High-yield value opportunity plays

10th June 2022 14:00

Kepler examines the attractions of investing in commercial property trusts.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

This year we have been running a series of articles looking at private assets and what they can offer in the midst of a surge of interest in them and inflows into funds investing in them.

While there are lots of new assets coming into the mass market via investment trusts, there is a well-established private asset class which, judging by discounts, has fallen out of favour in recent years: commercial property.

Below, we highlight why we think this sector has a lot to offer for income, inflation protection, and long-term total returns. We then review the sector, which is looking very different after the pandemic from when it started and highlight the current wide discount opportunities.

What does commercial property have to offer?

Commercial property can be seen as a relatively defensive way to generate an income with a different risk profile to bonds. One of the key reasons for including private assets in a portfolio is diversification. Property can generate bond-like yields without the interest rate risk of bonds. As we are currently in an interest rate hiking cycle, the lack of interest rate sensitivity is potentially a key attraction.

We think sometimes this can be missed by investors as they are misled by false analogies with bonds. A low yield on a bond typically implies a higher price risk. In the property sector, often low yields indicate high demand for a sector. They can mean that rent was agreed upon when demand was lower in the sector, since when property valuations have increased in the market and therefore there is the likelihood of increasing the rent. As properties are priced off forecast cash flows, the prospect of a higher yield means a higher property value. Low yields do not, therefore, always indicate price risk in the property market, unlike in the bond market. In fact, rising interest rates may lead to landlords asking for higher rents in the sector, which, if achieved, will push up the value of the properties, in contrast to the bond market, where prices will have to fall to offer the required yields. Bond investors don’t get to ask for higher coupon payments when conditions change, another factor differentiating property returns from those of fixed income. Low yields could indicate a property is being carried at too high a valuation, but in practice, this situation is unlikely to persist as properties are revalued every quarter based on market comparables.

The ability to ask for higher rent comes through a variety of sources. It can be agreed upon in a lease in various ways or negotiated when a lease comes up. In the UK market, upwards-only rent reviews have become common; these give the landlord the right to renegotiate the rent upwards, with the renegotiation being based on market comparables. There are often caps agreed too, but it should be clear that this is not only advantageous vis-à-vis interest rate risk but inflation as well. Indeed, history shows that commercial property has typically offered decent inflation protection. We covered this in more detail in a strategy article on inflation published last December.

Higher rents can only be achieved if there is sufficient demand for property, and so economic sensitivity is one of the risk factors in the property market. However, this sensitivity should be lower than for equities, and therefore price volatility (of commercial property portfolios) should be lower too. In falling markets, the income provides some support to total returns, meaning property shares a defensive characteristic with equity income. It is true that the defensiveness of property has been called into question by the impact of the pandemic and the slow decline of bricks and mortar retailing, which we consider below.

What does the investment trust sector offer?

The commercial property sector is a very different animal from a few years ago. In the past, funds tended to be distributed across retail, offices and industrials, which made up 30% or so of the typical benchmark used. When the average investor thinks of commercial property, this is probably the sort of exposure they have in mind. In reality, as the below table indicates, this has changed. We would highlight three key themes: the huge importance of industrials and logistics, the growing consensus that retail warehouses are the winners in the retail sector, and increased interest in alternatives. Another trend that comes up in conversation with managers is the importance of stock selection in the office sector, where managers tend to see a divergence in the fortunes of certain properties.

SECTOR EXPOSURE

| INDUSTRIAL | RETAIL WAREHOUSES | RETAIL | OFFICE | ALTS / OTHER | |

| UK Commercial Property REIT (LSE:UKCM) | 64.4 | 10.1 | 2 | 13.5 | 10 |

| Picton Property Income (LSE:PCTN) | 58.2 | 6.8 | 2.4 | 31.1 | 1.5 |

| Standard Life Inv. Prop. Inc (LSE:SLI) | 55 | 10 | 2 | 25 | 8 |

| BMO Real Estate Investments (LSE:BREI) | 53.2 | 18.1 | 6 | 22.7 | 0 |

| AEW UK REIT (LSE:AEWU) | 50.3 | 14.3 | 10.4 | 18 | 7 |

| Schroder Real Estate Invest (LSE:SREI) | 45.7 | 11.3 | 7.4 | 29.4 | 6.2 |

| Custodian REIT (LSE:CREI) | 39 | 21 | 12 | 16 | 12 |

| BMO Commercial Property Trust (LSE:BCPT) | 32.6 | 12 | 14.9 | 30.4 | 10.1 |

| LXI REIT (LSE:LXI) | 19 | 20 | 0 | 51 | |

| Regional REIT (LSE:RGL) | 5.1 | 3.7 | 89.8 | 1.4 | |

| Ediston Property Investment Company (LSE:EPIC) | 0 | 98 | 0 | 0 | 2 |

| Average ex Ediston | 42.3 | 13 | 8.1 | 27.6 | 10.7 |

Source: company announcements

Industrials

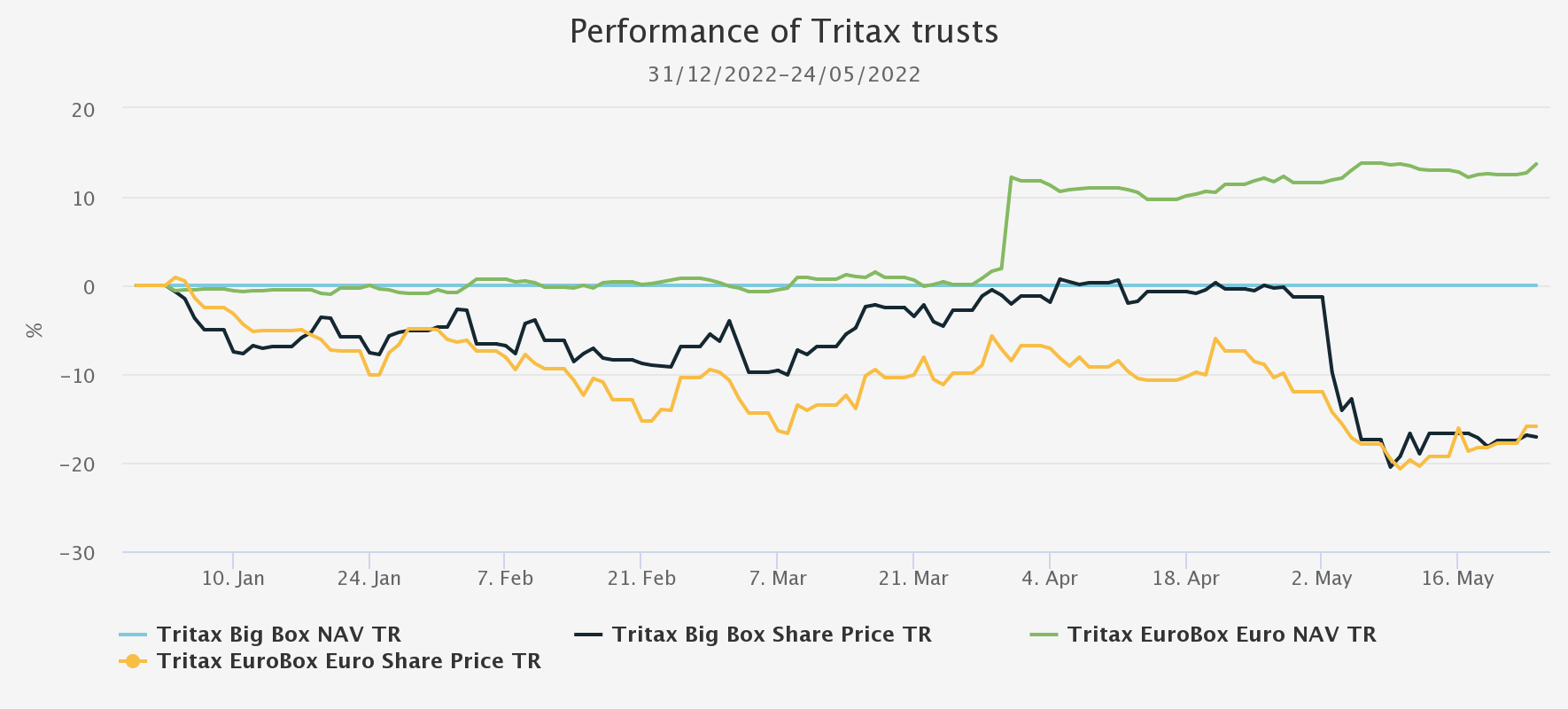

We note that four of the generalist trusts had over 50% in this sector as of their last report. There are a number of trends supporting demand for industrial property which have led to this bias. One is the trend of online retailing, which has seen rapid growth in demand for warehouse space along with delivery networks. This has been led by the success of Amazon (NASDAQ:AMZN), which has forced other retailers to compete. The strength of this trend, which was given fresh impetus by the lockdowns, has led to strong price growth in this sector and led to specialist trusts – chiefly Tritax Big Box (LSE:BBOX) – raising lots of money and trading on high premiums. In April, Amazon announced it would be cutting back on its pace of physical property expansion, which led to a sudden reaction in the share price of the specialist trusts, which we show below.

PERFORMANCE IN 2022

Source: Morningstar. Past performance is not a reliable indicator of future results

We have been highlighting for a while the relative value in the generalist portfolios, and this event illustrates the risks of buying a trust at a high premium. It appears the rating of BBOX, and peers reflected expectations of high growth in demand for their sub-sector, which are now being revised downwards.

The non-specialist trusts don’t have exposure to the largest sites, the “big boxes”, with one reason being the size of these investments (potentially well over £100m for the largest properties). However, investors may worry about the read-across from Amazon’s decision to the industrial sector as a whole. In our view, there are a number of reasons to be sanguine about buying into the sector via the generalist trusts. The first is that the secular shift to mixed online/ physical retailing is permanent, and the smaller end of the sector will be supported by rising demand as a result. While online sales as a percentage of retail sales have fallen from their pandemic-induced high of 37%, it remains at 26%, well above their pre-pandemic high of 22%. There are lots of retailers who need to improve their online offering and will require floor space to do so. Additionally, the re-shoring and deglobalisation trends, given an extra kick in the UK by Brexit, should see increased warehousing demand as companies look to increase stockpiles in the country as well as, in some cases, bring back manufacturing. Industry forecasts for distribution and logistics spaces remained high entering the year, although the poor economic news since may have led to some moderation.

We would also argue that the secular trends we have discussed should mean that the industrials sector has a lower beta to the economy than the retail and office sectors. While share prices of REITS and property companies might reflect growth expectations, physical property valuations should be more stable – one of the benefits of investing in private markets. Finally, the discounts on the sector provide a potential extra layer of security over the medium to long term.

Retail warehouses

Retail warehouses benefit from some of the same themes as industrials. These are typically out of town retail parks which have flexible space which can be used in last-mile delivery networks or as click-and-collect sites. They are typically well-served by transport links and have plenty of space for storage and display, which can be a problem with high street retail. The sub-sector has long been championed by Ediston, manager of Ediston Property Investment Company (EPIC). Ediston’s thesis was that retail warehouses would be the survivors in the bricks and mortar space. It took some time for this to become consensus, but anecdotally we think this may now be the case. We have seen significant increases in the weight to this sub-sector from generalist managers and a growing consensus that it has one of the strongest return potentials in the coming three to five years. Standard Life’s projections, for example, are for retail parks to deliver the best total returns in the commercial property sector over the next three years. Savills has London Industrial, Distribution Warehouses and Retail Warehouses as the only three sub-sectors expected to generate total returns above 8% over the next five years.

EPIC has doubled down on its thesis and converted itself into a sector specialist for the foreseeable future. With retail warehouses having been out of favour for some time, the yields available have been quite good. This plus gearing and the discount mean EPIC offers a highly attractive share price yield of 6.2%. We published a full note on the trust last week. Interestingly Marcus Phayre Mudge, manager of property security trust TR Property, has bought a 5% position in EPIC in recent months. Retail, ex-retail warehouses, is now of very little importance to the commercial property sector, and we don’t think they should feature in investors’ thinking much when it comes to considering an investment. The average allocation in the generalist trusts analysed above is just 8.1%, and we think may fall further.

Offices

When speaking with investors, nervousness about the office sector often comes up. Many are concerned that demand for office space will be permanently lower post-COVID-19, while concerns about a possible recession don’t help in the short term. Managers generally believe that high-spec offices with strong ESG credentials and good amenities will be in high demand. In fact, given the rapid evolution of ESG regulations and requirements, the supply of offices up to spec is likely to be too low to meet demand. One thing a board can do to improve its ESG performance is to move to more environmentally-friendly premises, and with 641 companies in the FTSE All-Share, that is a lot of real estate to find. The other side of this argument is that premises that because of their age, location or other reasons can’t be brought up to modern standards are potentially in trouble. Stock selection is likely to be key and competition fierce. We think investors should interrogate their managers as to the quality of their office portfolio when it comes to making an investment decision.

When we spoke to Kerri Hunter, manager of UK Commercial Property REIT (UKCM) recently, she explained that overall she expected offices to underperform the sector. However, she did think there were potentially good investments in high quality offices, particularly in the regional market, which has seen a greater return to the office than London. UKCM has a relatively low weighting to offices, as can be seen in the table above. We published a full note on the trust recently.

Conclusions: what looks attractive or cheap?

Dividends were cut almost across the board during the pandemic. We believe the slow retracement of these cuts is one reason discounts have been slow to shift. That said, the discounts in the sector did narrow prior to the recent rise of recession concerns. As we have discussed above, there are some secular trends within the commercial property sector which we think will provide some support even if we do enter a recession. Offices and retail would be affected, even the more popular retail warehouses. The question is whether the risks are reflected in the price.

The table below shows investors are still able to buy a generalist property portfolio at a considerable discount. In fact, most generalist commercial property trusts are available at a double-digit discount, and in many cases, this means the share price yield is very high. While discounts have not reached the levels seen during the pandemic, these look too wide to us. Considering the sector breakdown discussed above and the potential for some inflation linkage to the rental income, discount widening looks overdone, particularly when compared to the narrow discounts on the logistics specialist trusts.

DISCOUNTS

| TRUST | DISCOUNT (CURRENT) | YIELD |

| BMO Real Estate Investments | -28.5 | 4.3 |

| Schroder Real Estate Invest | -23.0 | 4.1 |

| UK Commercial Property REIT | -23.0 | 3.8 |

| Standard Life Inv. Prop. Inc. | -19.9 | 4.4 |

| BMO Commercial Property Trust | -18.3 | 4.1 |

| Ediston Property Investment Company | -16.5 | 6.2 |

| Custodian REIT (LSE:CREI) | -14.9 | 5.5 |

| Regional REIT (LSE:RGL) | -13.8 | 7.7 |

| Picton Property Income | -4.3 | 3.5 |

| AEW UK REIT | 1.9 | 6.6 |

| LXI REIT | 4.1 | 4.4 |

| Tritax Big Box (LSE:BBOX) | -5.6 | 3.3 |

| Warehouse REIT (LSE:WHR) | -8.6 | 4.0 |

| Urban Logistics REIT | 4.8 | 4.4 |

Source: Morningstar, as at 31/05/2022. Past performance is not a reliable indicator of future results

In particular, we would highlight UK Commercial Property. The discount seems excessive to us, particularly given the potential for income increases in the coming months and years, which we discussed in our recent note. The yield looks low compared to the sector, but the trust has lots of cash and gearing to invest, which could lead to dividend increases once put to work. BMO Commercial Property (BCPT) and BMO Real Estate Investments (BREI) are both trading on discounts in the 20s too, which look excessive. Picton Property Income (PCTN) doesn’t trade on such a wide discount but has a quality focus and the highest allocation to industrials in the sector.

In our view, there are a number of attractions to an investment in commercial property. The sector offers a decent yield, as can be seen in the table above, and there is the potential for some inflation linkage. In the portfolios, we see a very changed picture from a few years ago. Trusts offer exposure to some sectors and sub-sectors keyed into some structural changes in the economy, while traditional high street and shopping centre retail is no longer a particularly significant exposure. Meanwhile, these trusts trade on wide discounts, which seem to be pricing in another lockdown-type scenario. While a recession may not be good for valuations, it doesn’t seem to offer anything like the threat to rents and capital values of the pandemic. In our view, the sector as a whole looks like an interesting, high-yielding value opportunity.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.