Aveva shares still generate excitement

19th September 2018 12:20

by Graeme Evans from interactive investor

After pulling off an impressive merger with a French peer, investors have chased Aveva higher again after this update. Graeme Evans reports.

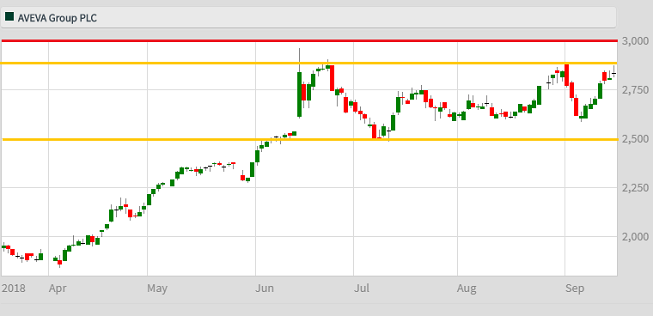

The honeymoon period for new-look Aveva Group shows no signs of ending after another positive update propelled shares through the £30 barrier.

Cambridge-based Aveva, which has enjoyed a stunning share price rally since tying the knot with Schneider's industrial software business earlier this year, kept up momentum with the release of new medium-term targets.

These were welcomed in the City ahead of Aveva's capital markets day, with shares up 6% after Aveva said it was planning for the enlarged business to achieve mid-single digit revenues growth and 30% margins.

Credit Suisse said:

"We have been signalling higher medium-term earnings power at Aveva for some time, and today's newly-announced targets confirm that view."

While the improvement in the margin from the starting point of 23.5% will take time to flow through, analyst Charles Brennan thinks achieving the target will mean 2020 earnings per share rising by about 25%.

This would put Aveva on a price/earnings (PE) multiple of about 25 times, which compares with rival Dassault on a 2019 PE of 39 times and broader sector peers on about 42 times.

Brennan has a price target of 3,050p, while Investec Securities has stated a case for the shares to be valued at 3,400p based on the targets and 120p of cash.

Source: interactive investor Past performance is not a guide to future performance

Investec analyst Julian Yates said the strength of the group's strategic and market positioning underpinned the new medium-term targets.

He added:

"We see them as realistic as opposed to optimistic and on a blue-sky basis we would expect there to be room for potential outperformance in the longer term."

The Schneider merger completed on March 1 following many years of discussion and speculation. The combination was structured as a reverse takeover as it gave the French energy group a 60% stake in Aveva.

As part of the deal process, Aveva handed £650 million or 1,015p a share to its shareholders in March. It recently maintained its final dividend at 27p a share.

Aveva is a specialist in engineering design and 3D visualisation technologies, but by combining with Schneider has significantly increased its presence in the key North American market and reduced exposure to the cyclical oil and gas end market. Schneider is a specialist in food, beverages and pharmaceuticals.

While Aveva is exposed to some cyclical markets, the company is well placed to benefit from the trend towards the digitalisation of various industries. It has also recently reported signs of recovery in oil and gas markets and in marine.

Credit Suisse's Brennan said that while the medium-term revenues growth forecast today appeared modest, it was important to note the planned rise in subscription revenues As a result, recurring revenues are targeted to increase from 52% of the total to 60%, helping to improve the quality of earnings.

Other margin levers include cost control and prioritising higher value software over lower margin services.

Aveva, which was established in 1967 as a breakaway from Cambridge University, was formerly known as CADCentre and listed on the London Stock Exchange in 1996. It changed its name to Aveva in 2001.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.