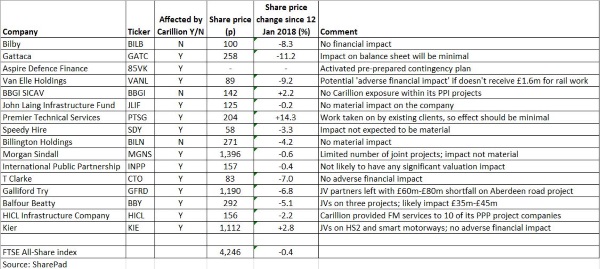

Here are the listed companies affected by Carillion chaos

17th January 2018 13:13

by Graeme Evans from interactive investor

From the flagship HS2 rail project to the future of facilities management contracts and tool hire agreements, the collapse of has had far-reaching consequences across a range of sectors and industries.

The company's demise demonstrates just how closely intertwined the fortunes of many UK companies and, indeed, the UK economy are. The financial pain from the collapse extends from lenders including and through to the company's pensioners and small businesses further down the supply chain.

In addition, there have been no less than 16 separate announcements from stockmarket-listed companies in relation to Carillion since Monday morning.

Most have been relatively reassuring for investors, with big names including Galliford Try, and not expecting any material impact from their exposure to the construction group.

Perhaps the biggest casualty among listed companies has been ground engineering contractor . It undertook several contracts for Carillion during December, with payment for this work not received, while other work also continued into this month.

As a result, Van Elle's outstanding debt and work-in-progress exposure with Carillion is approximately £1.6 million. The £70 million group's order book includes further expected work with Carillion for the remainder of the current financial year amounting to about £2.5 million. Its shares have fallen 9% since Friday night.

Carillion was also a big customer of , generating revenues of £12 million for the equipment hire business in 2017. Speedy is still owed £2 million, although the company insists the situation is not material and that it will deliver full-year results in line with hopes.

, which invests in public-private partnerships (PPP), has been left without new contractors for nine projects where Carillion provided facilities management.

They are four schools projects, four emergency services schemes and one road project. Contingency plans have been in place for some time and JL thinks that new providers can be found with minimal disruption and cost.

Much of the challenge for larger companies has involved finding ways to fill the gaps left in joint ventures involving Carillion. For example, and must cover the £60 million-£80 million that Carillion would have contributed on the £550 million Aberdeen Western Peripheral Route.

The terms of the contract are such that the remaining joint venture members are obliged to complete the contract. Balfour also worked with Carillion on the A14 in Cambridgeshire and the M60 Junction 8 to M62 Junction 20 scheme.

Balfour Beatty pledged to meet its contractual commitments and said the cash impact is likely to be in the range of £35 million to £45 million in 2018.

Meanwhile, operates joint ventures involving Carillion on the HS2 rail scheme and the Highways England smart motorways programme. It has contingency plans for each of these projects and is working closely with clients so as to achieve continuity of service.

The stockmarket announcements in relation to Carillion have continued two days after its collapse. Recruitment firm , which specialises in the engineering and technology sectors, said the vast majority of its debts with Carillion were covered by a credit insurer. At this time, it estimates its uninsured balance sheet exposure to be less than £100,000.

Some of those affected have bounced back from their worst levels, too. Among them is , an AIM-listed provider of building services to local authorities that we've talked highly of in the past.

It had a contract with CarillionAmey, a joint venture between Carillion and Amey UK, but it "does not believe these recent developments will have any financial impact on Bilby's trading".

The firm also carries out work for the Ministry of Defence on behalf of CarillionAmey. Amey will now provide the services previously provided by CarillionAmey, and is "is fully prepared to continue the service obligation of the CarillionAmey contracts without adverse effect on the employees of the joint venture or its supply chain".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.