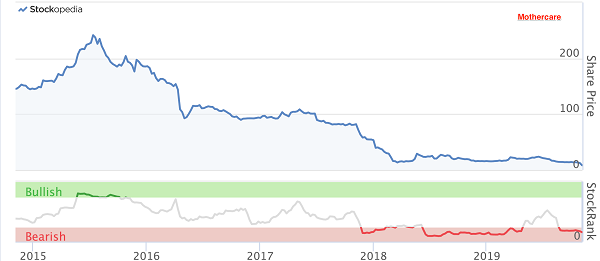

Despite catering for different markets, the slow-burning declines of Mothercare and Carpetright actually result in very similar five-year price charts. From a peak of around 241p in mid-2015, Mothercare's shares have fallen by 95%:

Past performance is not a guide to future performance

By comparison, shares in Carpetright were trading at 524p in the summer of 2015, but have since fallen by 99%.

The similarities between these charts is striking - but both tell the story of retail stocks that consistently failed to turn around their fortunes.

Another similarity is how the exposure of both shares to the factors of Quality, Value and Momentum gradually deteriorated over time (reflected in their StockRank charts). The trend in both cases was that the financial and business quality of both firms, the attractiveness of their valuations and the strength of their price momentum all collapsed between 2016 and 2018. These were real warning signs that both Mothercare and Carpetright were facing significant and very hard to solve problems.

Past performance is not a guide to future performance

Based on relative price strength, these stocks feature at the very bottom of the pile when measured up against other retail shares. Others that have lost the love of the market include firms like Moss Bros (LSE:MOSB), Sosandar (LSE:SOS) and Laura Ashley (LSE:ALY).

| Name | Mkt Cap £m | Relative Price Strength 1y | Relative Price Strength 5y | Forecast P/E Ratio | StockRank Style |

|---|---|---|---|---|---|

| Stanley Gibbons (LSE:SGI) | 10 | -39.2 | -99 | - | Sucker Stock |

| Carpetright (LSE:CPR) | 14.1 | -75.1 | -98.5 | - | Value Trap |

| Bagir (LSE:BAGR) | 1.86 | -71.6 | -95.7 | - | Value Trap |

| Mothercare (LSE:MTC) | 28.6 | -58.6 | -95 | - | Style Neutral |

| Laura Ashley (LSE:ALY) | 14.5 | -51.2 | -93.7 | 19.9 | Style Neutral |

| Sosandar (LSE:SOS) | 31.3 | -47.9 | -92.1 | - | Sucker Stock |

| Moss Bros (LSE:MOSB) | 19.1 | -40.7 | -81.2 | - | Value Trap |

But at the other end of the price strength scale, the strongest performers in retail have delivered excellent returns in recent years - proving that stock-pickers can do well in this sector. Typically, these shares have the profile of high quality, strong momentum stocks that are categorised as "High Flyers". They currently range from high street players like JD Sports (LSE:JD.) and WH Smith (LSE:SMWH) to online firms like Ocado Group (LSE:OCDO), Boohoo (LSE:BOO) and ASOS (LSE:ASC).

| Name | Mkt Cap £m | Relative Price Strength 1y | Relative Price Strength 5y | Forecast P/E Ratio | StockRank Style |

|---|---|---|---|---|---|

| JD Sports (LSE:JD.) | 7,379 | 74 | 617.2 | 23 | High Flyer |

| Boohoo (LSE:BOO) | 3,045 | 17.9 | 425.2 | 50.2 | High Flyer |

| Ocado (LSE:OCDO) | 9,426 | 53.5 | 347.6 | - | High Flyer |

| WH Smith (LSE:SMWH) | 2,559 | 9.3 | 70.5 | 17.8 | High Flyer |

| B&M (LSE:BME) | 3,826 | -12.8 | 32.5 | 17.9 | Style Neutral |

| Burberry (LSE:BRBY) | 8,449 | 7.2 | 21.5 | 23.5 | High Flyer |

| ASOS (LSE:ASC) | 2,770 | -43.8 | 11.4 | 58.5 | Falling Star |

| Watches of Switzerland Group (LSE:WOSG) | 718.4 | - | - | 31.4 | Style Neutral |

| Joules (LSE:JOUL) | 231.1 | -7.5 | - | 16.5 | High Flyer |

| ScS (LSE:SCS) | 94 | -0.1 | - | 10.2 | Super Stock |

With Christmas on the way - together with a general election and whatever Brexit brings - British retailers are going to be closely watched over the weeks and months ahead.

Some stocks in this sector have produced excellent returns for shareholders in recent years. Their defining profiles tend to veer towards high quality and strong momentum. But for others, the brutal environment on parts of the high street and dramatic shifts in the way people shop, have proved debilitating. The declining force of chains like Mothercare and Carpetright show just how wary investors need to be.

About Stockopedia

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

- Interactive Investor readers can enjoy a two-week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.