16 shares for the future

4th May 2018 17:33

by Richard Beddard from interactive investor

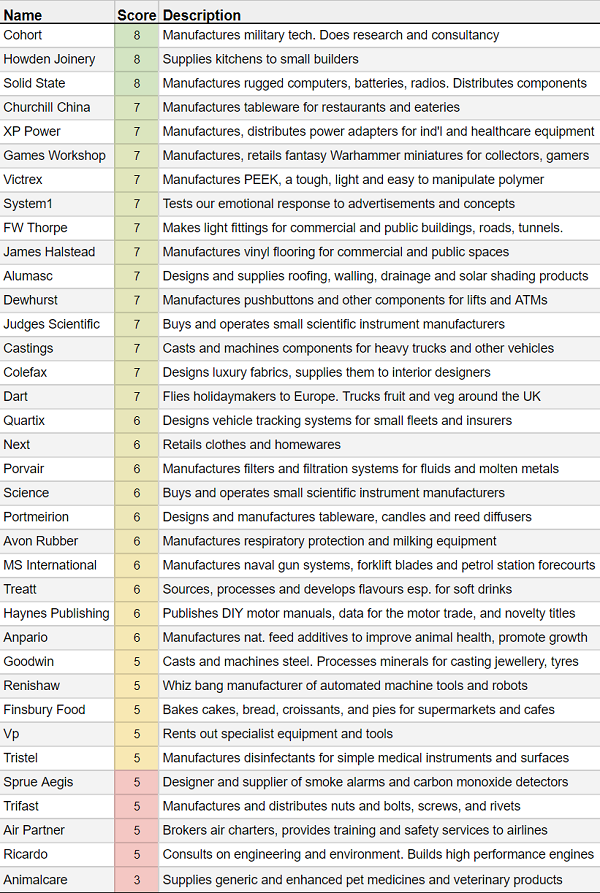

Every five weeks I publish the results from my Decision Engine, which ranks the shares I follow and helps me decide which are the best long-term investments.

Here's the list, most attractive at the top, least attractive down below:

Source: interactive investor Past performance is not a guide to future performance

• Is Portmeirion in the 'buy' zone?

• XP Power shares: They're electrifying!

• Howden Joinery: The IKEA of fitted kitchens

• Understanding Science is worth the effort

Upgrades and downgrades

We're right in the middle of the busiest time of year for me, when many companies publish annual reports and I update my Decision Engine spreadsheet with data and business analysis. Since the last update on 23 March I've re-evaluated , , , and .

The process of re-evaluation is not limited to this annual set-piece, though. Whenever I learn something new that changes my opinion on the long term prospects of a business, how successfully it makes money, what it's doing to make more, and what might go wrong, I update its score in the Decision Engine. Whenever the share price moves (i.e. all the time), the spreadsheet updates its valuation. The Decision Engine ranking for a particular share depends on the combination of the score I've given the business and its valuation. Good businesses at cheap prices achieve the highest scores.

Most of the time, shifting judgements and share prices amount to little more than divots or molehills in a rolling fairway on the way to a hole in one, or a par for the course investment at least. I get more agitated when a share's score breaches one of two arbitrary levels.

If the score rises above seven, either because the price has fallen or because I've warmed to the share, it means I'm confident enough to buy the shares for the long-term. If the score falls below five, either because the share price has escalated to very high levels or I'm fretting too much about the firm's long-term prospects, I consider selling.

James Halstead: Price slide

News that vinyl floor manufacturer , which I last evaluated in December, may make an offer for carpet tile manufacturer Airea has done little to abate a year-long slide in the company's share price. Maybe the market is recognising highly-profitable Halstead has become, as a friend describes it, "a chugger", a slow and steady grower, rather than the rapidly growing company it used to be. Halstead's new interest in carpet may also be an admission it needs to look beyond vinyl for growth.

A chugger can be a good investment at the right price, though, and Halstead's Decision Engine ranking suggests the current price, which is just shy of £4.00, may be right.

Science: AGM update

Maybe one of the other shareholders at the Science AGM on 19 April liked what they heard, because the share price has gone up by more than 20% since. The surge in price has had a negative impact on Science's score, knocking it down a peg to 6, and out of my buyzone for now.

I don't think the rise in the share price is particularly significant, I hope for many times more than a 20% gain over the long-term. But I was there at the AGM, and I exited with mixed feelings.

Science is a group of consultancies built on Sagentia, a firm of scientists based at a laboratory in Cambridge. Sagentia does scientific research and product development for a fee. Its customers are businesses that don't want to do the research themselves.

This decade, under the chairmanship and majority ownership of Martyn Ratcliffe, Science has diversified by acquiring consultancies that provide advice and services relating to technology, strategy, and regulation.

The resulting group has an array of capabilities, in an array of industries, across an array of territories and while it's obvious from Science's website it's trying to sell the services of each subsidiary to customers of the others, it's not obvious there's a guiding policy, other than to sell more services.

There is. Science is pitching services throughout the product development cycle, which Ratcliffe says differentiates it from its Cambridge competitors. Part of the rationale behind the recent acquisition of TSG, which provides regulatory advice, is that by bringing regulatory nous to bear at the product design stage, the resulting product is more likely to be approved.

We were also asked to vote on a share buy-back programme at the AGM. Science believes its shares are undervalued, which may be inhibiting the firm's strategy.

A low share price means the company is not keen to issue more shares to raise funds for acquisitions. If the shares don't go up, the newly minted share option scheme, designed to motivate and retain scientists, won't be worth the paper the certificates are printed on.

Science believes new institutional investors aren't interested in buying shares because they can't get their hands on sufficient quantity. 80% of the shares are owned by the firm's nine largest shareholders, who, believing they are undervalued aren't keen to sell them.

Science has outsourced the task of buying back shares to a broker, within limits, which may be good for the share prices, but it will also exacerbate the underlying problem as the shareholders' register becomes ever more concentrated.

Science doesn't appear to have a solution to the liquidity trap and put on the spot at the AGM, my suggestion, that the company court private investors, was dismissed.

That, Ratcliffe said, would add volatility to the share price, but not funds in the company's coffers when it needs them. Dealing with private investors would be expensive, and he's not about to recruit an investor relations department.

Solid State: Profit warning

I've got some thinking to do about , one of the highest ranked shares. The company owes its high rank to a slump in the share price that on the face of it looks inexplicable. Earlier this month Solid State said it will report higher revenue and profit for the year to March 2018 than it earned the year before.

Within Solid State's update was a warning, though. The lower margin battery and distribution divisions are doing better than the higher margin manufacturing division, and in particular communications, which makes radios and antenna. Solid State says it is losing out to domestic manufacturers in North American markets and its scaling back its expectations for the division in the year to March 2019.

Profit warnings are bad news in the short-term, but I'm not rushing to judgement about the long-term. We won't know how significant North American sales were in the year just concluded until July when Solid State publishes its results, but Solid State only earned £900,000 (compared to total revenue of £40 million) in North America in the year to March 2017, when the company invested £1 million in its "world class" antenna factory. Presumably it hasn't received as many orders as anticipated, and the costs of operating the new facility at a low capacity may eat into profit in 2019 too.

I don't think these events are sufficient to change my opinion of the business and its long-term prospects, but as we go through the reporting cycle and learn more I will be updating the Decision Engine.

Coming soon

and have published annual reports recently. I have already updated the figures in the Decision Engine, however their rankings could still change when as I re-evaluate the businesses.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Richard owns shares in Science and Solid State.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.