Is a 50% stockmarket correction realistic?

23rd November 2016 10:37

by Lance Roberts from ii contributor

This won't end well

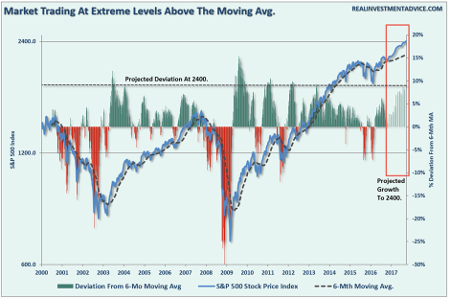

As shown in the chart below, the rising dollar and interest rates will lead to an explosion somewhere in the economy and the markets that will negate a good chunk, if not all, of any fiscal policy measures implemented by the next administration.

Where, and when, are the two questions that cannot be answered.

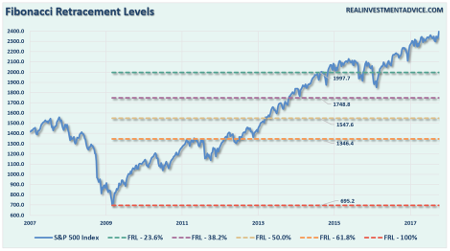

How big of a correction could be witnessed? The second chart below, once again extrapolated to 2,400, shows the mathematical retracement levels based on the Fibonacci sequence.

The most likely correction would be back to 2,000-ish, which would officially enter "bear market" territory of 23.6%.

However, most corrections, historically speaking, generally approach the 38.2% correction level. Such a correction would be consistent with a normal recessionary decline and bear market.

Of course, given the length and duration of the current bull-market with extremely weak fundamental underpinnings, leverage, and over-valuations, a 50% correction back towards the 1,300 level is certainly not out of the question. Let's not even discuss what would happen if we go beyond that, but suffice it to say it wouldn't be good.

And when it does, the media will ask first "why no-one saw it coming". Then they will ask "why you didn't see it coming when it so obvious".

It will likely be a one-way trip; such a move is consistent with the final stages of a market melt-upIn the end, being right or wrong has no effect on the media as they are not managing money, nor are they held responsible for consistently poor advice. However, being right or wrong has a very big effect on you.

Yes, a move to 2,400 is viable, but there must be a sharp improvement in the underlying fundamental and economic backdrop. Right now, there is little evidence of that in the making and, with the rise of the dollar and rates, the Fed tightening monetary policy and real consumption weak, there are many headwinds to conquer.

Regardless, it will likely be a one-way trip and it should be realized that such a move would be consistent with the final stages of a market melt-up.

To read the rest of Lance's fantastic newsletter click here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In.