Best and worst AIM shares in Q3 2019

The junior market has underperformed large-caps in 2019, but one company rose 686% in three months.

10th October 2019 13:27

by Graeme Evans from interactive investor

The junior market has underperformed large-caps in 2019, but one company rose 686% in three months.

When the annual AIM awards take place in London tonight, the talk will be about success stories such as Boohoo (LSE:BOO) or AB Dynamics (LSE:ABDP) rather than the junior market's difficult summer.

The AIM All-Share has just endured a miserable third quarter, losing 5% of its value to rank among the worst-performing of the major global indices that UK investors might follow. The FTSE 100 index was flat, while the mid-cap FTSE 250 rose by a surprising 2.5%.

The performance is in sharp contrast to a year earlier, when the annual black-tie AIM awards took place against a backdrop of outperformance over London's bigger indices.

This year's downturn reflects hefty share price declines for some of AIM's biggest hitters, particularly the 47% slide suffered by litigation funding firm Burford Capital (LSE:BUR) in the wake of its high-profile attack by US hedge fund Muddy Waters.

Hutchison China Meditech (LSE:HCM) is another of AIM's big-name stocks under pressure, while ASOS (LSE:ASC) continues to struggle after its sell-off in 2018. It's also a sign of the times that Fevertree Drinks (LSE:FEVR) isn't on the shortlist for any accolades at tonight's AIM Awards.

Boohoo, however, is one of the contenders to be named company of the year after its leading brands bucked the uncertain trend in the retail world. The Manchester-based company is now worth just over £3 billion after its shares rose another 25% in Q3.

But that rise is nothing compared to the gains enjoyed by investors who backed some of the oil and gas minnows and emerging technology stocks in the AIM All-Share index.

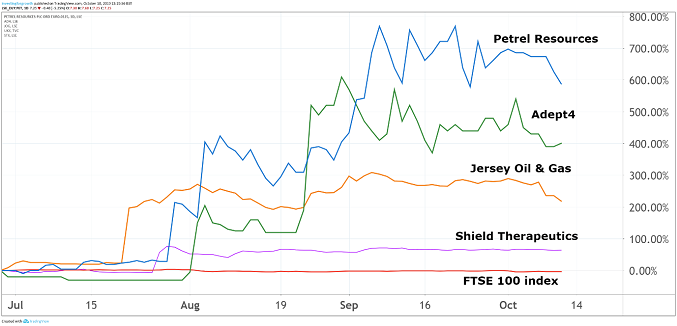

Eight out of the 12 stocks that doubled in value in the three-month period were resource stocks – oil and gas or mining. They are led by Ireland-based exploration and production company Petrel Resources (LSE:PET), which sits top of the pile after jumping 686% to 7.375p.

Petrel, which is a veteran on AIM having listed back in 2000, surged after "an influential group of substantial investors" took an initial 29.99% stake in the company.

The proceeds will be used to acquire and develop assets in the Middle East, particularly Iraq. Petrel has worked in the region since 1999, which it believes offers unique oil and gas opportunities for those companies with the know-how.

Source: TradingView Past performance is not a guide to future performance

Jersey Oil and Gas (LSE:JOG) also rose 253% after news of some transformational licence awards in the North Sea. The company, which listed on AIM in 2015 following the acquisition of Trap Oil, is a popular stock among interactive investor clients, although the share price performance has been somewhat choppy since the start of drilling its Verbier discovery in 2017.

Warrington-based adept4 (LSE:AD4), which delivers IT as a service to UK small and medium-sized companies (SMEs), was the second-biggest riser on AIM in the quarter after it reduced debt as part of a deal to combine with fast-growing start-up CloudCoCo.

Further down the list of AIM risers, Shield Therapeutics (LSE:STX) continued its stunning year since it gained US Food & Drug Administration (FDA) approval for iron deficiency treatment Feraccru. The approval was broader than anticipated and this has doubled the potential market.

Shield is now hoping to secure a commercial partner in the US before the end of 2019, which could provide a further boost for a share price that rose 67% in the third quarter.

On the AIM downside, trading and risk management software business Brady was among the biggest fallers after it warned in August that forecast revenues from new customers will not materialise in the 2019 financial year.

It subsequently said it was looking at funding to provide the company with access to approximately £1.5 million to meet working capital requirements. Shares fell 40% after the profits warning and are down 83% over the quarter.

A profit warning at the start of the period was also to blame for the 78% slide in share price at remote meeting software supplier LoopUp (LSE:LOOP). While the Shoreditch-based company continues to see strong demand for its products, revenue trends among longer-term customers have been subdued. The stock peaked at 470p in May 2018, but now stands at 54.8p.

Among other AIM fallers, ad agency M&C Saatchi (LSE:SAA) lost half its value in Q3 after it said in August that it expected a one-off charge of £6.4 million in relation to an accounting review. At the end of the quarter, it added that profits were also likely to be between 5% and 10% below estimates.

AIM All-Share risers in Q3

| Company | Ticker | Current share price (p) | Performance in Q3 (July-Sep) (%) |

| Petrel Resources (LSE:PET) | PET | 7.375 | 686 |

| Adept4 (LSE:AD4) | AD4 | 2.5 | 575 |

| IDE Group (LSE:IDE) | IDE | 4.5 | 494 |

| Jersey Oil and Gas (LSE:JOG) | JOG | 192 | 253 |

| Clontarf Energy (LSE:CLON) | CLON | 0.615 | 198 |

Source: Sharepad

AIM All-Share fallers in Q3

| Company | Ticker | Current share price (p) | Performance in Q3 (July-Sep) (%) |

| Hydrodec (LSE:HYR) | HYR | 11.25 | -84.6 |

| Brady (LSE:BRY) | BRY | 7 | -83.8 |

| LoopUp (LSE:LOOP) | LOOP | 53.5 | -78.3 |

| Nu-Oil and Gas (LSE:NUOG) | NUOG | 0.08 | -74.5 |

| Kazera Global (LSE:KZG) | KZG | 0.475 | -68.7 |

Source: Sharepad

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.