The investment lessons from the 1970s as inflation soars and rates rise

28th March 2022 13:46

by Sam Benstead from interactive investor

Sam Benstead talks to the economists making comparisons to the 1970s and the investors who successfully navigated that turbulent decade.

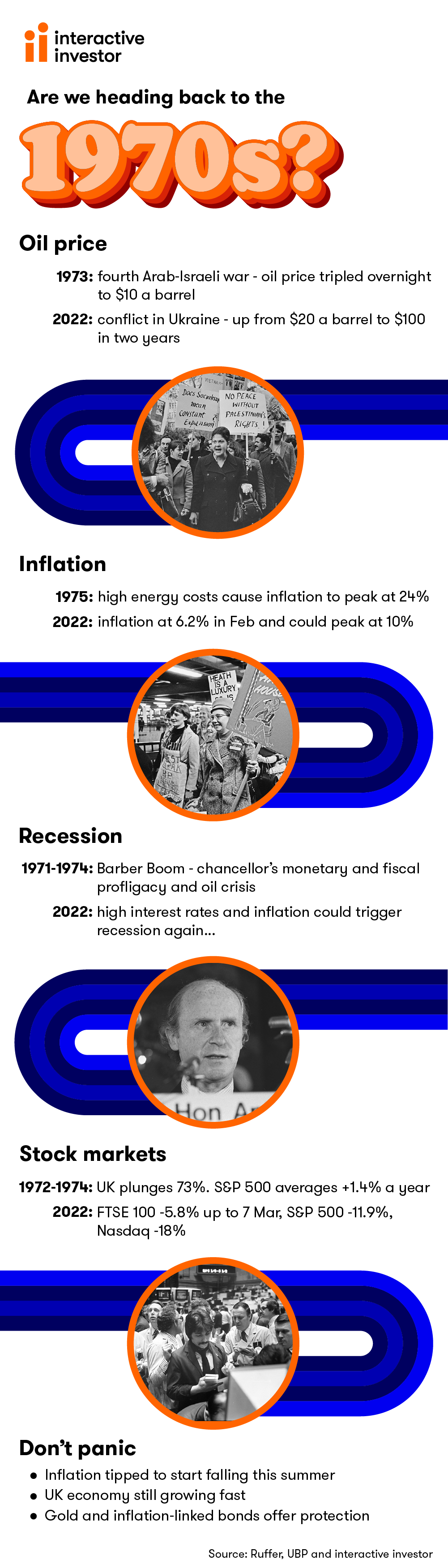

Soaring inflation, geopolitical tension and rising interest rates: the post-Covid decade is starting to look a lot like the 1970s.

In 1973, the fourth Arab-Israeli War resulted in the OPEC crude oil embargo to Western economies which quadrupled the cost of a barrel of oil overnight and lay the foundation for UK inflation hitting 24% in 1975.

The government reacted by declaring a state of emergency and implementing wages freezes and a three-day working week to conserve energy.

Similarly, this year has started with a sharp jump in oil prices due to sanctions on Russian oil, but also supply chain pressures and a hot economy due to government spending during the pandemic.

Jim Reid, head of global fundamental credit strategy at Deutsche Bank, says it is becoming increasingly hard to ignore the comparisons to the 1970s due to the moves in commodity prices.

He said: “While oil hasn’t spiked by as much as in the 1970s, gas has increased by a much greater amount than at any point in history and the broader pace of the commodity rally is in many cases now beyond that seen in the 1970s.”

Norman Villamin, chief investment officer of fund group Union Bancaire Privée, adds that monetary policy could begin to feel very familiar to the 1970s if inflation keeps rising, saying: “Should wider sanctions against Russian energy be implemented, Western policymakers will be faced with a stark choice – pursue similar monetary policies as seen in the 1970s, which resulted in deep recessions throughout the decade, or accommodate the inflation in order to preserve growth.”

- A tactic to ride out the inflation storm using these funds and trusts

- Fund and trust ideas to income-boost portfolios to beat inflation

Some financial assets are already beginning to behave in the same ways as 50 years ago, according to John Higgins, chief markets economist at consultancy Capital Economics.

“If the Russia-Ukraine war escalated, we would expect some of the recent patterns in relative asset market performance to continue to echo those during the 1973-74 oil crisis.

“The relative performances of the various assets have been similar since the end of November 2021 and in the 1973-74 oil embargo itself – oil and other commodities outperformed ‘safe’ and ‘risky’ financial assets in the first oil crisis and have done so again recently,” he said.

Where to invest

Investing successfully in these conditions will not be easy, but drawing on experience from the 1970s can help.

Two investors who were managing money 50 years ago, and still do today, are Peter Spiller, manager of the Capital Gearing (LSE:CGT) investment trust, and Paul Mumford, co-manager of the TM Stonehage Fleming Opportunities fund and the TM Stonehage Fleming Aim fund.

Spiller reckons that investors are in for a tough period if the 2020s turn out to be similar to the 1970s.

He said: “Every investment – except for gold – is negatively correlated with higher inflation. Assets people think will protect them, such as stocks and houses, won’t work.

“It was ghastly to be an investor in 1973 – there was nowhere to go. Bonds were a non-starter due to inflation and index-linked bonds didn’t exist.”

- Income tips for 2022: should investors go global or back the UK?

- Inflation hits 30-year high and could rise much further

- The secret weapon to combat inflation

While bonds are hurt by inflation as they pay a fixed income which is worth less in real terms, some companies – in theory – can pass on rising costs to consumers and maintain their profit margins. But this does not mean that equity investors will come out of an inflationary period unscathed.

Spiller notes: “Rising inflation is bad for equities, but if someone owns stocks over the full cycle (through inflation and back) – then they will be fine. The peak of inflation is the best time to invest as it can signal the start of a period of interest rate cuts.”

Spiller argues that inflation will remain elevated for some time yet as central banks will not raise interest rates too quickly to avoid plunging economies into recession. This means that investors’ options are limited, but there are a number of havens to turn to.

Index-linked assets, whose income rises with inflation, are one of them. This includes index-linked bonds as well as investment trusts that generate an income from residential rents, such as Grainger (LSE:GRI) and PRS REIT (LSE:PRSR).

Gold is another option, according to Spiller, as it has traditionally been a good haven when inflation is elevated, as the idea is that it holds its real value.

However, he points out that gold can be volatile and is expensive at the moment – due its price being close to an all-time hight. Spiller added: “Paying a high price today makes it more risky, but if the war in Ukraine spreads, then gold may perform very well. Holding some cash is also a good idea to take advantage of lower share prices.”

Spread your bets

Mumford, who started working in finance in 1964, said a key a thing to do was to spread a portfolio across plenty of stocks to reduce risk, and concentrate on firms that have good balance sheets so they can withstand interest rates going up, as well as high profit margins so they can absorb high input costs.

“We have more than 70 stocks in our funds at the moment. We avoid areas where margins are low, such as construction companies and food producers that won’t be able to pass on rising costs as supermarkets are low margin businesses and there is lots of competition.”

He has been buying shares in IOG (LSE:IOG), a gas exploration company that operates in the North Sea that has profited from high gas prices.

Other investments he backs to perform well during a period of high inflation are self-storage firm Lok'n Store (LSE:LOK), which has high occupancy levels and reliable earnings, and Zoo Digital Group (LSE:ZOO), a dubbing company which operates remotely and internationally. Mumford points out that it has very few fixed costs and profits from the boom in television screen globally due to platforms such as Netflix.

Spiller is finding value in oil companies. He said: “Oil shares are cheap if you assume the price of a barrel can be sustained at $70. Oil stocks will generate a lot of cash and return it to shareholders, as well as invest in renewable energy.

“Oil shares are also good value because of the rise of ethical investing. This has also meant less money going into developing new oil fields, which means that supply is lower and prices for oil and gas will be higher. While the spike in the oil price today is due to the war, taking a five-to-seven-year view prices will stay high.”

- How to play and profit from the commodities boom

- Commodities shock: wild times as scarcity looms

- The funds and investment trusts to profit from the energy revolution

Markets in the 2020s have so far been very volatile – and this is unlikely to change soon. Instead of fearing these markets, Mumford says that experience has taught him to embrace them and pick up bargains instead of panicking.

He said: “Central banks are unlikely to ramp up rates too much due to the negative effects this would have on the economy. This makes it different to the 1970s, so I am more optimistic and taking this volatility in my stride. I am relaxed and excited.”

Other promising news comes from Capital Economics’ Higgins. He said: “We wouldn’t expect US equities to perform as badly as they did in the 1970s oil crisis given the US economy’s reduced reliance on imported oil.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.