Bargain Hunter: sizing up ‘cheap’ investment trusts on 5%-plus yields

8th June 2023 13:09

by Kyle Caldwell from interactive investor

Kyle Caldwell hunts for high income at a cheap price across the investment trust universe.

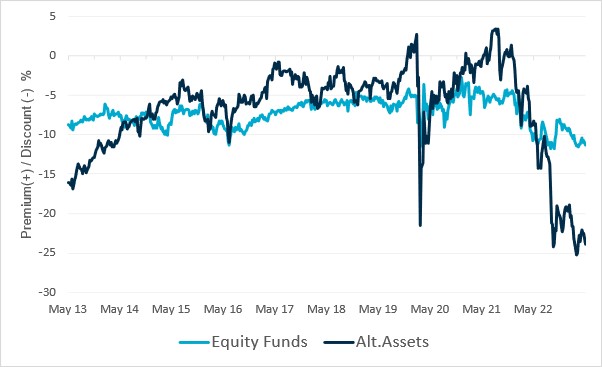

For investment trust fans now is one of the best opportunities over the past decade to try and pick up a bargain, as the chart below from stockbroker Numis shows.

The average equity investment trust is trading on a discount a smidge over 10%, while those that focus on alternative assets are trading on discounts around the 25% mark.

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

Investment trust discounts have been widening in response to interest rate rises, which has triggered a re-pricing of risk assets, due to the fact that investors can now for the first time in more than a decade obtain a decent level of income on low-risk assets, namely cash and bonds.

With yields of between 4% and 5% available on cash and relatively low-risk bonds, there’s less appeal in trying to obtain bigger returns for greater risk. In response, investment trust discounts have widened. In addition, some investment trusts have seen their yields rise in response to share price falls.

For investors sizing up discounts today, the re-pricing of discounts offers a cheaper entry point. This could prove tempting for investors looking for some ‘jam today’, as well as long-term income and capital growth that will hopefully outstrip inflation. In contrast, the income on bonds is fixed, meaning there’s no possibility of a higher return.

In this article we pick out a selection of investment trusts that are potential discount opportunities and trading on yields of around 5% or higher, so are therefore ahead of most cash rates and low-risk bond yields. In all cases, the investment trusts highlighted are trading on wider discounts than their 12-month averages.

However, do bear in mind that it is important to avoid being seduced solely by the discount. Instead, consider the prospects for the investment trust going forwards. If those prospects look bleak, then the discount could widen further, so now may not be a good time to buy.

UK equity funds offering high yields on the cheap

For investors on the lookout for a high-yielding trust for the ‘unloved’ UK equity market Lowland (LSE:LWI) stands out. It is trading on a discount that’s wider than usual, and is offering 5% income today. The trust, managed by James Henderson and Laura Foll, adopts a multi-cap approach, but tends to have a bias towards smaller companies. This has proved to be a headwind to performance over the short term.

Peter Walls, manager of the Unicorn Mastertrust fund (an open-ended fund that invests in closed-ended funds), says that at some point smaller company shares will return to form. In the meantime, investors are being paid to be patient with the high income on offer.

“I would not say Lowland is outstandingly cheap on its current discount, but it is a worthy way of getting a 5% yield,” says Walls.

Another smaller-company focused trust trading on a bigger discount than usual is Diverse Income Trust (LSE:DIVI), 6.1% versus 5% for its 12-month average. The trust, which appears on our Super 60 investment ideas list, is managed by Gervais Williams and yielding 4.8%. The trust has shown growth in its dividend payments over time and has produced some good relative performance over the long term.

JPMorgan Claverhouse (LSE:JCH) also catches the eye. It offers a 5.1% yield, and trades on a discount of 6% against 2.2% over the past year. Claverhouse is part of the eight-strong investment trust club that have consistently raised their dividends for 50 years or more. It owns both growth and value shares to try and strike an appropriate style balance.

- Watch our JPMorgan Claverhouse video:patient investors can make plenty of money from these four sectors

- Watch our JPMorgan Claverhouse video:the high-yielding shares powering this income heavyweight

- The eight income investment trust heavyweights: how sustainable are the dividends?

However, for the rest of the UK equity income trust sector bargains are thin on the ground. City of London (LSE:CTY), which has 56 years of consecutive dividend payments under its belt and a 4.9% yield, is trading on a small 2.1% premium. Elsewhere, the two highest income-paying trusts in the sector, Henderson High Income (LSE:HHI) and Shires Income (LSE:SHRS), are trading on minuscule discounts. The respective yields are 6.1% and 5.6%.

Looking further afield

When looking beyond the UK equity market, there’s plenty of opportunity to find high yields overseas, with European Assets (LSE:EAT) trust standing out on discount grounds.

This ‘enhanced income’ trust finances its dividends from capital as well as income. Its policy is to pay 6% of its net asset value a year, on a quarterly basis.

Investment trusts that adopt this approach do not have to focus predominantly on income-producing companies and can therefore combine an attractive yield with exposure to a variety of growth-oriented companies.

As Matthew Read, a senior analyst at QuotedData, points out “its yield is well ahead of peers”, however its overall total returns have lagged peers, including Montanaro European Smaller (LSE:MTE) and The European Smaller Companies Trust (LSE:ESCT).

This is the risk that investors buying a high-yielding trust face - the price of a higher income today could be a lower total return in future.

Another trust that dips into capital to help fund its dividend is International Biotechnology (LSE:IBT). Rising interest rates and regulatory uncertainty has negatively impacted the biotech sector over the past couple of years, but as Read points out “there is a potential for a re-rating if the sector and/or growth comes back into vogue”.

- Should you invest in Baillie Gifford funds or investment trusts?

- Six experts name their top five funds that should be in every portfolio

- Are you investing in the most-popular funds and trusts?

Read adds that its wider-than-usual discount also reflects uncertainty around its management contract. He explains: “The current manager, SV Health, gave the trust notice in February although we are told the portfolio managers want to stay in the role, and the board says it is reviewing its options.

“This is despite it providing decent returns during the last year – a NAV total return of 17.1%, and 7.2% compound over five years. Hopefully the board will find a new home for the trust so that Ailsa Craig and Marek Poszepczynski can get on with running the portfolio.”

Walls notes that “the jury has been out” since the rule change around a decade ago, which allowed investment trusts to pay some of their dividends from capital.

He notes: “The idea is that by having a higher, but manufactured yield, this will increase the attractiveness of an investment trust. And then in turn, the discount will narrow. It has worked in some cases, but it is not a long-term solution if performance is not up to scratch.”

Moreover, large discounts can be a more permanent feature for trusts due to a lack of investor appetite for shares and a lack of share buybacks by the board.

Elsewhere, abrdn Diversified Income & Growth (LSE:ADIG), is yielding 6.6%, and could be one to watch, according to Walls. He says that following a strategic review a couple of years ago, which resulted in an increased focus on private assets, performance has improved. Since the new investment strategy was adopted in September 2020, the investment trust has delivered a net asset value (NAV) total return of 19.6%, ahead of the target return of 6% per annum, equivalent to 16.2% over the same period.

Alternative assets

Investment trusts specialising in alternative areas, such as infrastructure and renewable infrastructure, have seen their discounts widen notably in response to interest rate rises.

The appeal of owning complicated and expensive-to-manage renewable energy projects for income decreases when investors can simply buy a US or UK government bond and achieve a smaller, but similar, level of income.

Higher interest rates also increases the cost of debt, which is a key tool for renewable infrastructure trusts to purchase new assets.

For both sectors Gavin Trodd, analyst at Numis, picked out International Public Partnerships (LSE:INPP) and Bluefield Solar Income Fund (LSE:BSIF) as two potential bargains.

Trodd said: “International Public Partnerships offers one of the strongest levels of inflation protection (circa 70%), robust dividend cover and quality cashflows within its sector. Dividend cover is healthy at 1.3x with a 2.5% per annum dividend growth rate and [it] has recently reiterated guidance for a 7.93p dividend (5.7% yield) in 2023 and a new target of 8.13p (5.8% yield) in 2024.

“Bluefield Solar Income continues to be one of the highest-quality renewable businesses in the peer group, given its consistently strong track record of earnings growth, and fully covered dividends, even in periods of low power prices.

“In our view, the current rating does not factor in the opportunity set and potential to continue to deliver sector-leading returns, underpinned by a high-quality well covered dividend.”

Another trust trading on a sizeable discount is HICL Infrastructure (LSE:HICL). Over the past 12 months its average discount is 1.1%, and it is now trading on a 12.6% discount.

- Are the 7% yields on renewable energy trusts worth the risk?

- Renewable energy investment trust faces continuation vote

- Investment trust share buybacks: do they benefit private investors?

James Carthew, head of investment companies at QuotedData, points out that while renewables trust are not created equal, for the most part he thinks discounts are unjustified.

“They appear to have been driven by rising interest rates, but high inflation – which tends to be good news for the NAVs of these funds – is largely offsetting the impact of higher rates.

“Ignoring the minnows, the yields on offer now range from 4.8% to over 8%. What’s more, these yields look set to climb further as these funds continue to increase dividends.

“Some are achieving impressive uplifts. In February this year, Greencoat UK Wind (LSE:UKW) hiked its dividend target for 2023 by 13.5%, in May NextEnergy Solar (LSE:NESF) increased its target by 11%. The dividends in this sector are also well covered by cash earnings. This is probably my favoured area for income at the moment.”

Discount data: high income on the cheap

| Investment trust | Dividend yield (%) | Discount (%) | 12-month average discount (%) |

|---|---|---|---|

| NextEnergy Solar | 8.1 | 9.3 | 8.9 |

| abrdn Diversified Income & Growth | 6.6 | 26.9 | 21.8 |

| European Assets | 6.4 | 8.8 | 6.7 |

| Bluefield Solar Income | 6.4 | 5.8 | 2 |

| JPMorgan Claverhouse | 6 | 2.2 | 5.1 |

| Greencoat UK Wind | 5.9 | 10.4 | 4.7 |

| HICL Infrastructure | 5.8 | 12.6 | 1.1 |

| International Public Partnerships | 5.8 | 13.4 | 4.4 |

| Lowland | 5 | 9.6 | 8.9 |

| Diverse Income | 4.8 | 6.1 | 5 |

| International Biotechnology | 4.6 | 7.4 | 5 |

Source: Numis. Discount data to 5 June 2023. Past performance is not a guide to future performance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.