Commodities outlook: Clear catalyst for bounce in gold?

2nd July 2018 12:28

by Rajan Dhall from interactive investor

After a small period of consolidation last week, commodities in general have found themselves on the back foot at the start of this week.

Crude oil gapped down at the open after reports over the weekend stated that US president Trump looks set to meet the Saudi prince in a bid to lower oil prices before the US holiday season begins.

It has been suggested by some media outlets that he may even ask for an increase of 2 million barrels per day (mbpd).

Furthermore, Trump is said to have persuaded Saudi King Salman bin Abdulaziz to effectively increase Saudi production to maximum levels. It is a reason for concern for the US as at the moment. Oil prices at the pump are currently just over 50 cents higher than the summer of last year and the US has met its inflation target.

As such, the president is hoping for some room for manoeuvre. As for the price action in oil, we recently saw a rise as the 'output hike' was much less than the market expected, with the US leaving the Iran nuclear deal also impacting on prices.

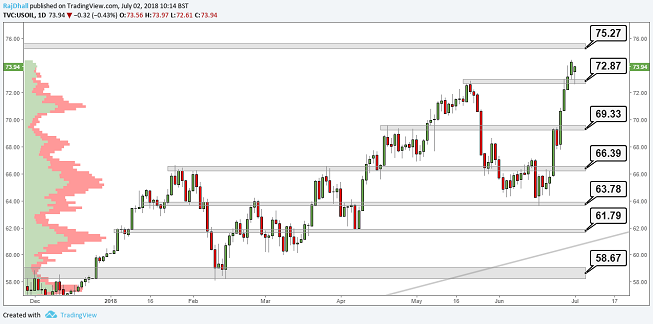

Below is a daily spot WTI chart, and you can see price has currently rejected to lows and moved back up on the day as it seems as the bulls are firmly in control. The resistance level at $75.27/bbl is a level from Sept '09 where price bounced very hard, using it as support following the 9/11 terror attacks.

Past performance is not a guide to future performance

Copper cannot catch a break at the moment. The industrial metal started the week softer, just as downside price action just showed signs of losing momentum.

At the start of this week, the catalyst for the move lower was softer than expected Chinese manufacturing data overnight. The all-important Caixin Manufacturing Index came in at 51.0 vs the exp 51.1, at least still in expansionary territory.

In terms of the price action on the weekly chart below, we can see price just printed below the consolidation support. Importantly, we must wait for a close below that level to confirm prices have breached and point to a move further down, but the last three weeks have been very bearish indeed.

Past performance is not a guide to future performance

Gold is another commodity that continues to fall, although it is reaching an important level.

How much more of a fall can be priced in by good US data given a risk averse backdrop? Yes, the economy has been performing well and at the last FOMC meeting we saw the dot plot move from three to four hike, but US dollar (USD) gains are looking stretched.

At what stage will longer term investors believe they are starting to find value? Naturally, if the USD continues to strengthen we may see the trend continue as investors opt for US Treasuries, but with tensions and trade wars hanging overhead, there is a clear potential catalyst for a bounce?

Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.