10 stocks that helped AIM be a world beater

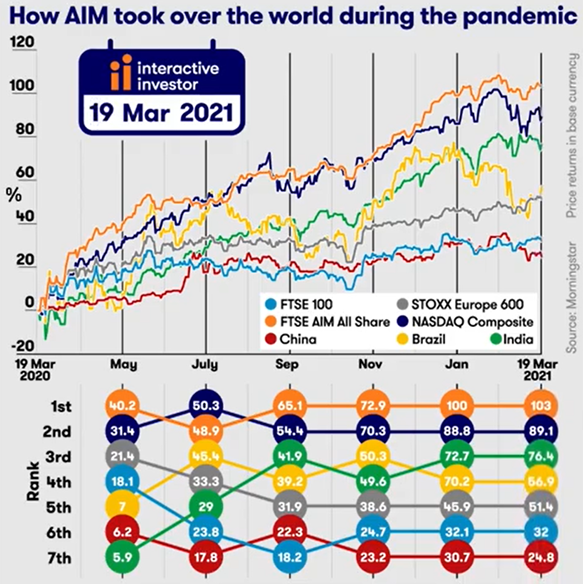

We name shares that helped the AIM market beat major global stock market indices over the past year.

29th March 2021 15:51

by Myron Jobson from interactive investor

We name shares that helped the AIM market beat major global stock market indices over the past year.

- Watch interactive investor’s infographic on how the UK's AIM market beat major global stock market indices in the past year here. The infographic is free for journalistic use.

There was one place to be when the music stopped and global stock markets hit rock bottom in March 2020, and it wasn’t on Wall Street, Frankfurt or Mumbai.

The best performing of the world’s major stock indices was the army of innovative, mostly smaller companies on the AIM market.

- Invest with ii: Top UK Shares | Super 60 Investment Ideas | Open a Trading Account

The FTSE AIM All Share was the only major index where you would have doubled your returns had you bought at its low point on 19 March 2020 and held on for 12 months, returning 103% over the period - outstripping the performance of the S&P 500 (63.2%), tech-centric Nasdaq (89.1%) and the FTSE 100 (32%).

AIM stocks accounted for 38% of UK trades on interactive investor, the UK’s second-largest direct-to-consumer investment platform over the past year. The list of top 10 most-bought AIM stocks since the FTSE AIM All Share’s 19 March 2020 low point (to 26 March 2021) is dominated by clean energy, fashion retailing and biotechnology companies.

Online fashion retailer Boohoo (LSE:BOO), whose share price had a torrid time after very serious allegations about employment practice and factory working conditions, was the most-bought AIM stock on the platform, and clothes retailer ASOS (LSE:ASC) makes the top 10 cut in seventh.

ITM Power (LSE:ITM), in fourth position, is one of three clean energy firms on the most bought AIM stocks list - with AFC Energy (LSE:AFC) and Ceres Power (LSE:CWR)in eighth and ninth positions, respectively. UK-based oil exploration and production company Hurricane Energy (LSE:HUR) also made the list in sixth position.

Biotechnology firms Synairgen (LSE:SNG) and Novacyt (LSE:NCYT), were the second and third bestseller on ii, with pharmaceuticals firm 4d pharma (LSE:DDDD) in fifth position.

British multinational airline company Jet2 (LSE:JET2) completes the top 10.

Lee Wild, Head of Equity Strategy, interactive investor, says: “AIM is home to some of the UK’s hottest companies. They’re typically fast-growing businesses involved in some form of technology, drug discovery or new way of working. They are nimble, able to adapt quickly to new or changing circumstances, and have potential to be large-caps of the future. Because their fortunes can change very quickly, gains can be quite dramatic, which has an obvious attraction for investors looking for a speculative element to their portfolios.

“In any major market sell-off, small stocks tend to get sold first because investors prefer to keep what are perceived to be safer large-caps. Because small-caps can be less liquid and harder to sell, losses are exaggerated during a correction, which is what we saw in February/March 2020.

“UK tech stocks were also overlooked because of uncertainty in the run up to Brexit, around how Britain will cope in the aftermath, and then over fears about the pandemic. It was only a matter of time before investors remembered tech was not just about Nasdaq, and how many exciting UK small-caps were great value and packed with potential.”

Most-bought AIM stocks on interactive investor from 19 March 2020 to 26 March 2021

Position | AIM stock |

1 | |

2 | |

3 | |

4 | |

5 | |

6 | |

7 | |

8 | |

9 | |

10 |

The performance of the FTSE AIM All Share index compared to major stock indices and regions over 12 months to 19 March 2021

Source: interactive investor/Morningstar. Price returns in base currency.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.