Brexit, the euro and good news for holidaymakers

This technical analyst explains forex trading and his view on sterling's relationship with the euro.

22nd March 2019 10:28

by Alistair Strang from Trends and Targets

This technical analyst explains forex trading and his view on sterling's relationship with the euro.

GBP:EUR and the strange case of moving goalposts

A common complaint when attempting to extract logic from a given situation, is of goalposts moving. Pausing and considering this, wouldn't football become an interesting sport if the goalposts moved around randomly during a match!

Imagine the players, enacting a carefully thought out strategy, playing the ball in a particular direction, while their target goal stealthily made its way along the other edge of the pitch toward the centre line, chased by a jogging goalie?

I rather suspect I'd enjoy watching such a match.

For now, I'm left with analysing Forex, the only game in town where goalposts have always been mobile.

Alas, with Forex, to preserve sanity, I’m resigned to viewing big picture movement cycles. Too often, zooming in and reviewing day to day movements, all I see is a blur of goalposts moving up and down in nonsensical patterns. Usually, it feels the market is controlled, day to day, by a bunch of folk with their own agenda.

Perhaps I'm being cynical but there is something quite odd, we're invariably correct with Big Picture outlooks but invariably wrong footed with day to day stuff. What happens is quite simple.

A basic, conventional, trading scenario:

If the market goes above X, then expect Y. Logically the stop loss should be at W.

What happens?

The market goes above X, triggering positions.

It then sharply reverses, hitting W. Triggering stop losses.

And then, it goes above X and hits Y.

Responding with a more complex game plan.

If the market goes above X, do nothing. It will reverse to W.

Buy at W. It will go to Y.

Emplace a seriously tight stop loss just below W.

What happens?

The market goes to X, reverses to W, breaks slightly below W. Then goes to Y anyway.

The solution?

Do not provide near-term Forex plays. The market moves the goalposts, needing big pockets and a warped sense of humour. It is said over 90% of Forex players lose money.

Frustratingly, at Trends and Targets, we once advised on a real play with a client whose funds from Australia increased by £100,000 for every one-cent movement against sterling. The potential mapping scenario expected the market to grow from 1.94 Australian dollars up to A$2.20. The bloke bailed at 2.12. His original property deal had netted an extra £1.8 million and he joined the Happy Bunny Society.

Now I've laid out credentials and explained why I can't be bothered giving daily Forex projections, am I grumpy about GBP:EUR?

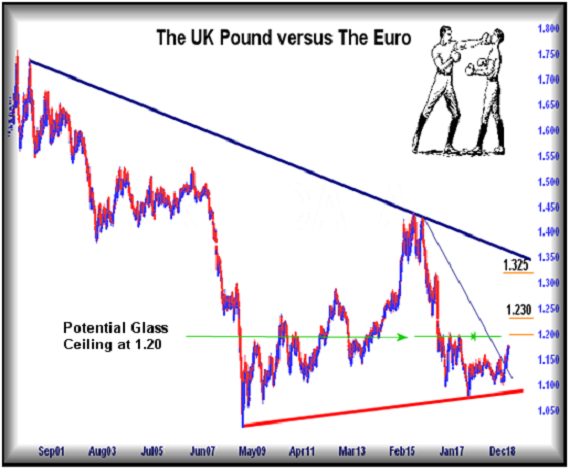

The answer is fairly simple. It's a bit insane but the currency pairing is presently heading to €1.200. There's a market "law" of "higher highs" with the Pound:Euro now achieving higher levels than 2017. Worryingly, achieving my target of 1.200 will simply match the high which followed the Brexit vote.

I'm going to get a bit technical and charty next.

Visually, something commonly called a Glass Ceiling awaits at 1.200.

Everyone is used to Trend Lines, some heading down, some heading up. A Downtrend is measured by the day highs, an Uptrend measured by the day lows. We chose to paint Uptrends in red, Downtrends in blue. But most of the time, they prove to be eye candy, showing nothing realistic.

"Glass Ceilings" on the other hand are different. They are also a trend and we now call them Flat Trends. Essentially, a point where the market says to itself; "this far and no further!"

It's actually quite a big deal and the logic fairly simple.

When the markets appear to decide this is a particular maximum or minimum value, any break beyond such a point is a pretty big signal the goalposts have moved. In the case of sterling and the euro, it seems 1.200 shall prove the real deal sometime in the future.

I'm pretty interested if the level is bettered, even slightly.

At present, I can calculate movement to an initial 1.230 which will doubtless see loads of Brits again facing legal extortion at EuroDisney outside Paris. Rather more importantly, if 1.230 is bettered, a longer term 1.325 makes quite a lot of sense.

Now I've given all this optimism, there is something worthy of consideration, and it's the blue downtrend since 2001. The UK's currency presently needs better than 1.36 to suggest it's "safe", and nothing suggests this is possible. Instead, it appears 1.325 is about as good as we dare hope.

Finally, to remind us of common sense lurking in the wings, the red uptrend on the chart is fairly important. Should this pairing reverse below (roughly) 1.10245, parity becomes the very best hope for the longer term.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.