How savers really access their pensions, revealed

Craig Rickman delves into the latest consumer data on the retirement income space, and analyses which options retirees go for when drawing from their pension pots.

18th April 2024 13:40

by Craig Rickman from interactive investor

The Financial Conduct Authority (FCA), the City watchdog, published a report this week showing how consumers are accessing their pension pots at retirement. And it makes for intriguing reading.

Few financial decisions carry more weight than how you choose to draw income from your pensions, so it’s essential to select your strategy with care.

- Invest with ii: Open a SIPP | Are SIPPs worth it? | SIPP Offers & Cashback

So, what does the data tell us? Do savers hook out the lot, use income drawdown or buy a guaranteed income? And how does the size of pension savings impact these decisions?

Here I analyse what we can learn from the FCA’s latest findings to help you make sensible choices with your own savings.

But first, let’s run through what your options are.

What are your options when accessing your pension?

When it comes to taking a defined contribution (DC) pension, where you save and invest during your working life to accrue a pot of money, there are four options on the table: income drawdown, annuity, uncrystallised fund pension lump sum (UFPLS), and taking the lot in one hit. No matter which one(s) you go for, you can usually take 25% tax free while the rest is taxed at your marginal rate.

With drawdown, your money remains invested, allowing you to take income flexibly as and when you please. Should anything happen to you, whatever’s left can pass to your loved ones.

The main risk with drawdown is that if your investments perform poorly and/or your income strategy is overly aggressive, you could drain the pot too soon.

This contrasts starkly with annuities, which is where you trade some or all your pension savings for a guaranteed income – typically for life. The benefit here is that you get certainty of future income. But the drawbacks are a lack of lump sum death benefits, and the decision is irreversible. The terms you choose at the outset are fixed for life. There is no margin for error.

- Six retirement income mistakes and how to avoid them

- 9 things to learn about pensions from ii customers

- Ill-health retirement: what are your options?

The monstrous piece of jargon that is uncrystallised fund pension lump sum (UFPLS) is where you draw part of your pension pot without buying an annuity or moving into drawdown; on each withdrawal 25% is tax free, while the remaining 75% is taxable.

To be clear, other than fully encashing your savings, how you draw from your pension isn’t an all-or-nothing decision. You can mix and match to suit your personal retirement needs.

Drawdown still rules the retirement income roost

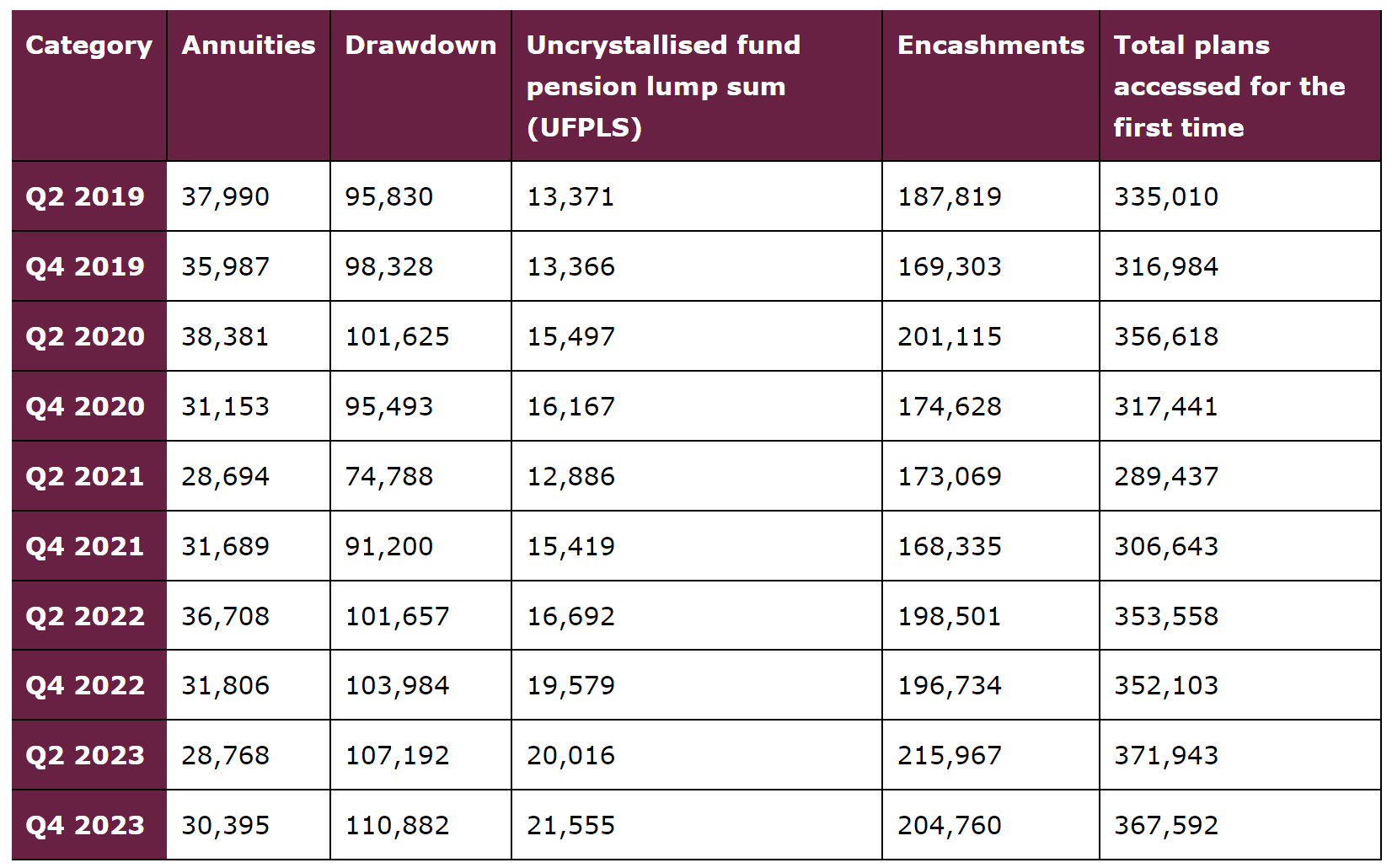

So, let’s get into the numbers, starting with the number of plans that have been accessed by the various methods since Q2 2019.

Source: Financial Conduct Authority

Many believed that improved annuity rates, which leapt 50% at one point in response to higher interest rates, would coax more savers towards guaranteed income products.

But that hasn’t come to pass - quite the opposite, in fact. Total annuity purchases decreased from 68,514 in 2021-22 to 59,163 in 2022-23, a 13.6% drop.

In contrast, drawdown numbers have increased, widening the popularity gap between the two products. This suggests that retirees aren’t sensitive to annuity rate changes and may view other aspects such as the rigidity and lack of lump sum death benefits as bigger turn-offs.

- Seven pension tips I learned as a financial adviser

- When paying your state pension into a personal pension makes sense

A further striking trend can be found with UFPLS, which ticked up a massive 61% in Q4 2023 compared to Q2 2019.

The attraction of UFPLS is that you can get your hands on some pension cash without committing to a retirement income product. You can also hold back what remains of your 25% tax-free cash, which, if your investments grow, could entitle you to more in the future.

How pot sizes impact retirement choices

The data above only tells part of the story. The decisions you make at retirement, and the viable options available to you, are also influenced by how much you’ve saved.

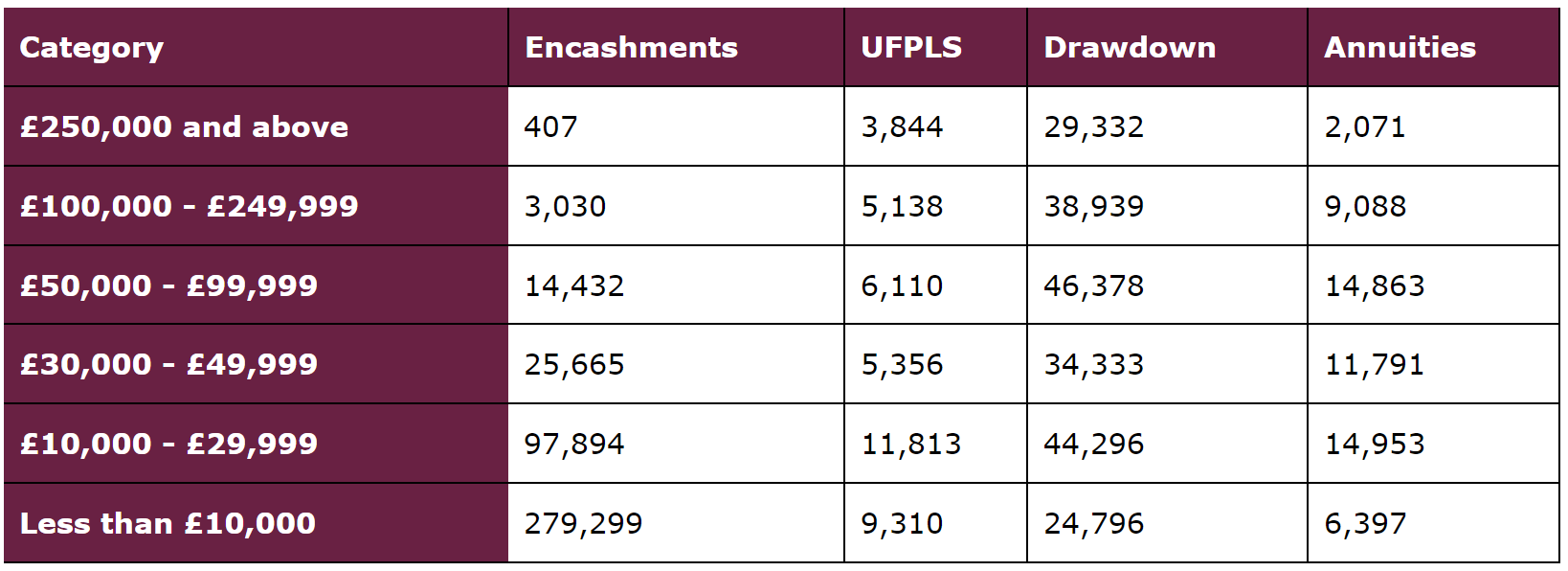

For 2022-23, the FCA has broken down each method of access into pot sizes, shown in the table below.

Source: Financial Conduct Authority

There are some interesting patterns to examine here.

With regards to full encashments, this typically happens with pension pots smaller than £10,000, which makes sense.

But interestingly, more than 400 plans taken in one hit were on funds of £250,000 and above. While this is a tiny number in the grand scheme of things, those who chose this route could’ve been hit with mammoth tax bills.

Aside from the 25% tax-free cash, pension withdrawals are added to other income and taxed at your marginal rate. So those who fully encashed a sum of £250,000-plus during this period, may have paid 45% tax on some of the withdrawal.

There could, however, be another explanation. If you have less than 12 months to live, you can usually withdraw your full pot tax free, although you must be under age 75 and have less than the lifetime allowance (LTA) of £1,073,100 in pension savings to qualify.

For annuity purchases, the sweet spot seems to be pots between £30,000 and £100,000. Those with larger pensions typically swerve guaranteed income. On plans of £250,000 and above, drawdown outstripped annuities by almost 15 to one.

Sticking with drawdown, the numbers are pretty consistent across all pot sizes, showing that savers with various levels of pension wealth see flexible income as the preferred means to support their retirement lifestyle.

The income drawdown conundrum

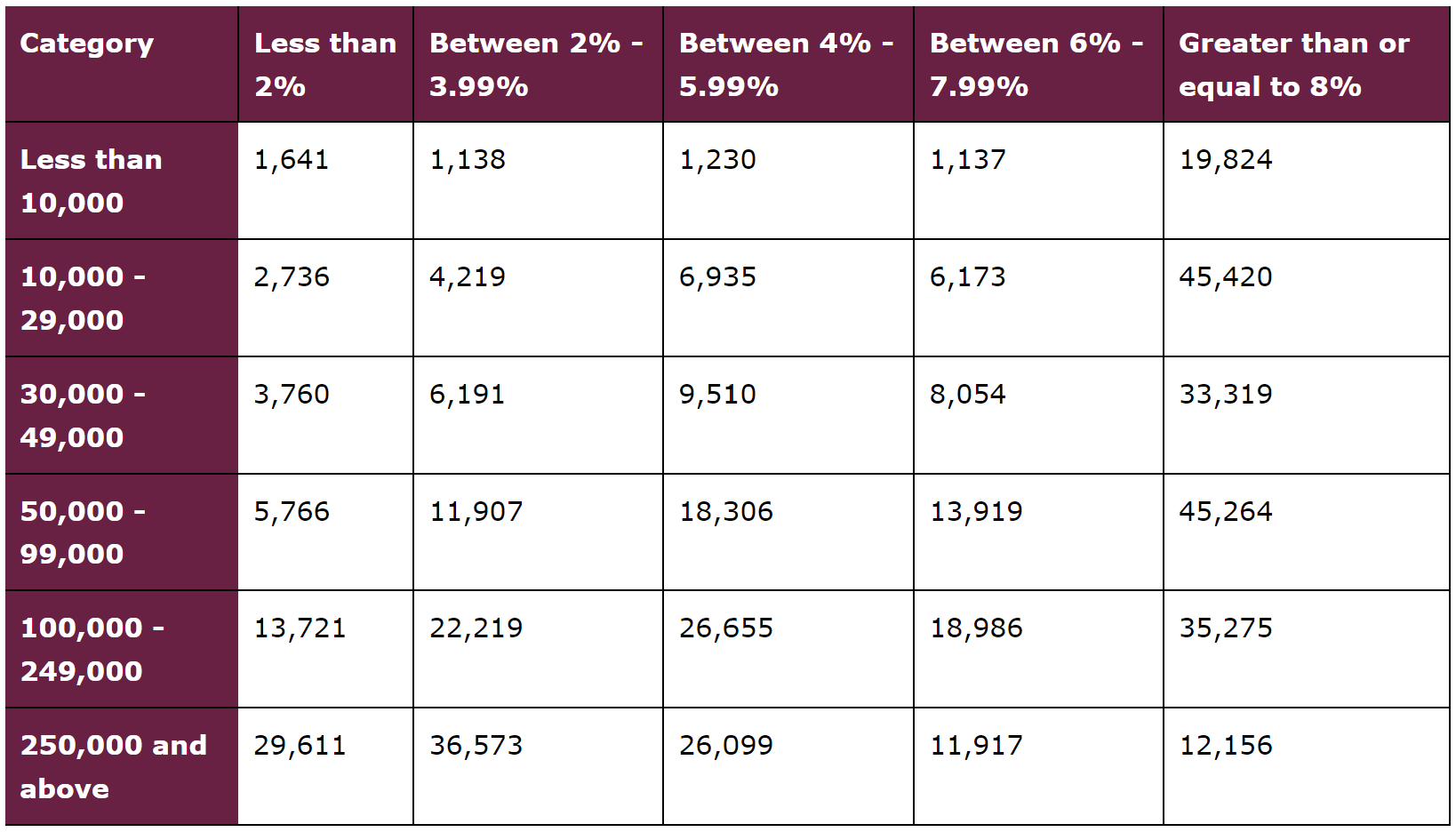

For the final table, let’s analyse what percentage people take as regular income using drawdown, again based on pot size.

Source: Financial Conduct Authority

This table offers some vital insight, especially for ii customers. Finding a sustainable withdrawal rate is crucial to ensuring your self-invested personal pension (SIPP) lasts the distance.

As those currently in this boat will appreciate, the answer here isn’t straightforward. From life expectancy and inflation to investment returns, there are lots of unknown variables at play.

Across the board, the most popular withdrawal rate is 8% or more. This may prompt some concern, as annual investment returns at this level are hard to come by. A long-standing rule of thumb puts 4% as a “safe” annual rate of withdrawal, although this is a guide more than anything else.

We can’t ignore the impact of the ongoing cost-of-living crisis, which may have forced retirees to up withdrawals to make ends meet. Now that inflation is heading towards a more respectable level, it will be interesting to see whether things change in future years.

- The cost of not knowing your portfolio fees

- Day in the life of a pension fund manager: Invesco’s Matthew Henly

What also sticks out is that the two most popular rates of withdrawal for pots of £250,000-plus are less than 2% and between 2% and 3.99%. This indicates that those who saved particularly hard for their retirement are treading carefully here. Savers in this group may also have income from other sources, such as defined benefit (DB) pensions, rental properties, and individual savings accounts (ISA).

Savers going it alone

The FCA’s figures underline that there is no one-size-fits-all approach to drawing retirement income. What’s right for someone else might not be right for you.

And a further notable trend concerns the take-up of financial advice.

Some 32.9% of plans accessed for the first time in 2022-23 were by plan holders who sought the service of a financial planner – a marginal reduction from the 33.4% registered in 2021-22.

This means that two-thirds of savers are ploughing their own furrow at the point of retirement. While this is far from a shock, the complexity of the pension landscape means it’s prudent to think carefully, and do your research where necessary, to make sure the options you choose give you the best chance of achieving the retirement lifestyle you want.

An important task for those who opt for income drawdown is to avoid paying too much in fees.

As a recent Which? study showed, on a savings pot of £250,000 over a five-year time frame, the difference between the most and least expensive drawdown providers is a hefty £12,139. Unless the extra cost translates into improved returns, your retirement may suffer.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.