Have growth and value fund pairs outperformed the market?

23rd June 2022 09:15

by Jennifer Hill from interactive investor

Last year we asked experts to name value and growth fund pairs to navigate the market rotation. The tactic has not yet paid off, but should investors stick with them?

Last spring, after several false starts, we wondered if the rotation to value stocks would become entrenched. No one could have predicted what happened next: war in eastern Europe, soaring inflation and investor nervousness that led high-growth stocks such as technology giants to plunge and unloved ones like banks and energy companies to soar.

The sharp reversal in fortunes highlights the folly of pinning your colours to a single mast. But did our six value and growth pairs do as was intended – capturing the upside of the rotation and thereby protecting against the downside?

Given that the rout in growth stocks has far outstripped the rebound in value stocks, it comes as little surprise that all six pairs lost ground. Data from FE Analytics from 24 March 2021, when our original article was published, to 14 June 2022 shows that the pairs, when invested in equally, lost between 8.5% and 49.5%.

- What an inflation shock really looks like

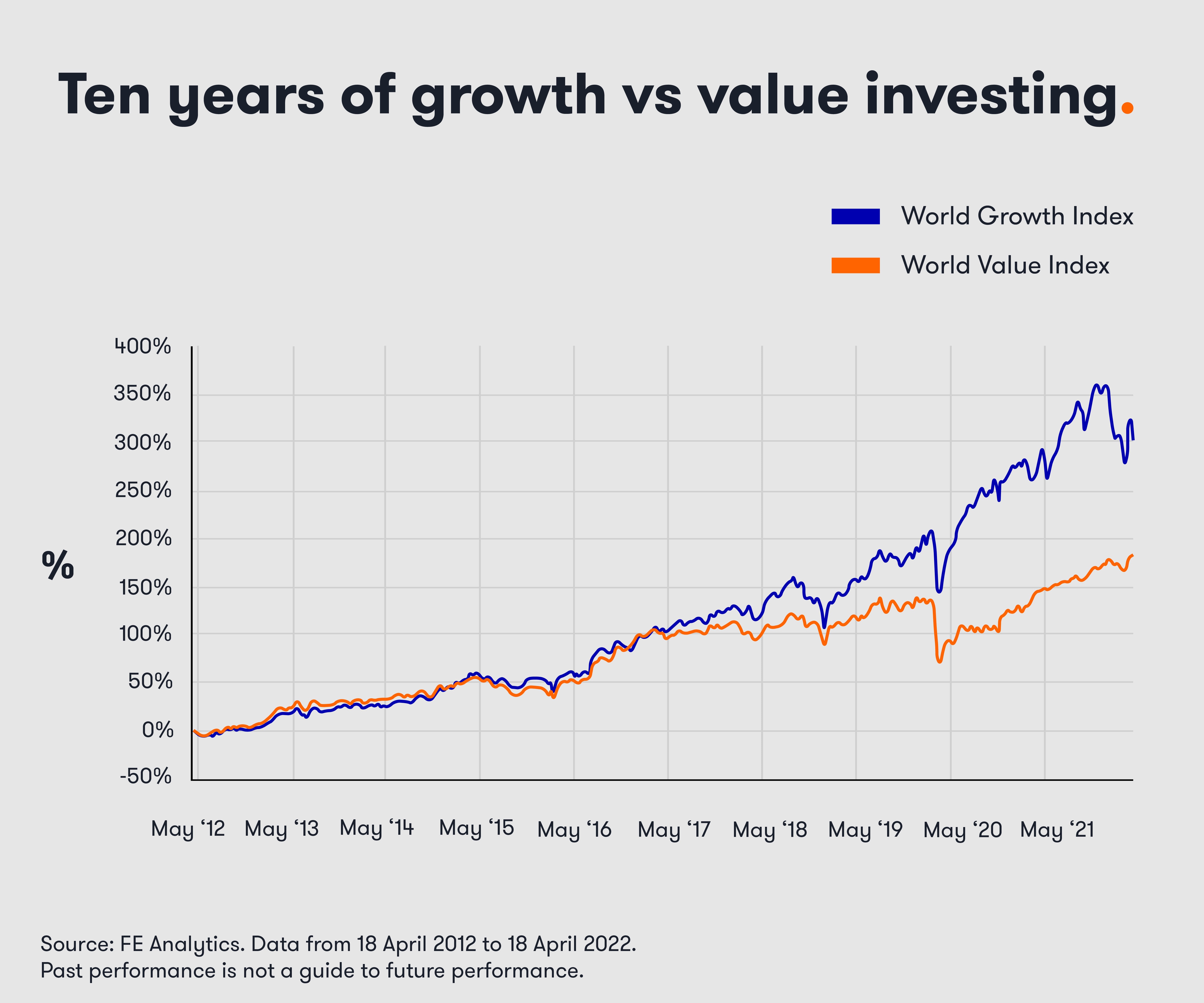

- Watch our video on proof that value investing pays off

- How to play the market rotation: fund, trust and ETF ideas

“The pace and aggression of the growth/value unwind would have left many within the investment community with a bloody nose having drunk the growth Kool-Aid,” says James Sullivan, head of partnerships at Tyndall Investment Management.

He added: “A pairs trade, with funds at either end of the spectrum, was always likely to be about one offsetting the other, akin to a tug of war between two sumo wrestlers. In some cases, one sumo was seriously incapacitated as inflation became far less transitory than the authorities believed.”

Top three

The best-performing pair was two UK equity income plays suggested by Charles Stanley analyst Adam Carruthers. Temple Bar (LSE:TMPL), run by value investors Nick Purves and Ian Lance of RWC Partners, made a 3% gain after a torrid period of losses, and Finsbury Growth & Income (LSE:FGT) run by seasoned growth investor Nick Train, was down 11.5%, holding up far better than many of the experts’ other growth picks.

Both underperformed the FTSE All-Share Index (8.1%) and the investment trust (IT) UK Equity Income sector (3.8%), albeit Temple Bar marginally so. “Both have had their share of stock-specific disappointments,” says Carruthers. “Given their unique investment processes, we would expect performances to be very different to the benchmark.”

He still rates the duo, concurring with the managers’ view that UK-listed businesses have a large amount of underperformance to recoup and favouring their low turnover approaches.

“Any short-term fall in cash flows in a recession does little to impact the long-term intrinsic value of a business, highlighting the importance of investing for the long run, not just one year,” added Carruthers.

David Winckler, Kingswood’s associate director of investment strategy, plumped for two small and medium UK companies funds that had been in its core portfolios since 2018.

- The UK shares three pros have snapped up in this volatile market

- Ian Cowie: dividends to the rescue during market storm

Value proposition Allianz UK Listed Opportunities, run by Matthew Tillet, is the top performer of all 12 suggestions with a 15.9% gain, far outstripping the unit trust (UT) All Companies sector (-0.9%) and the FTSE 250 Index (-8.3%). Growth play Jupiter UK Mid Cap, managed by Richard Watts, returned -33.4%, dragging overall performance down to -17.5%.

For Winckler, the pairing has worked well, generating market-like returns with lower volatility. However, Kingswood removed the Jupiter fund from almost all its core portfolios last July amid “excessive” valuations in the FTSE 250. Today, it prefers to pair the Allianz fund with Slater Growth, which held up a lot better (-4.7%) due to its margin of safety approach and overweight in cash.

Shore Financial Planning director Ben Yearsley paired Man GLG Japan CoreAlpha (11.2%) with Baillie Gifford Japan (LSE:BGFD)(-34.4%), delivering a collective return of -23.2%. While the former significantly outperformed both the Topix (-7.5%) and the UT Japan sector (-9.6%), the latter fell far short of the IT Japan sector (-20.3%).

“I always expect one to be doing well and one poorly, but didn’t expect the level of dross from Baillie Gifford,” he says.

He has stuck by the trust but recently switched into Fidelity Index Japan from the Man GLG fund. “It tends to perform in very big spurts then underperform over a longer period. The index still has a large value weight – obviously not as much as the Man fund – but is 15 times cheaper.”

Bottom three

Sullivan at Tyndall also fell foul of the pounding received by staunch growth investor Baillie Gifford. Its Scottish Mortgage (LSE:SMT) investment trust returned -38%, hugely underperforming the FTSE All-World (4.5%) and IT Global sector (-14.1%). Blending that with value-focused income proposition Murray International (LSE:MYI), which gained 11.2%, almost double the 5.7% rise in the IT Global Equity Income sector, gave an overall performance of -26.8%.

“Funds that sit at the sharp end of the growth spectrum often own numerous companies not forecasting profitability for many years,” says Sullivan. “Applying a present-day valuation to such a fund is fraught with jeopardy.”

Although he believes the fundamentals of the trade remain sound, it depends how much volatility one can stomach: “It’s a question of risk appetite: what emotional roller-coaster is one willing to ride in pursuit of long-term gains?”

The next pair, value proposition Aberdeen Emerging Markets and growthier play JPMorgan Emerging Markets (LSE:JMG), showed the least divergence in performance with returns of -13.7% and -18.8%, respectively.

That is owing to the former being rebranded abrdn China (LSE:ACIC) and switching from investing in emerging markets on a fund-of-funds basis to investing directly in Chinese equities last autumn.

- Why world’s biggest fund manager isn’t buying the dip

- A tactic to ride out the inflation storm using these funds and trusts

“Thereafter, beating the benchmark has been largely down to how much exposure you had to Russia, your bias to growth stocks and whether you were underweight China or not,” says James Carthew, head of investment trust research at QuotedData, who recommended the pair.

Drawing up the rear are UK equities trust Fidelity Special Values (LSE:FSV) and global trust Edinburgh Worldwide (LSE:EWI), which share a focus on small and medium companies. At 1.7%, the former made the smallest gain of our value picks (excluding abrdn China given the change of mandate) and the latter the biggest loss of our growth picks (-51.2%), giving an overall return of -49.5%.

“The degree of underperformance from Edinburgh Worldwide has been a surprise,” says Ewan Lovett-Turner, head of investment companies research at Numis Securities. “It’s been in the eye of the storm given its focus on high-growth global smaller companies with a bias towards technology and healthcare.”

He still believes the trusts combined should deliver an attractive return profile over the long term, albeit the timing of a recovery in Edinburgh Worldwide is hard to call.

Style neutral

Our experts generally concur that high growth stocks will continue to be under the cosh for the rest of 2022 and potentially next year, too.

“There’s a higher-than-average probability of this happening,” says Carruthers. “High levels of inflation and the interest rate levels needed to combat it will be strong headwinds for high growth shares.”

That said, digitalisation is not going to be reversed, and the prospect of recession and more expansionary monetary policy could see the tide turn again.

“The first growth shares that come back into favour are those that can deliver against operational milestones and have solid financing in place,” says Lovett-Turner.

- Here’s why investor sentiment among fund managers is ‘dire’

- The income funds and trusts investors are turning to

Instead of pitting growth against value a style-neutral fund may be preferable. Kingswood tends to use ETFs or tracker funds for such exposure. In the UK, it uses the Vanguard FTSE 100 Index Unit Trust, which has been one of its best performers over the last year.

Lovett-Turner rates Edinburgh (LSE:EDIN), a UK equity income trust that combines growth, value and recovery stocks. Within Japanese equities, Yearsley suggests M&G Japan – “neither an out-and-out value or an out-and-out growth fund”.

For global exposure, Lovett-Turner and Carthew both like Alliance Trust (LSE:ATST) while Tyndall uses the LF Havelock Global Select and Schroder Global Equity funds as core global holdings.

“Pinning one’s colour to any one factor at this stage of the economic cycle is nothing short of cavalier,” adds Sullivan. “Diversification can be our best friend. When times are tough, it’s important to stay in the game and make sure there is always a tomorrow.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.