Bargain Hunter: Baillie Gifford trusts are cheap, time to buy?

14th June 2022 11:15

by Kyle Caldwell from interactive investor

11 Baillie Gifford trusts are trading on wider-than-usual discounts. We ask analysts whether this is an opportunity for brave investors to pick up bargains.

The dramatic shift away from the growth style of investing over the past six months or so has hurt Baillie Gifford more than most.

The Edinburgh-based fund management firm has a distinctive long-term, growth-focused investment approach that runs across its fund and investment trust range.

With inflation levels soaring and interest rates on the rise, growth companies, including tech firms, have fallen out of favour. Instead, investors have turned their attention to cheaper ‘value’ stocks.

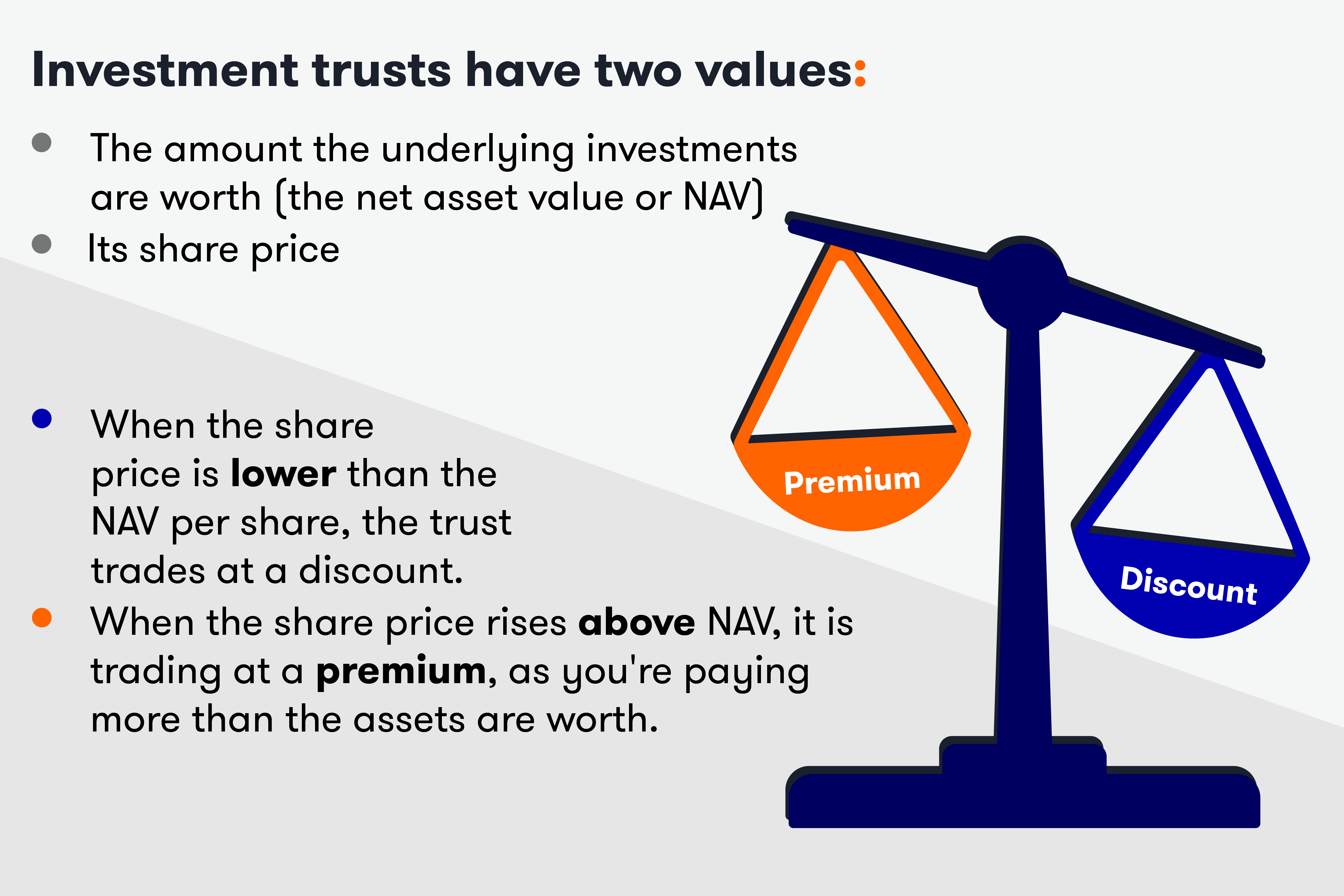

As a result, most of Baillie Gifford’s investment trusts have fallen out favour, and are now trading on discounts to net asset values (NAVs).

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

The table below shows that 11 of the firm’s 13 closed-ended funds are trading on discounts. The two exceptions are Schiehallion (LSE:MNTN) and Baillie Gifford China Growth Trust (LSE:BGCG).

- Funds Fan: dividend demand, bear market tips, and Mobius interview

- Fund and trust alternatives to Scottish Mortgage and Fundsmith Equity

All 11 trusts, which are ranked in the table below according to their Z-score, are trading on discounts in excess of their 12-month average.

For our Bargain Hunter column, this is the stating point for a potential bargain. We then consider how the trust’s discount stacks up versus comparable trusts in its sector, and also assess the mood among investment trust analysts.

Baillie Gifford trusts suffer from market rotation

| Investment trust | Z-score | Current discount (%) | 12-month average discount (%) | Year-to-date share price performance (%) | Five-year share price performance (%) |

|---|---|---|---|---|---|

| Scottish Mortgage | -2.9 | -11 | -0.9 | -44.1 | 87.5 |

| Scottish American | -2.7 | -1.7 | 1.8 (premium) | -13.5 | 49.8 |

| Baillie Gifford Shin Nippon | -2.6 | -6.9 | -0.5 | -33.9 | 3.6 |

| Baillie Gifford Japan | -2.4 | -7.3 | -1.1 | -26.4 | 6.7 |

| Baillie Gifford US Growth | -2.3 | -15.9 | -3.1 | -50.1 | *N/A as IPO was March 2018 |

| Baillie Gifford UK Growth | -1.8 | -11.5 | -3.9 | -35.1 | -1 |

| Keystone Positive Change | -1.8 | -11.3 | -5.4 | -37.4 | *N/A as took over the trust in February 2021 |

| Baillie Gifford European Growth | -1.8 | -7.8 | -3.5 | -40.1 | * N/A as took over the trust in October 2019 |

| Edinburgh Worldwide | -1.7 | -14.2 | -4.8 | -40.2 | 42.9 |

| Monks | -1.7 | -7.8 | -2.6 | -31.4 | 35.8 |

| Pacific Horizon | -1.5 | -4.5 | -1.5 | -21.4 | 155.2 |

Source: Winterflood for trust discounts, FE Fundinfo for share price information. Data sourced ahead of market open on 13 June. Past performance is not a guide to future performance.

While the discounts are eye-catching, the risk is that investors buying today will catch the proverbial falling knife, given that growth shares look likely to remain under pressure in the short term.

However, for investors taking a long-term perspective, the current discounts may be seen as an opportunity to ‘buy low’ – ahead of share prices and discounts recovering from current levels.

Gavin Haynes, co-founder of consultancy Fairview Investing, says: “If the current inflationary environment continues, then the group’s trusts may continue to face headwinds for some time. However, the myopic pessimism can provide opportunities for long-term investors to buy trusts where the underlying holdings have seen some heavy price falls and the trusts are trading on historical discounts.”

A similar point is made by Pascal Dowling, of Kepler Trust Intelligence, who says: “There are no quick ‘bargains’ to be had here. The current trajectory of markets remains deeply unpleasant, and anyone looking to make a quick buck out of a closing discount is probably on a road to nowhere.

“But the idea that tech has had its day is rather like saying mass transit had its day with the apex of the ocean liner. If you think the demise of growth is overblown, there are some interesting options for those willing to wait, and they are available at juicy discounts.”

Dowling picked out Baillie Gifford Shin Nippon (LSE:BGS) and Baillie Gifford European Growth (LSE:BGEU) as the two most interesting options in terms of current discounts.

- Listen to our interview with Scottish Mortgage

- How to play the market rotation: fund, trust and ETF ideas

- Why it’s important to avoid being overexposed to one fund house

While there’s likely to be further short-term pain, Dowling says that Baillie Gifford Shin Nippon’s board has stated its intention to buy back its own shares in a bid to reduce its discount if it remains substantial, while Baillie Gifford European Growth's discount is much wider than its nearest growth peer in the sector.

Dowling said: “Ballie Gifford Shin Nippon doubled the returns of its nearest peer over the decade to the start of 2022, and it continues to offer a very attractive means to reach the smallest, fastest growing companies in Japan for those who want well-managed exposure to that market.

“Baillie Gifford Europe is another interesting option. Europe, arguably, faces less inflationary pressure than the UK at the point when the Ukraine conflict cools down, and we would see any resolution there as a likely catalyst for a re-rating, putting this trust on the ‘potentials list’ for those seeking international diversification.”

In contrast to Dowling, Haynes is not drawn to Baillie Gifford European Growth's discount. He also has reservations about Baillie Gifford UK Growth Trust (LSE:BGUK).

Haynes explained: “The trusts I would be more cautious of would be European and UK Growth. These markets do not offer the wealth of choice for growth investors that you can get exposure to through Global and US mandates.

“Their recent falls have seen them give up their longer-term outperformance and I wouldn’t be rushing to buy growth-focused trusts in these markets.”

Haynes instead favours Baillie Gifford trusts with a wide global remit that focus on exciting long-term growth prospects. He picked out Scottish Mortgage (LSE:SMT) and Keystone Positive Change (LSE:KPC) as two cheap trusts looking attractive for brave investors willing to invest for the long term.

“Scottish Mortgage, which has seen its discount widen as much as 13% recently, is a good choice to pick up during risk-off periods when investors become overly pessimistic and indiscriminately sell higher-risk areas of their portfolio.

“In a similar vein, Keystone Positive Change offers exposure to transformative growth ideas with a sustainable focus. Its discount looks attractive [for an] entry point.”

James Carthew, head of investment companies at QuotedData, cautions thatin the case of some of the Baillie Gifford trusts, there may be a reasonably well-founded suspicion among investors that the true value of the trusts’ unlisted investments may be lower than the figure in the NAV.

He said: “Baillie Gifford revalue its unlisted investments on a three-month rolling basis. So there may be a bit of a lag for the ones that are valued with reference to comparable quoted companies.”

- Scottish Mortgage unlisted valuations kept ‘fresh’ as markets nosedive

- Don’t be shy, ask ii…when is an investment trust premium too high?

Baillie Gifford US Growth (LSE:USA), Scottish Mortgage, and Edinburgh Worldwide (LSE:EWI) have large weightings to unlisted stocks: 34.6%, 28.7%, and 16.7%, respectively.

Carthew added: “Double-digit discounts on trusts invested in reasonably liquid stocks ought to represent good value. These are the sorts of discount levels where boards should be considering share buybacks.”

In general, investment trusts have a greater tendency to converge to their mean discount rather than the value of their underlying investments, the NAV.

The author owns shares in Scottish Mortgage, along with other investment trusts and funds.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.