Active funds are unlikely to be winners all the time

Just 11% of fund managers outperformed their index by more than 5% when fees are accounted for.

18th October 2019 11:52

by Tom Bailey from interactive investor

Just 11% of fund managers outperformed their index by more than 5% when fees are accounted for.

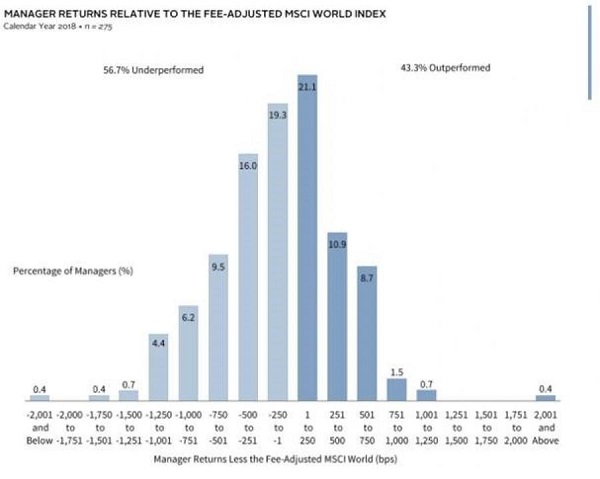

Only 20% of fund managers outperformed their benchmark by more than 2.5% once fees were taken into account in 2018, according to the Global Equity Manager Performance Report 2018, produced by Cambridge Associates.

Based on the performance of 275 fund managers, the study found that just 11% outperformed their index by more than 5%, again on a fee adjusted basis.

In total, more fund managers were found to provide performance below their benchmark during 2018. After fees, a total of 56.7% provided returns below their benchmark, with 43.3% beating their benchmark.

The majority of those that beat their index, however, provided only a relatively small amount of outperformance – or "alpha" as it is commonly referred to. As the graph below shows, the largest cohort of managers that beat the benchmark only did so by between 1% and 2.5% (presented in the graph as basis points).

The study also published stats showing the degree to which a fund manager's performance can change.

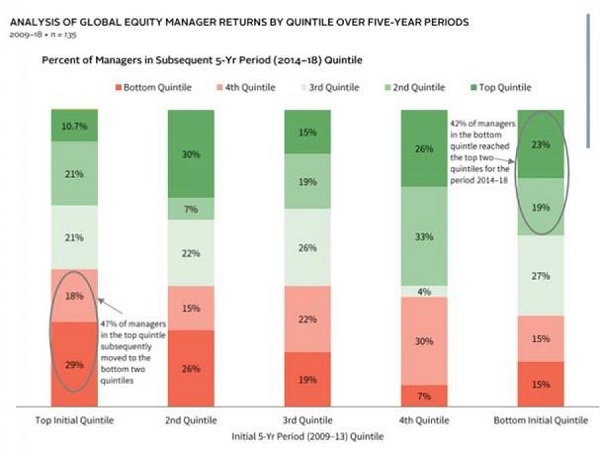

The report shows that 42% of managers that found themselves in the bottom 20% of their peer group for performance in the period between 2009 and 2013 saw themselves enter the top 40% on the following five year period, dated 2014-2018. This can be seen in the graph below.

This, the paper's authors argue, shows the importance of investors not attempting to chase performance, moving in and out of funds based on short-term results. Instead, the study argues, investors should take a long-term approach and accept that managers will likely go through periods of poor performance, either relative to peers or their benchmark.

Sean Duffin, investment director at Cambridge Associates, says: "Winning fund managers are unlikely to be winners all the time so it's crucial that investors don't unnecessarily chop and change too quickly. A good manager will rebound and it's important to be there when that happens.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.