A new investment strategy for building a robust portfolio

Steady, inflation-beating income from both shares and bonds is hard, but alternative assets can help.

19th July 2019 09:50

by Kyle Caldwell from interactive investor

The days of achieving steady, inflation-beating income from a mix of shares and bonds are gone. We explore how investors can strengthen their portfolio using alternative assets.

A balanced investment portfolio of around half in shares and half in bonds has historically served investors well by producing inflation-beating returns while protecting capital to some extent during turbulent times. However, with the outlook for both asset classes looking precarious, this strategy has lost much of its appeal.

Research by fund manager Vanguard hammers the point home. The firm looked at how a 60/40 portfolio of global shares and global bonds has fared over the years. It found that the average annual return since 1970 has been an eye-catching 10.5%, while since 1990 the average return has been 8% – not too shabby.

However, such high returns may now be consigned to history. Vanguard's forecast, based on 10,000 simulations that take into account both past performance and the firm's forward-looking outlook, is that a 60/40 portfolio will now return roughly 4% a year, and that’s before charges that will eat into that figure are taken into account.

Be ready for a rethink

"Investors need to brace themselves for lower returns over the next decade," says James Norton, a senior investment planner at Vanguard. That's mainly because yields on the safest type of bond, government bonds, are at historic lows following a 35-year period of strong performance. As a consequence, their prices have risen and they are now dangerously expensive, so they can no longer be regarded as low-risk.

Norton adds:

"Although returns on fixed interest are likely to remain low for a while, they are an incredibly important part of a portfolio, as they act as a risk dampener. A mix of shares and bonds is still much better than cash. But we think investors need to reset their expectations."

One strategy for building a robust portfolio, which has been growing in prominence in this new investment environment, is to dedicate a portion of the portfolio to alternative assets. Investments that can be put into the alternatives 'bucket' include property, infrastructure (transport and roads), private equity, renewable energy, loans (including peer-to-peer lending), commodities such as gold, aircraft leasing and even music royalties.

Peter Elston, chief investment officer at Seneca Investment Managers, says such alternative investments "provide the features that give you something similar to bonds".

He adds: "The income-producing alternatives that we are looking at offer yields of around 4% or more, which makes them much better options than government bonds and in general investment-grade bonds. When assessing bond substitutes, we look for some sort of safety. Where we get that is from the yield and the sustainability of the income stream, and by assessing the volatility of the income being generated."

Firm foundation

On the whole, these are "boring investments", notes Sanlam Investments' Mike Pinggera, manager of the Sanlam Multi-Strategy fund. He says that in the present climate, with little value available for investors in the bond market and following a 10-year bull run for developed equity markets led by the US market, alternative investments offer a "firm foundation for a good level of income, even in times of stress".

He adds:

"For me, having a portion of a portfolio in what I call 'real assets' gives me a solid base from which to participate when equity markets rise, while protecting on the downside. It is much easier to put risk on the table from a position of strength."

There is no consensus on what proportion of an portfolio should be allocated to alternative investments, although, as Elston points out, a small weighting of, say, 5% is unlikely to offer much in the way of value in terms of either boosting the yield or reducing the risk level of the portfolio as a whole.

The multi-asset portfolios that he co-manages, including the Seneca Global Income & Growth Trust (LSE:SIGT), each have around 25% in specialist assets. The Global Income & Growth portfolio's top five holdings are an eclectic mix: Doric Nimrod Air Two (LSE:DNA2) (which acquires, leases and sells aircraft), International Public Partnerships (LSE:INPP) (which invests in infrastructure), Merian Chrysalis Investment Company (LSE:MERI) (unquoted companies), Fair Oaks Income Fund (collateralised debt) and Sequoia Economic Infrastructure (LSE:SEQI) (infrastructure debt).

Other multi-asset investors hold similar amounts, with around 15-20% held in alternatives in the TB Wise Multi-Asset Growth and TB Wise Multi-Asset Income.

Co-manager Vincent Ropers mainly focuses his sights on private equity, infrastructure, renewable energy and property. He says the investment trust structure is "much more appropriate" for investing in alternative areas, compared with open-ended funds. "It is far more appropriate for liquidity reasons," he adds.

However, Ropers cautions that it has become fashionable for investors to hunt around for bond substitutes, so some specialist investment trust areas are commanding high premiums.

He says: "Private equity is a sector we had exposure to for a number of years, but exposure has been coming down on valuation concerns. We had more than 20% three years ago and now it is 10%. HgCapital Trust (LSE:HGT), for example, has moved from a 15% discount since the start of year to a small premium at the start of June. Our fund held an 8% position in it a couple of years ago, but that is now 1%. Massive amounts of money are being deployed into the private equity space, as well as other alternative areas."

Selective strategy

Ropers is highly selective in his approach and points out that investment trusts that focus on renewables also look pricey. The Renewables Infrastructure (LSE:TRIG) was priced at a premium of 9% to its asset value at the end of April.

This, he says, appeared anomalous, when the Ecofin Global Utilities (LSE:EGL) was trading at a discount of more than 10%. He therefore cut his exposure to TRIG.

Nevertheless, while investors should be wary of paying over the odds, sometimes a premium price is worth it. Elston says:

"With 30-year inflation-linked gilts yielding 1.8% currently, your total real return to maturity is a loss of 42%. In contrast, infrastructure investment trusts are yielding 4% and [investment] revenues are explicitly linked to inflation."

Ropers stresses that care needs to be taken over the sustainability of the income stream of investment trusts that specialise in alternative assets, warning that there are signs that some trusts are overstretching themselves in order to satisfy investor appetite for income.

He adds: "Alternatives pay decent yields, but some are paying out 100% of their earnings in dividends. In some alternative areas, the dividend cover is low and growth potential relatively limited."

Norton also urges caution, pointing out that "while moving out of bonds into other asset classes may provide a higher return, it is likely to increase risk".

Finally, investors should be aware of the potential 'opportunity cost' of holding too much of a portfolio in alternatives. Those who are overexposed will miss out on the potential for higher returns offered by equity markets.

Alternative approach pays dividends but struggles in volatile markets

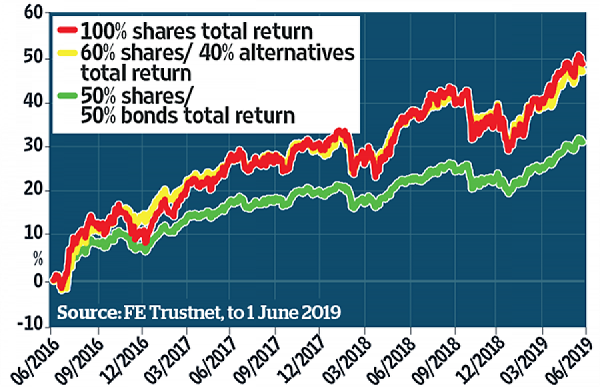

Over the past three years, the tactic of replacing a portion of bond funds in a portfolio with more specialist funds that focus on particular alternative assets has paid off.

Using funds in our Rated Fund universe, we put together three hypothetical portfolios: 100% shares, 50% shares/50% bonds and 60% shares/40% alternatives. Full details of the funds chosen are shown in the table below.

The 100% shares portfolio won out over three years (as the chart below shows), but only just, having returned 49.1%. Hot on its heels was the portfolio with 40% in alternatives, which gained 47.4%. Bonds proved a drag on performance, with the 50% shares/50% bond portfolio delivering a return of just 31.4%.

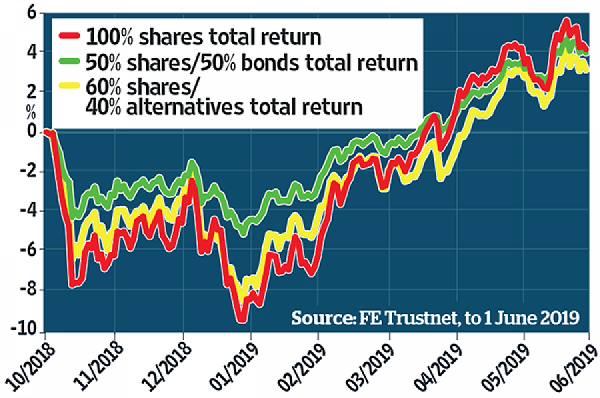

Overall, the three-year period provided a favourable backdrop for investors, but in the final quarter of 2018 volatility struck, hitting share and bond markets globally. However, as the chart below shows, bonds protected investors the best during that time, as the biggest fall from peak to trough for the 50% shares/50% bonds portfolio during those torrid three months was just 5%. The 60% shares/40% alternatives portfolio declined by as much as 8%, while, as expected, the 100% shares portfolio endured the heaviest fall, of nearly 10%.

Since the start of 2019 global stockmarkets have regained their poise, so performance has been similar from the start of October 2018 to the end of May 2019 for all three portfolios – but the 60% shares/40% alternatives portfolio has lagged slightly.

| Three portfolios | |

|---|---|

| 100% shares | |

| Fund/investment trust | Portfolio weighting (%) |

| Liontrust Special Situations | 25 |

| City of London (LSE:CTY) | 25 |

| Fundsmith Equity | 25 |

| Fidelity Global Dividend | 25 |

| 50% shares/50% bonds | |

| Fund/investment trust | Portfolio weighting (%) |

| Liontrust Special Situations | 25 |

| Fidelity Global Dividend | 25 |

| Royal London Global Bond Opportunities | 25 |

| Jupiter Strategic Bond | 25 |

| 60% shares/40% alternatives | |

| Fund/investment trust | Portfolio weighting (%) |

| Liontrust Special Situations | 30 |

| Fidelity Global Dividend | 30 |

| Impax Environmental Markets (LSE:IEM) | 10 |

| Pantheon International (LSE:PIN) | 10 |

| Renewables Infrastructure (LSE:TRIG) | 10 |

| BMO Commercial Property Trust (LSE:BCPT) | 10 |

Source: FE Analytics

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.