ii Investment Outlook: Full-Year 2019

Investors did well in 2019. These were the best markets, sectors, bonds and funds of the year.

29th January 2020 09:45

by Lee Wild from interactive investor

Investors did well in 2019. These were the best markets, sectors, bonds and funds of the year.

Market round-up

There was plenty to keep investors on their toes in 2019, but most who held their nerve would have ended the year with double-digit returns.

US President Donald Trump, now in the midst of impeachment, crossed swords with his Chinese counterpart for much of the 12 months before eventually agreeing a so-called phase one deal; a December general election in the UK finally decided Britain’s relationship with European Union once and for all; rioting in Hong Kong grabbed headlines for months; and tensions in the Middle East flared again when America assassinated Iran’s military leader.

Despite the threat posed to global stock markets by each or all of these events, investor appetite for US tech stocks was unaffected. The Nasdaq index rallied another 35.2% in 2019 and by 12.2% in the fourth quarter alone. In fact, all the major markets, led by a 45% gain for Russia, rose sharply, although that the UK indices joined Hong Kong in propping up the performance table illustrates perfectly the impact of Brexit on investor confidence.

A sense of optimism spilled over into 2020, when US markets made fresh highs. However, most of last year’s potential banana skins remain in place, and now the deadly coronavirus spreading from China has caused havoc on global stock markets, wiping out this year’s gains.

Investors are typically bullish in US presidential election years, for Trump will want a smooth run up to November’s vote. The global economy has been chugging along, too, and an anticipated government spending spree in the UK could bode well for domestic stocks.

And, for the most part, stocks look in good shape both in terms of earnings growth and valuations. However, it is likely to be another unpredictable year. Chinese economic growth is slowing, no one really knows how bad coronavirus will be, Trump is in the middle of an impeachment trial, and the chance of the UK agreeing a trade deal with the EU in 2020 looks wildly optimistic. What is certain, is that events such as these will present alert investors with opportunities in the months ahead.

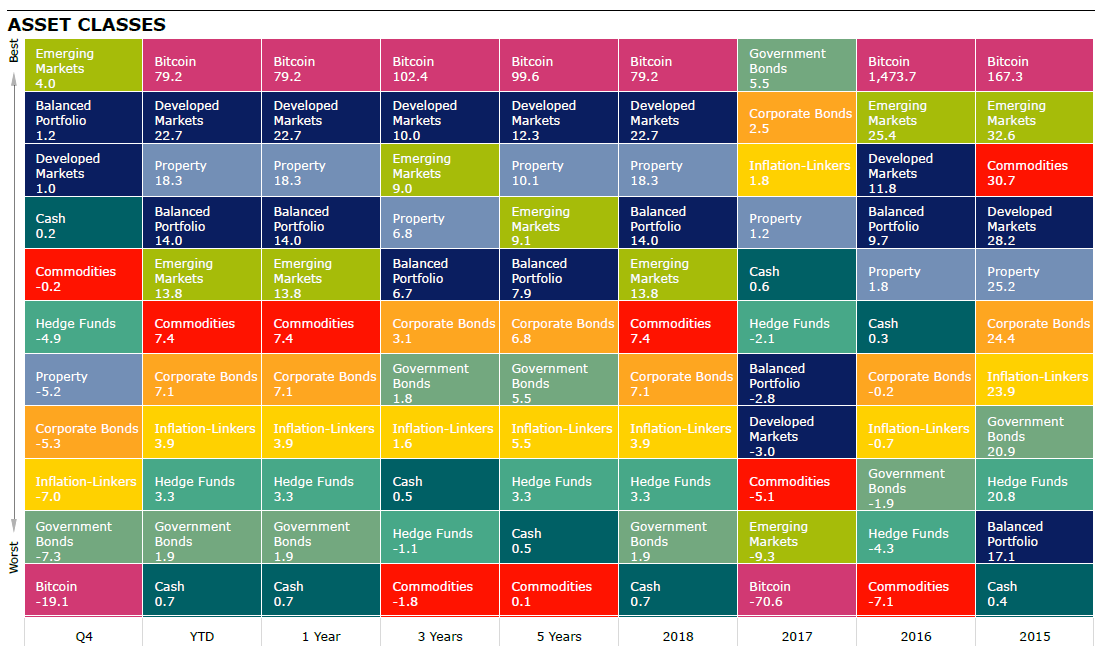

Source: Morningstar Total returns in sterling

Shares

Despite the significant political risks and fears of global economic slowdown, 2019 was great for equities. That was the case especially in the developed markets, which returned on average 23% (mostly driven by the US and Europe), while their emerging market peers delivered about 14%.

The US-Sino trade tensions were under the spotlight and drove volatility throughout the entire year, with plenty of speculation about reaching a deal. Growth stocks continued to outperform value, though valuations in some areas look high relative to historical data.

In the UK, the outcome of the general election on 12th December gave investors some relief as the risk of nationalisation of UK utilities was removed, but the biggest challenge of “getting Brexit done” still weighs on the British economy.

| Performance | ||||

|---|---|---|---|---|

| Q4 (%) | 1 Year | 3 Years | 5 Years | |

| Russia* | 8.60 | 45.08 | 13.83 | 24.60 |

| FTSE 250 | 10.43 | 28.88 | 9.61 | 9.32 |

| S&P 500 | 1.46 | 26.41 | 12.63 | 15.40 |

| World | 0.98 | 22.74 | 9.99 | 12.34 |

| Brazil* | 6.24 | 21.43 | 13.31 | 12.34 |

| Europe Ex UK* | 0.89 | 19.99 | 7.80 | 9.33 |

| FTSE All Share | 4.16 | 19.17 | 6.85 | 7.54 |

| FTSE Small Cap | 9.69 | 18.82 | 8.30 | 9.65 |

| China* | 6.71 | 18.69 | 12.91 | 11.05 |

| FTSE 100 | 2.68 | 17.32 | 6.23 | 7.09 |

| TOPIX Japan | 0.45 | 14.64 | 6.69 | 12.11 |

| Asia Pacific Ex Japan* | 2.82 | 14.56 | 9.43 | 9.86 |

| Emerging Markets* | 4.03 | 13.85 | 9.01 | 9.11 |

| India* | -2.03 | 3.42 | 8.87 | 8.55 |

Source: Morningstar *MSCI, Total returns in sterling

Sectors

Information Technology continued to be the best-performing sector in 2019, returning around 42%, largely driven by FAANG stocks. Valuations in this sector reached historic levels which put many investors in the “cautious camp”. In terms of sector dynamics, there was no strong pattern of defensive stocks outperforming the more economically sensitive ones. This might come as a bit of a surprise considering that the economic cycle is maturing.

Although there were plenty of high-risk events such as the attack on Saudi Aramco’s pipeline infrastructure and fears of oil supply shortage, Energy remained the only sector that delivered single-digit returns last year, with valuations close to a three-year low.

| Performance | ||||

|---|---|---|---|---|

| Q4 (%) | 1 Year | 3 Years | 5 Years | |

| Information Technology | 6.02 | 41.85 | 22.83 | 22.25 |

| Industrials | -0.13 | 22.83 | 8.44 | 12.21 |

| Communication Services | 0.37 | 22.47 | 4.20 | 9.11 |

| Consumer Discretionary | -0.63 | 21.68 | 11.33 | 13.63 |

| Financials | 1.17 | 20.67 | 6.06 | 10.35 |

| Materials | 1.07 | 18.58 | 7.21 | 10.04 |

| Health Care | 5.76 | 18.48 | 12.18 | 12.09 |

| Real Estate | -5.89 | 18.21 | 7.18 | 9.87 |

| Consumer Staples | -4.58 | 18.05 | 6.42 | 10.45 |

| Utilities | -5.07 | 17.79 | 9.82 | 10.59 |

| Energy | -2.33 | 7.15 | -2.80 | 2.52 |

Source: Morningstar Total returns in sterling

Bonds

Within the Fixed Income space, Corporate Bonds delivered 7.1% in 2019 against just under 2% for Sovereigns. The yield curve inversion, which theoretically raises concerns for recession, happened in March, but failed to scare the markets.

Amid escalating trade tensions and the introduction of tariffs, central banks were left with no choice but to continue easing their monetary policies and supply the markets with liquidity. Consequently, income investors were forced to consider riskier asset classes.

| Performance | ||||

|---|---|---|---|---|

| Q4 (%) | 1 Year | 3 Years | 5 Years | |

| Sterling Corporate | -0.69 | 9.47 | 3.98 | 4.60 |

| Global High Yield | -3.81 | 9.34 | 4.15 | 9.41 |

| Global Corporate | -5.35 | 7.14 | 3.11 | 6.78 |

| UK Gilts | -3.89 | 6.90 | 3.07 | 3.92 |

| UK Inflation Linked | -8.92 | 6.33 | 2.77 | 6.12 |

| Global Inflation Linked | -6.98 | 3.87 | 1.64 | 5.52 |

| Global Aggregate | -6.53 | 2.71 | 1.88 | 5.70 |

| Global Government | -7.32 | 1.87 | 1.76 | 5.53 |

| EURO Corporate | -4.71 | 0.34 | 2.16 | 4.06 |

Source: Morningstar Total returns in sterling

Commodities and Alternative investments

It would not be a surprise to say that alternatives were expected to do well in 2019. Considering the economy is late cycle, investors were looking for alternative and real assets to diversify away their systematic risk exposure.

Real Estate in the UK did extremely well, returning more than 30% for the year. Global infrastructure, which historically also worked as a hedge against inflation, was another area that investor favoured last year with returns of over 22%.

The most popular safe haven asset – gold - delivered over 14% total return on the back of increased political and market worries. Despite the overall healthy markets, hedge funds continued to disappoint throughout 2019, returning just over 2% which, in most cases, barely covers their management fees.

| Performance | ||||

|---|---|---|---|---|

| Q4 (%) | 1 Year | 3 Years | 5 Years | |

| UK REITs | 12.49 | 30.64 | 8.58 | 5.60 |

| Global Infrastructure | -2.22 | 22.09 | 8.80 | 10.10 |

| Brent Crude Oil | 1.01 | 17.94 | 2.71 | 6.26 |

| Gold | -4.76 | 14.24 | 7.02 | 8.37 |

| Global Natural Resources | 1.90 | 12.67 | 5.44 | 8.26 |

| Commodity | -0.24 | 7.44 | -1.81 | 0.08 |

| Hedge Funds | -3.94 | 3.15 | 2.26 | 7.10 |

| Cash | 0.18 | 0.74 | 0.54 | 0.51 |

| CBOE Market Volatility (VIX) | -28.57 | -52.84 | -6.08 | -5.23 |

Source: Morningstar Total returns in sterling

ii Super 60 fund selections

Since launch at the start of 2019, interactive investor's Super 60 list of funds continues to perform in line with expectation in absolute and relative terms. Performance over the longer term is very strong. All active funds delivered positive returns over 5 years and 98% of active funds delivered a positive return over 1 and 3 years.

The majority of the rated trust discounts have remained consistent or improved over the last 12 months. None of the trusts are at a current significantly geared level (+30%) that would cause concern.

The majority of the Index funds have kept tight tracking errors over the long term and are below their peer group averages over the year.

Top five ii Super 60 funds in 2019

| Performance | |

|---|---|

| Investment | Return (%) |

| Henderson Smaller Companies (LSE:HSL) | 46.3 |

| TR Property (LSE:TRY) | 41.4 |

| Man GLG Continental European Growth Fund | 30.7 |

| TB Amati UK Smaller Companies | 30.3 |

| Marlborough UK Multi-Cap Growth | 29.2 |

Source: Morningstar Total returns in sterling

Bottom five ii Super 60 funds in 2019

| Performance | |

|---|---|

| Investment | Return (%) |

| Marlborough Global Bond | 7.1 |

| M&G Global Macro Bond | 4.4 |

| BlackRock Frontiers (LSE:BRFI) | 3.6 |

| Templeton Emerging Markets Smaller Companies | 1.7 |

| BMO Commercial Property Trust (LSE:BCPT) | -2.4 |

Source: Morningstar Total returns in sterling

Most-traded funds on the ii platform in 2019

Changes to the ii Super 60 list (under review/developments)

One year since the launch of Super 60, there have been no changes to the line up to date, but LF Lindsell Train UK Equity was put under formal review on 29 November 2019. This review has now been concluded, it has been removed from being under formal review, and it will remain on our Super 60 list

The ii Super 60 Annual Review

We have now completed the Super 60 Annual Review and are pleased to confirm there are no changes. Several potential new entries were carefully considered, but all were added to our reserve list after lengthy and challenging discussion among our panel of selectors.

Moira O’Neill, Head of Personal Finance, says: “Our funds research team and selection committee completed a full review of the funds universe, in which we analysed each sector for the best options. We scrutinised all existing and prospective choices and made a final decision after everyone had the opportunity to analyse and discuss all possible options.”

Dzmitry Lipski, Head of Funds Research, says: “We will continue to monitor the market and meet with fund managers regularly throughout 2020 to ensure our list continues to offer the best options for our investors.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.