Active Income portfolio: Royal Mail out, Raven Russia in

20th December 2013 12:00

by Nick Louth from interactive investor

Russia-focused warehouse company Raven Russia is one of the great secrets of any income portfolio.

It's a truly liquid preference stock with a fat yield of close on 8%, which pumps out a reliable quarterly payment. The fact that the company invests in Russia has always put many investors off, as it is considered the dodgiest BRIC (Brazil, Russia, India, China) in the emerging markets wall.

Yet the warehouses the company builds and leases are in great demand in a country that has a real shortage, as its recent interim management statement showed.

Raven Russia has 1.4 million square metres of its portfolio of warehouses in Moscow, St Petersburg, Rostov-on-Don and Novosibirsk, and only 3% of that floor space is vacant. Rental income is due to rise further as the firm has just signed a lease with Dixy, the large Russian supermarket operator, for 39,284 square metres of new space in the next phase of the retail company's Noginsk project in Moscow. That deal involves an almost 18% rental yield.

Forecasted rise in NAV

Fortunately, the company has plenty of land to build more such units. Better still, analysts forecast the net asset value (NAV) is expected to rise from the current 77p to more than 90p by the end of 2013.

There are three ways to play this company's strength. Investors can choose between its ordinary shares, preference shares (which this portfolio has held for more than a year) or warrants.

The ordinary shares offer an effective yield of about 5.3%, largely effected through buyback tenders. For the full year, analysts expect a total payout of 5p through this route, to boost the yield to 6.3%. However, the ordinary share price has so far only made a muted recovery from the damage of the global financial crisis, in line with the company's NAV, and is still way short of the 125p reached in 2007.

There may now, however, be a new stimulus for change. On 27 November, Raven Russia made an offer to existing shareholders, of two new ordinary shares in exchange for each preference share, for up to half of each shareholder's holdings.

The preference shares pay a hefty sterling dividend, and the idea of the exchange is to cut this large sterling-denominated outgoing (which is taken from dollar-denominated earnings) in order to improve the company's risk profile. There is even a chance that the enlarged equity could allow the firm into the FTSE 250. With the 79p value of the ordinary shares, this proposal added a few pence to the prevailing 149p price of the preference shares.

Shareholder agreement

This all makes sense for the company, and key shareholders have already agreed to go along with it. Invesco Asset Management, which alone owns 51.3 % of the stock, has irrevocably committed to accept, as have chairman Anton Bilton and his associates, who own a further 14.4%.

But is it right for every investor? For the purposes of the active income portfolio, I don't think so.

Having the prefs has given us an extra layer of fixed-dividend security against both the Russia-risk exposure and the property cycle. Though the ordinary shares may be attractive, any dividends will be variable and probably smaller. I don't want to forgo the prefs that have served so well, and are still not over-priced.

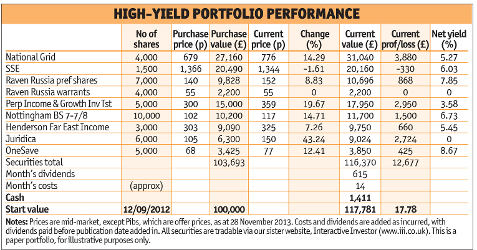

Instead, I will sell the Royal Mail shares that have had a terrific run and are now dramatically overpriced at the prevailing price of 560p, and invest this sum, plus some of the portfolio's existing cash, into Raven Russia warrants.

This is a geared way to ride any upward move of the ordinary shares. Each warrant allows for the purchase of an ordinary share at 25p, and at the current offer price of 57p, we are only paying 3p for the time value of what is in effect a call option on the ordinary shares running until March 2019. Because of the implicit gearing of the warrants, this is the most capital-effective way to gain upside to the opportunities that Raven Russia has.

There are two dividends this time: Raven Russia pref, 3p a share (£210 total), and 2.7p from Perpetual Income & Growth Investment Trust (£405).