ii Tech Focus: Nvidia, Microsoft, Strive Inc, AMD, Airbnb

With US technology stocks grabbing headlines, ii’s head of investment has the latest sector news, most-bought tech stocks on the ii platform, and forecasts for upcoming results.

31st October 2025 10:33

by Victoria Scholar from interactive investor

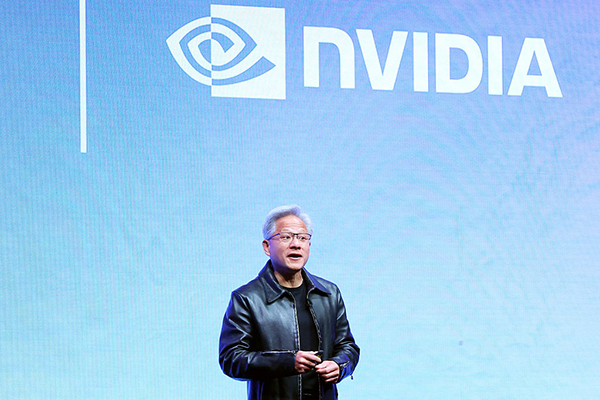

Jensen Huang, CEO of Nvidia, pictured in Japan earlier this month. Photo: YOSHIKAZU TSUNO/Gamma-Rapho via Getty Images.

Nvidia

NVIDIA Corp (NASDAQ:NVDA) has become the first company to reach a market valuation of $5 trillion (£3.8 trillion), just three months after hitting $4 trillion, rallying by 50% so far this year. The company that has positioned itself at the centre of the AI revolution said it expects $500 billion in AI chip orders and plans to build seven new supercomputers for the US government. CEO Jensen Huang, pictured above, has announced new partnerships including with Uber Technologies Inc (NYSE:UBER), Palantir Technologies Inc Ordinary Shares - Class A (NASDAQ:PLTR) and CrowdStrike Holdings Inc Class A (NASDAQ:CRWD). Nvidia also announced a $1 billion investment deal with Nokia Oyj ADR (NYSE:NOK). Huang also said that he doesn’t believe there is an AI bubble.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Microsoft

Despite reporting a beat on the top and bottom line in the fiscal first quarter, Microsoft Corp (NASDAQ:MSFT)’s shares fell after-hours Wednesday. Earnings per share (EPS) hit $3.72 and revenue reached $77.67 billion, up 18% year-on-year. Azure revenues rose by 39%, which was ahead of average estimates, although some were expecting an even stronger number. Microsoft is also spending billions in the AI race with capex for Q1 hitting $34.9 billion. Microsoft said its investment in OpenAI would reduce net income in the current quarter by $3.1 billion, or 41 cents a share. Earlier in the week, OpenAI gave its long-standing investor, Microsoft, a 27% stake in the company, equal to about $135 billion.

Microsoft shares are up by around 25% year-to-date with a consensus buy recommendation from analysts and target price 15% above the current share price.

Meta

Shares in Meta Platforms Inc Class A (NASDAQ:META) fell sharply after it raised its 2025 guidance for capex, which is now expected to come in between $70 billion and $72 billion, up from between $66 billion and $72 billion. It also faced a one-off tax charge of $15.93 relating to Trump’s One Big Beautiful Bill Act. Meanwhile, EPS hit $7.25 adjusted, versus forecasts for $6.69, and revenue of $51.24 billion was ahead of estimates for $49.41 billion. Ad sales of $50.08 billion also beat forecasts.

Meta shares are up around 13% year-to-date and most analysts rate the stock a buy.

Alphabet

Alphabet Inc Class A (NASDAQ:GOOGL) reported third-quarter revenue that topped $100 billion for the first time, while adjusted EPS hit $3.10, flying past forecasts for $2.26. Having spent $52.5 billion last year, Google’s parent company says full-year capex is expected to jump to between $91 billion and $93 billion, a notable contribution to the mega-cap tech AI spending spree. Cloud revenue grew by 34% to $15.16 billion, while ad sales increased by 12.6% to $74.18 billion.

- ii view: Gemini app owner Alphabet chased to new record

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Shares in Alphabet are up by over 50% year-to-date. Most analysts have a buy recommendation on the stock.

Amazon

Amazon.com Inc (NASDAQ:AMZN) shares soared as much as 14% after-hours on the back of its third-quarter earnings report, which saw its cloud division, Amazon Web Services (AWS), enjoy a 20% increase in revenue to $33 billion, ahead of expectations. AWS now accounts for about 60% of Amazon’s total operating profit. A week ago, AWS was hit by a major outage, affecting thousands of websites globally.

Meanwhile, Q3 EPS of $1.95 and revenue of $180 billion both beat forecasts. However, it raised its outlook for capital expenditure to $125 billion from $118 billion as the AI bill continues to ramp up. This week, Amazon opened a new $11 billion AI data centre, Project Rainier. Earlier this week, Amazon announced 14,000 layoffs in its corporate division out of its 350,000 total corporate workers.

There is a consensus buy from the analysts on the stock with price target of $270.73.

Apple

Apple Inc (NASDAQ:AAPL) shares rose after-hours following an upgrade to its current-quarter sales forecast. CEO Tim Cook said the company expected 10-12% revenue growth for the quarter ending in December. Meanwhile, Apple delivered fiscal fourth-quarter EPS of $1.85 on revenue of $102.47, both beating consensus. Cook said demand for its new iPhone 17 had been “off the chart”. But Apple is dealing with shipping delays for new iPhones to China that could dampen sales as US-China tensions continue to be a noteworthy headwind for the hardware-dependent tech giant.

These results come the same week that Apple reached a market cap of $4 trillion for the first time. However, Apple shares have underperformed the wider Mag 7 group this year as it tries to play catch up in the generative AI race.

Apple shares are up 10% year-to-date. Most analysts rate them a buy.

10 most-bought tech stocks on the ii platform

1 | |

2 | |

3 | |

4 | |

5 | |

6 | |

7 | |

8 | |

9 | |

10 |

Source interactive investor, 27-30 October 2025.

Strive Inc

Co-founded by former US presidential candidate and billionaire Vivek Ramaswamy, Strive Inc Class A (NASDAQ:ASST) is a bitcoin treasury company. It has been available to trade publicly for less than two months following a reverse merger with Asset Entities on 12 September. Its correlation with bitcoin and its micro-cap nature make Strive a highly volatile stock that is not for the faint-hearted.

Shares are up around 30% over the past week but are down more than 50% over the past month. Nonetheless, it has certainly piqued investor interest on the ii platform, landing itself on the list of most-bought stocks this week.

Week Ahead

AMD – 4 November

According to Refinitiv, Advanced Micro Devices Inc (NASDAQ:AMD) is expected to see a significant jump in EPS to $1.16 in the third quarter versus 48 cents the previous quarter on revenues of $8.7 billion, up from $7.7 billion in Q2. Last quarter, AMD beat on the top line but slightly missed on the bottom line. The stock has performed extremely well lately, rallying by more than 60% over one month, partly thanks to a deal with OpenAI in early October. The ChatGPT maker agreed to buy tens of billions of dollars of AMD chips with the potential to take a 10% stake in the business. Reuters also reported that the US has formed a $1 billion partnership with AMD to construct two supercomputers, pushing shares higher again.

Analysts are mostly optimistic towards AMD with a consensus buy recommendation. Wells Fargo just raised its price target ahead of earnings. AMD is up around 120% year-to-date.

Airbnb – 6 November

According to Refinitiv, Airbnb Inc Ordinary Shares - Class A (NASDAQ:ABNB) is expected to report Q3 EPS of $2.34 on revenues of $4.08 billion. The accommodation rental giant could announce a further share buyback programme having repurchased $1 billion of stock in Q2. Airbnb is facing uncertainty around the macro environment and US President Donald Trump’s tariffs.

However, in Q2, Airbnb saw a pick-up in demand, with increased bookings year-on-year and it reported a beat on the top and bottom line. Revenue grew by 13% year-on-year to $3.1 billion and it said that revenue is likely to increase to $4.02 billion and $4.1 billion in the third quarter. This year, Airbnb announced plans to invest $200-250 million in new business opportunities. In May, it carried out a major app redesign and this month it announced plans to add new social features.

Shares are down around 4% so far this year, and down 8% over one year. However, the stock has picked up lately, gaining 4% over the past month. Analysts are on the fence, though, with an average hold recommendation on the stock.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.