Is the oil price really heading for $110?

With trouble brewing in the Middle East, our chartist investigates how high energy prices might surge.

7th January 2020 09:16

by Alistair Strang from Trends and Targets

With trouble brewing in the Middle East, our chartist investigates how high energy prices might surge.

Brent crude

Few market signals are more useful than "the drop dead obvious". Moves such as this become self fulfilling prophecies, simply due to the sheer volume of people watching an indicator, each believing they are the only one being clever.

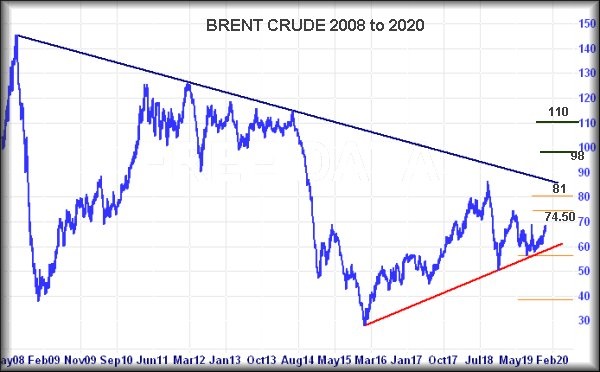

At present, Brent crude exhibits such a sense of nonsense, thanks to the downtrend since 2008.

This trend line (shown below in blue) has been pretty firmly respected over the years and it'd be mad to think the current surge in the price of crude shall not face being derailed by the trend.

Presently, this 12-year-old line, ageing like a decent malt, needs the price of the black glop to exceed $86 to suggest oil prices are about to go slightly crazy.

Of course, the risk of further conflict in the Middle East is always going to be capable of provoking an interesting market.

Essentially, above $86 calculates with an initial ambition at $98 with secondary, if exceeded, a longer term $110. Surprisingly, a ceiling around $110 makes for a very logical picture on the chart.

Alas, this appears unlikely given moves since the start of this year. Now, above $71 suggests growth to $74.50 and some hesitation, given prior highs.

If exceeded, our secondary calculates at $81, an ambition unable to break the ruling downtrend anytime soon.

Can we be the only folk wondering whether, thanks to 2019's terrorism attack on a Saudi refinery failing to give a lasting boost to oil, we're now witnessing another artificial (aside from those directly involved) attempt to ignite prices to new highs.

Of course, perhaps we're just becoming too cynical. But if Brent somehow manages below $60 anytime soon, it remains with the prospect of a bottom at $39.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.