Dogs of the Footsie stock performance update

We report on the effects of deep dividend cuts on this Dogs of the Footsie strategy.

27th November 2019 10:57

by Hannah Smith from interactive investor

We report on the effects of deep dividend cuts on this Dogs of the Footsie strategy.

With Brexit uncertainty still weighing on investor sentiment, it’s been a difficult environment for UK plc this year, although a weak pound has helped the FTSE 100 index’s overseas earners. Our Dogs of the Footsie portfolio has struggled against the wider index since inception, but a yield of more than 10% provides some compensation.

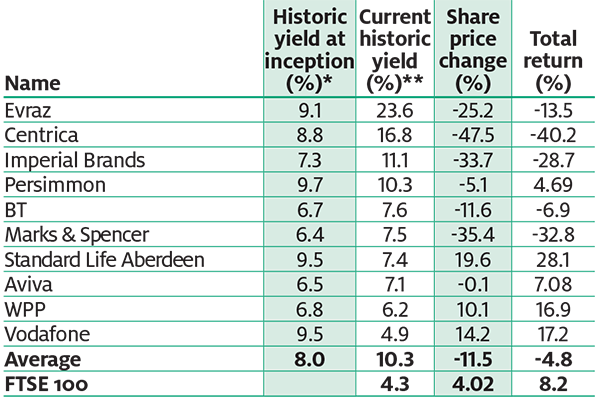

The Dogs of the Footsie strategy takes a portfolio of the 10 stocks in the FTSE 100 with the highest historic dividend yields, invests the same amount in every stock and holds them for a year. Since our 2019 portfolio’s inception on 1 February, the FTSE 100 has returned 4% in share price terms, while the Dogs saw an average fall of 11.5%. On a total return basis, with dividends included, the FTSE 100 returned 8.2%, compared to an average fall of 4.8% for the Dogs.

Why are they struggling? Savage dividend cuts from the likes of Marks & Spencer (LSE:MKS), Vodafone (LSE:VOD) and Centrica (LSE:CNA) have held back performance, while some companies' share prices have recently seen painful falls. Four Dogs now have double-digit yields.

Retailer Marks & Spencer has struggled to win over customers with its clothing range and analysts are predicting it will announce a profits slump in its half-year results. Its shares have lost around 35% and in fact it was relegated to the FTSE 350 in September. Centrica too has seen its share price walloped this year, down 48% since February. The owner of British Gas faces long-term problems including government price caps and a dwindling customer base. So far this year it has suffered a £569 million first-half loss and halved its dividend, and its chief executive has resigned.

EVRAZ (LSE:EVR), Russia’s largest steel producer, boasts a whopping yield, but its shares have also taken a battering in the last few months after several of its top shareholders sold stock: shares are down 41% since 1 September. Evraz looks cheap on current valuations, although future profitability could be in question as falling steel prices and slowing global growth weigh on the commodities sector.

Imperial Brands (LSE:IMB) shares have dropped 21% since our August update as it struggles with changing consumer behaviour and US regulators’ concerns over vaping. The company issued a profit warning in October and its chief executive Alison Cooper stepped down.

It’s not all bad news. Housebuilder Persimmon (LSE:PSN) has been the strongest of our dogs in share price terms since our last update, up 14% despite Brexit-related concerns for this domestically oriented business. The group has been focusing on improving the quality of its homes in response to customer complaints. Vodafone has also performed well after the telecoms giant announced plans to shrink its high street presence by 15%, closing 1,000 stores across Europe and moving customers online.

Scottish asset manager Standard Life Aberdeen (LSE:SLA) has had a year of two halves. Disappointing half-year results, £200 million of share buybacks and the planned departure of its chief executive Martin Gilbert saw the firm’s shares tank in August; but they rebounded to make it the best performer of all of our 2019 dogs in terms of share price performance, up 20% since February.

Similarly, BT Group's (LSE:BT.A) stock hit a four-year low in August, but it has since rebounded and BT is working on a turnaround strategy. While analysts say the stock looks cheaply valued, Brexit uncertainties and a possible ban on its supplier Huawei could weigh in future.

Ad agency WPP (LSE:WPP) recovered from the acrimonious exit of its founder Martin Sorrell to post a surprise return to growth in the third quarter and this, combined with plans to spin off research arm Kantar, helped lift the shares 10% since February.

Despite rising earnings, Aviva shareholders punished the stock when the group announced changes to its dividend policy earlier this year in a bid to cut its debt, although it has made a 5% share price gain since we last updated.

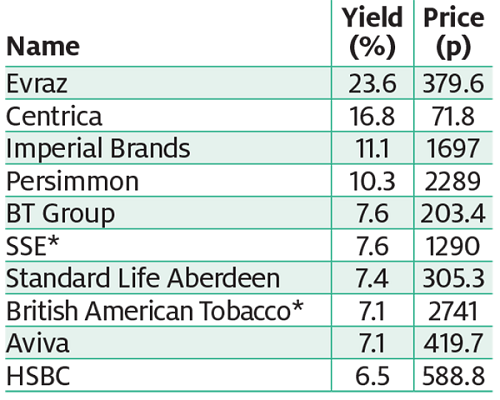

The beauty of the Dogs approach is that you can start this strategy at any point in time. If you had let your dogs out of the kennel on 1 November, you’d find WPP and Vodafone replaced by SSE (LSE:SSE) and British American Tobacco (LSE:BATS), while HSBC (LSE:HSBA) replaced the relegated M&S (see table).

Blood in the kennels since February

Notes: Figures show performance for the period 1 February 2019 to 1 November 2019; Dogs ranked by share price change. *Inception date is 1 February 2019. **As at 1 November 2019. Source: SharePad.

How a November line-up would look

Note: *New entrants for November. The highest-yielding FTSE 100 companies, as at 1 November 2019. Source: SharePad

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.