Baillie Gifford’s Charles Plowden on the catalyst that transformed Monks

A manager of Monks Investment Trust explains how a shift of approach has changed the trust’s performan…

18th March 2020 09:45

by Kyle Caldwell from interactive investor

A manager of Monks Investment Trust explains how a shift of approach has changed the trust’s performance.

This piece was written before the impact of the coronavirus on global markets.

Investor inertia is a powerful phenomenon. In an investment context, it leads to poor outcomes and keeps alive sub-standard actively managed funds that do not deliver discernible value.

This is less of a problem in the investment trust space than in the open-ended fund arena, as trusts are overseen by their independent boards of directors, which have a duty to act in the best interest of shareholders. As a consequence of their interventions, fund management groups may be chopped and changed on performance grounds, or a change of internal manager may even be implemented – which admittedly seems an awkward conversation from the outside looking in.

Five years ago, however, the board of Monks investment trust chose the latter option, electing to stay with Baillie Gifford, the fund manager that has managed the trust since 1931, but move to a new team.

Read more on investment trusts:

- 11 investment trusts for a £10,000 annual income

- Alliance Trust switch to multi-manager approach is paying off

- Specialist investment trust choices for 2020: hidden gems

Switch from value to growth

Charles Plowden and his team (co-managers Spencer Adair & Malcolm MacColl) were appointed with a mandate to mirror the way they had successfully invested for Baillie Gifford’s institutional clients. Their change of approach took effect with a switch from a ‘value’ style of buying recovery stocks to a growth focus, searching out the ‘best of the best’ – or in Plowden’s own words, “seeking out that rare subset of companies with the potential to grow to multiples of their current size”.

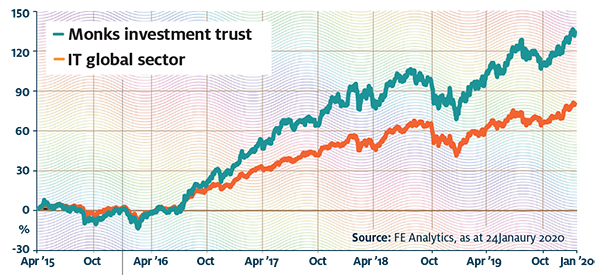

They overhauled the portfolio and subsequent performance has impressed: Monks’ share price total return since Plowden took over (end of March 2015) stands at 135%, versus 80% for the average global investment trust. Shareholders who held the trust under its previous guise will no doubt be happy; moreover, its performance has caught the eye of a cohort of new investors, as the trust’s share price has moved from a high discount to net asset value of 13% to a small premium (as of late January).

Earnings growth hurdle

All of the 120 holdings in the portfolio fall into one of four categories: ‘rapid growth’, ‘growth stalwarts’, ‘cyclical growth’ and ‘latent growth’. Plowden and his team look for businesses that are growing earnings by at least 10% per year – a high hurdle that narrows the investable universe.

“We avoid structurally challenged businesses – oil majors, the big banks, big pharma, high-street retailers and traditional car manufacturers,” explains Plowden. “A more recent worry is low-cost airliners, as I think there will be more ‘flight shaming’ in the years to come following greater levels of carbon awareness. Instead, we are looking 10 years ahead and investing in businesses that have a defendable edge. Our ambition is to invest in the best growth companies in the world that are growing their earnings at least 10% annually.”

The biggest bucket, comprising 40% of the portfolio, is the rapid growth business. “This category houses innovative companies, many at an early stage, that are growing quickly (by 15% to 25% a year) and in five years’ time could be twice or three times the size they are today,” he says.

The big technology giants such as Amazon, Alibaba, Alphabet and Facebook, are held and will continue to feature despite a specular run over the past five years. Plowden adds: “We have and will take profits, for instance with Amazon we have sold half of our holding over the past three years, but we are keen and happy to run our winners.

“The scale these businesses have is an enormous competitive advantage, so in respect to valuations I do not mind paying a sensible premium for quality and for high levels of future growth. For every single holding we invest on the basis that there is a 30% chance our investment will double over the next five years – otherwise it gets sold.”

Network effects

While Plowden remains bullish on the famous tech names, he has also increasingly focused on more specialist earlier-stage technology companies that benefit from having the same network effects. The theory is that the more users these firm have, the stronger their competitive advantage becomes. Examples of firms Plowden has been buying include Lending Tree (financial services aggregator), Teladoc (virtual doctor business) and Axon Enterprise (which produces Taser smart weapons for law enforcement).

All three are US businesses; they are what Plowden describes as “incubator holdings”, and as such have individual weightings of 0.5% or less. Some are private businesses, with Monks’ board last year agreeing to increase unlisted exposure from 2% to 5% of the portfolio. “The investment trust structure has proved it can handle illiquid holdings – having a fixed pool of assets means I do not have to worry about funding redemptions,” he observes.

Two of the remaining three growth categories – cyclical growth and latent growth – are more tactical. Cyclical growth, which comprises 18% of the portfolio, involves looking for “management teams that are skilled asset allocators” in terms of adding value during a cyclical downturn. Latent growth (12%) contains out-of-form businesses.

“In this category we hold dull businesses whose future we think will improve – it could be signs of positive change in the industry it operates in, or a new management team,” Plowden says.

While Monks has a big focus on unearthing the future stars of tomorrow and exploiting various tactical themes and opportunities, Plowden reduces risk through having the remainder of the portfolio (around 30%) in steady-eddy stocks – growth stalwarts. He explains: “Whatever the economic weather, these businesses will continue to grow and will be operating in 20 years’ time, as they have durable franchises and competitive advantages.” Three of the biggest holdings are Prudential, Moody’s and Visa.

Risk is also reduced somewhat by the average holding in the portfolio being less than 1% of the total. Indeed, the overall composition of Monks is less aggressive than its big global trust rival, Scottish Mortgage – which is also managed by Baillie Gifford.

Looking ahead, Plowden does not share the doom and gloom of other commentators who argue the longest bull market in history is increasingly looking long in the tooth. “We are today not finding investment opportunities any more elusive than we did five years ago. The forecast growth for the portfolio is the same as it was five years ago. I am not saying the level of returns will be the same, but the world is not running out of growth opportunities – there’s an increasing number of disruptors.”

Monks outperformed its sector by 55% since 2015

Charles Plowden in six

1. Best investment: My best investment has to be Amazon, which has profited our clients many times over. We invested for our institutional clients in 2006, backing Amazon’s ambition and potential when most observers considered it to be a bookseller. While we were bullish, we could have never imagined how far the story would go, which underlines the importance of management ambition and flexibility to success.

2. Worst investment and lesson learned: OGX the Brazilian E&P stock, which went from being Brazil’s second-largest company in 2012 to filing for bankruptcy in 2013. The lessons: stick to what you understand, and when in a hole stop digging.

3. My alternative career would have been: I once toyed with political risk analysis.

4. In my spare time, I like to: get out into the Scottish country air.

5. The one thing I would like to see change in financial services is: for the industry to rediscover the purpose of investing: allocating capital to entrepreneurs and companies which provide products and services that generate wealth and benefit society.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.