Q1 stock market stats: A 1,410% gain amid the carnage

Covid-19 has devastated financial markets, but some lucky investors have made an absolute fortune.

1st April 2020 15:02

by Graeme Evans from interactive investor

Covid-19 has devastated financial markets, but some lucky investors have made an absolute fortune.

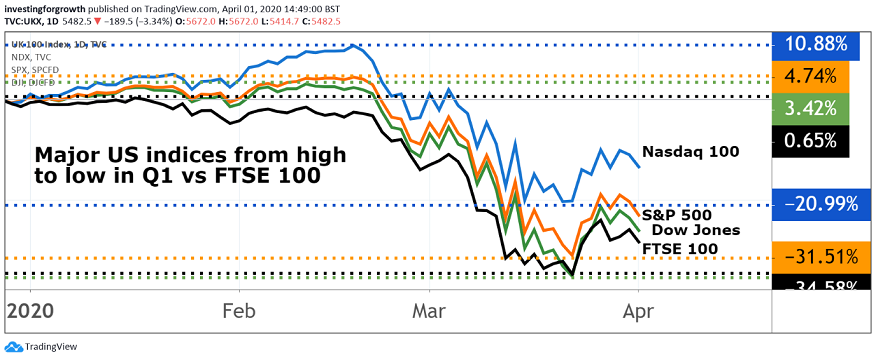

It was a quarter that no investor will ever forget. Having begun with new year optimism and the FTSE 100 index above 7,500, a remarkable period has just ended, with investors in lockdown and nursing substantial losses following a fall of 24.8% for the top-flight.

There were very few hiding places from the pandemic-driven sell-off, with the top 25 blue-chip fallers down by between 73% for cruise ship operator Carnival (LSE:CCL) and 39% for oil major Royal Dutch Shell (LSE:RDSB).

Some popular and widely-held stocks are on this list, with Lloyds Banking Group (LSE:LLOY) down 49%, British Airways owner International Consolidated Airlines Group (LSE:IAG) off 66% and already bombed-out Centrica (LSE:CNA) shares 57% lower at just 38p. Previously high-flying retailers JD Sports Fashion (LSE:JD.) and Next (LSE:NXT) were also down more than 40% after being forced to shut shops.

To add to the misery for investors, the income taps have been turned off as companies preserve cash in readiness for what could turn out to be a major economic hit. The banks last night withdrew forthcoming payments, joining housebuilders, ITV (LSE:ITV), WPP (LSE:WPP) and many others in doing so.

- The single most important concept for every investor

- Coronavirus crisis: An essential guide for all investors

- 11 UK stocks where experts think the dividend is safe

- A checklist for finding dividend shares in a crisis

The FTSE 100 index finished the quarter at 5,671.96, with only its rally from near to 5,000 ensuring 2020 didn't better Black Monday in 1987 for the worst quarterly performance since the index opened in 1984. There were just six top-flight risers in the period, including defensive plays Pennon Group (LSE:PNN) and National Grid (LSE:NG.), as well as consumer goods firm Reckitt Benckiser (LSE:RB.).

The more UK-exposed FTSE 250 index took an even heavier toll as its 31% slide made it one of the worst performing indices worldwide. The Nasdaq, in contrast, was down only 10.5% after excitement over Tesla (NASDAQ:TSLA) and other tech stocks helped it achieve record highs early in the quarter.

Source: TradingView Past performance is not a guide to future performance

London's biggest second-tier fallers included the 80% slide for outsourcing group Capita (LSE:CPI) as investors worried about how economic disruption will affect the company's restructuring. Pub chains, transport groups and shopping centre owners are unsurprisingly on the list — with Marston's (LSE:MARS) down 67%, Go-Ahead Group (LSE:GOG) 63% lower and Hammerson (LSE:HMSO) down 75%.

The absence of sporting events has also dealt a severe blow to William Hill (LSE:WMH), along with an estimated £25 million in lost profits for every month its high street bookies are shut. The shares closed down 64% at 68.1p but had been as low as 28.6p.

That proved too good an opportunity to miss for directors including chief executive Ulrik Bengtsson, who bought 75,000 Hill shares at 39.83p and then 15,000 at 38.76p, costing a total of £45,000. A rally in recent days means directors are currently sitting on big paper profits.

Among the smaller cap stocks, the lockdown has left a big mark on a number of well-known retail companies. Shares in Card Factory (LSE:CARD), Superdry (LSE:SDRY) and Ted Baker (LSE:TED) all fell by more than 70%, while online fashion group N Brown (LSE:BWNG) tumbled 91%!

The market volatility has been good news for some stocks, with contracts-for-difference trading specialist Plus500 up 22% in the quarter. Russian gold miner Petropavlovsk (LSE:POG), which was tipped by our own Edmond Jackson last month, rose 66% on the back of higher gold prices.

There have also been some spectacular gains in the AIM junior market, most notably for three companies on the frontline of the coronavirus fight. Novacyt shares surged 1,410% in the quarter after its Southampton-based Primerdesign division sold and received orders for over £17.8 million of its CE-Mark and research-use only tests for coronavirus. It is now battling to keep up with demand as it looks to produce four million tests per month.

Synairgen, the respiratory drug discovery and development company, jumped 938% after announcing it had commenced dosing patients in its trial of SNG001 in Covid-19 patients.

Byotrol, meanwhile, rose 223% in the quarter as demand for its range of infection prevention and control technologies resulted in orders of £1.7 million for deliveries up to June, with many more still being processed. Its order book in a more normal period is typically around £350,000.

Source: TradingView Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.