12 coronavirus stocks: another AIM share rallies 90%

After surging over 90% today, this AIM share is among a growing number being bought for Covid potential.

24th April 2020 12:31

by Lee Wild from interactive investor

After surging over 90% today, this AIM share is among a growing number being bought for Covid potential.

Another stock almost most doubled in value today, providing further proof, if it were needed, that coronavirus vaccine and testing work is the hottest investment trend right now.

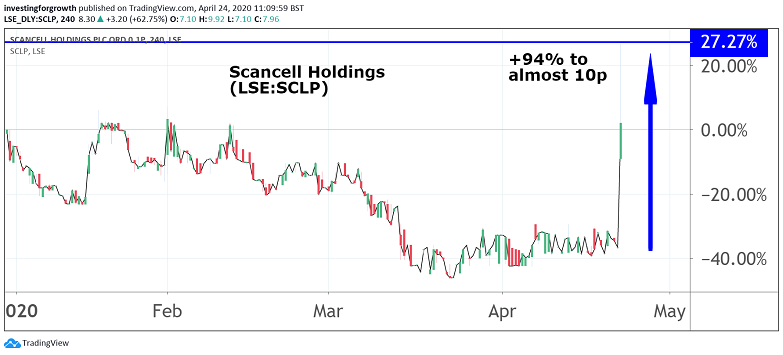

Scancell (LSE:SCLP) is an AIM-listed biotech company that has been around for years. It’s had highs and lows, but the trend since a spell of euphoria in 2012-13 has most definitely been downward.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

However, the share price rocketed as much as 94% today, up from 5.1p to 9.9p on news that it is has teamed up with scientists at the University of Nottingham and Nottingham Trent University to develop a vaccine against Covid-19.

Source: TradingView Past performance is not a guide to future performance

“Vaccines are the long-term solution and we believe our combined high avidity T cell and neutralising antibody approach has the potential to produce a second-generation vaccine that will generate an effective and durable immune response to Covid-19,” explains Professor Lindy Durrant, chief scientific officer at Scancell and lead on this project.

That Scancell’s previous DNA vaccines, including cancer vaccine SCIB1, have been successful, has caused great optimism among investors. The technology is already shown to be safe and effective in cancer, and the company believes it should provide a more potent and long-lasting response than others being developed, ultimately leading to better immunity.

What’s more, the company claims that “this new vaccine has the potential to generate protection not only against SARS-CoV-2 [the virus that causes Covid-19], but also against new strains of coronavirus that may arise in the future.”

It’s this level of protection which sets it apart from other vaccines currently being developed. Initial research is underway and a Phase 1 clinical trial will only begin in Q1 2021, which is subject to funding. Scancell will need money from development partners, plus additional funding from governments and global institutions to support the rapid development of its vaccine.

However, while there do appear to be differences with this project, it is not the only player in town. Big American firms and other multinational drug companies are already working tirelessly to find a cure for Covid-19, and Scancell’s vaccine, if successful, is unlikely to be first to market.

- Stockwatch: a Covid tip update

- Two coronavirus stocks where momentum favours the brave

- The AIM share that just made investors an 8,500% profit

We’ve already written about many of these popular vaccine and testing stocks this year. The table below is by no means exhaustive, but does give an idea of where the activity has been and, in the case of Open Orphan (LSE:ORPH) especially, how any association with cure or test for Covid-19 attracts interest from investors.

Open Orphan’s London-based subsidiary hVIVO has just begun testing an anti-viral for treating Covid-19 on behalf of its client Nearmedic International.

| Company | TIDM | Country/Stock market index | Share price | Share price change today (%) | Share price change in 2020 (%) | Market Cap (m) |

|---|---|---|---|---|---|---|

| Novacyt (LSE:NCYT) | NCYT | AIM | 375p | 1.6 | 2,780 | £253.90 |

| Synairgen (LSE:SNG) | SNG | AIM | 62p | -1.6 | 955 | £92.60 |

| Novavax (NASDAQ:NVAX) | NVAX | US | $20.38 | NA | 412 | $1,050 |

| Byotrol (LSE:BYOT) | BYOT | AIM | 6.125p | 7 | 266 | £27.00 |

| Inovio Pharmaceuticals (NASDAQ:INO) | INO | US | $12.03 | NA | 265 | $1,755 |

| Moderna (NASDAQ:MRNA) | MRNA | US | $47.44 | NA | 143 | $15,608 |

| Open Orphan (LSE:ORPH) | ORPH | AIM | 7.65p | 5.5 | 68.1 | £42.00 |

| Regeneron Pharmaceuticals (NASDAQ:REGN) | REGN | US | $565.52 | NA | 50.6 | $62,220 |

| Gilead Sciences (NASDAQ:GILD) | GILD | US | $77.78 | NA | 19.7 | $97,926 |

| Scancell Holdings (LSE:SCLP) | SCLP | AIM | 8.25p | 61.8 | 13.8 | £38.40 |

| Johnson & Johnson (NYSE:JNJ) | JNJ | US | $155.75 | NA | 6.8 | $410,585 |

| GlaxoSmithKline (LSE:GSK) | GSK | FTSE 100 | 1,691.8p | -0.13 | -4.9 | £84,878 |

| Source: SharePad as at midday 24 April 2020 |

Currently, stocks like these should come with their own health warning, if only as a reminder that all of them, but especially the smaller, less liquid ones, can be extremely volatile and leave investors nursing heavy losses as well as spectacular gains.

Indeed, this sort of speculative activity is nothing new to Scancell. In 2012, its shares began the year trading at less than 5p, but excitement around its new Moditope vaccine technology platform and lead cancer vaccine SCIB1, caused them to spike above 60p just 10 months later.

- Q1 stock market stats: A 1,410% gain amid the carnage

- Two winning stocks in the race to cure Covid-19

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.