Oil share analysis and Covid-19 stock round-up

Negative oil prices have put the sector in focus Tuesday. We also assess the latest company updates.

21st April 2020 13:04

by Graeme Evans from interactive investor

Negative oil prices have put the sector in focus Tuesday. We also assess the latest company updates.

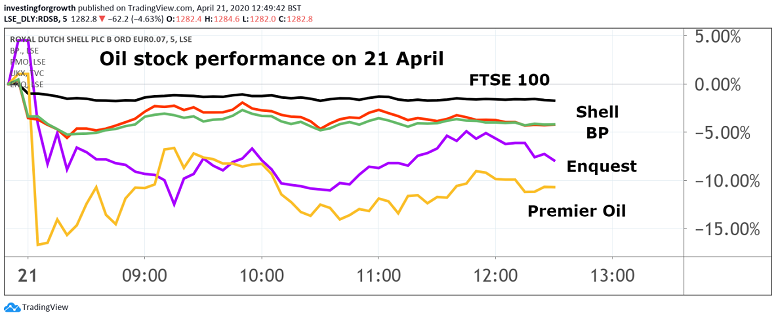

Barrels of oil at giveaway prices sent stocks from BP (LSE:BP.) to AIM minnow Solo Oil (LSE:SOLO) sharply lower today as investors got a reality check on rising hopes for a V-shaped markets recovery.

The FTSE 100 index slipped 2% to just above 5,700, with the top-flight losing some of the 16% rebound seen since it plunged below 5,000 on 23 March.

Oil wasn't the only focus for investors, however, with Associated British Foods (LSE:ABF) down 5% after unveiling a big write-down on unsold Primark stock. Pub chains Marston's (LSE:MARS) and Mitchells & Butlers (LSE:MAB) were 6% lower and troubled outsourcer Capita (LSE:CPI) off another 7% in the FTSE 350 index.

Last night's negative price for American crude oil futures was a powerful reminder for investors that Covid-19 will continue to deliver severe demand shocks. It comes at a time when markets have been increasingly looking ahead to life after the global lockdown.

Commodity-based stocks dominated the blue-chip fallers board, with steel producer EVRAZ (LSE:EVR) down 8%, Glencore (LSE:GLEN) off 6% and oil heavyweights Royal Dutch Shell (LSE:RDSB) and BP both 5% cheaper. Share price volatility is only likely to increase for the oil majors, with Q1 results due next week.

Source: TradingView Past performance is not a guide to future performance

UBS reckons that the sector will suffer a first-quarter net income slide of 58%, with worse to come in the current period as demand for oil is expected to fall by as much as 29 million barrels per day this month to levels not seen in 25 years.

The oil industry is running out of places to store unwanted supplies, leading to last night's unprecedented developments in the US.

Brent crude was trading at a lowly $22 a barrel this morning, which will add to doubts about whether BP and Shell can sustain their dividends this year. UBS added:

“There are pros and cons but we see limited benefit in immediate capitulation and longer term value in defending the commitment even if policy is revised at a later, calmer date.”

The price shock meant smaller oil stocks in the FTSE All-Share were down by more than 10%, with EnQuest (LSE:ENQ) and Premier Oil (LSE:PMO) the worst affected and closely followed by Tullow Oil (LSE:TLW). And with investors wondering what the point is of backing explorers when there's so little demand for the end product, AIM minnows Solo Oil and Borders & Southern Petroleum (LSE:BOR) lost a fifth of their value.

Despite the oil plunge, there were some pockets of encouragement for investors in the latest round of Covid-19 updates. FTSE 100 index-listed Halma (LSE:HLMA) was among them after the conglomerate stuck by the full-year guidance it gave investors a month ago.

Halma, whose products have been used to protect and improve life for people over 45 years, added it was well positioned to resume growth as soon as markets recover.

The company's track record of robust growth has certainly proved attractive to investors in the current crisis, with shares up 29% since 23 March and not far from where they were prior to the market sell-off.

That's good news for followers of the interactive investor Consistent Winter Portfolio, particularly as Halma is now comfortably higher than at the portfolio’s launch in October.

London Stock Exchange (LSE:LSE) also continues to provide comfort for investors, helped by its pledge today to pay its 2019 dividend.

LSE shares rose as high as 7,800p in the opening minutes of trading after the exchange said higher trading volumes in the current market volatility had helped first quarter total income rise 13% year-on-year to £615 million. It also remains committed to the US$27 billion takeover of data company Refinitiv later this year.

Among smaller stocks, shares in retailer Joules surged 13% after its latest trading update highlighted the benefits of recent actions to improve its balance sheet.

This includes a £15 million equity placing completed in early April and a £15 million increase to its revolving credit facility. Customer traffic and demand to Joules.com has also been ahead of revised expectations.

Structural steel group Severfield (LSE:SFR) also reassured investors after its latest update showed that order books were holding up well despite the current uncertainty.

Analysts at Jefferies noted that a good year of cash generation in the 2020 financial year had left the group in good shape to weather the storm. Jefferies has a price target of 85p, which compares with an unchanged 67p seen after today's solid update.

Meanwhile, shares in industrial LED lighting specialist Dialight (LSE:DIA) were back under pressure after it said expectations for 2020 results were significantly reduced. While the company said long-term prospects remain “excellent”, shares tumbled 12% to 177p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.