Relief after Dixons Carphone results

6th September 2018 12:15

by Richard Hunter from interactive investor

Dixons has been a problem stock for a couple of years and, despite a shock-free numbers, Richard Hunter, head of markets at interactive investor, believes there's much work to be done here.

Given its recent history of a profits warning in May and a fairly sorry set of full-year numbers in June, Dixons Carphone will be pleased with a reasonably uneventful first quarter.

Revenues are generally flat, with highlights coming in the form of continued online growth of 13% and a better contribution from Greece, up 9%. Meanwhile, the sale of consumer electronics was bolstered by the World Cup fever which gripped the country in the summer, and helped to offset weaker performances in white goods and computing.

Of some comfort is the reiteration of previous guidance for the full-year ahead profit number, whilst in the background the dividend yield of 6.9% is a compelling reason to stay with the shares as the company's transformation plays out.

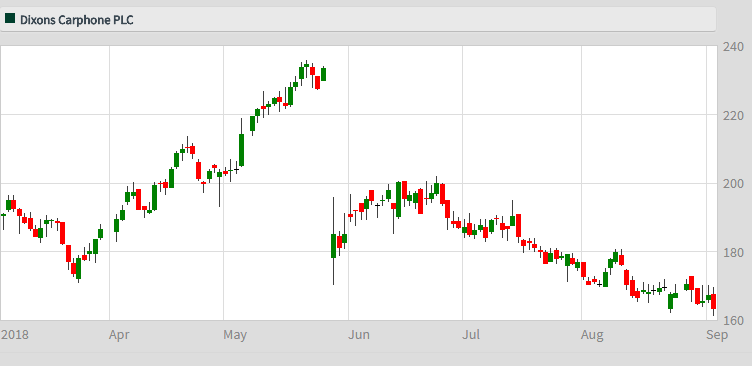

Source: interactive investor Past performance is not a guide to future performance

Even so, Dixons Carphone's issues will not be resolved overnight. Regular smartphone updates across the industry are dwindling as the market approaches saturation point and for the company mobile revenues have slipped on a like-for-like basis.

The general pressure on retailers and the possibility of UK consumer retrenchment also weigh on prospects, particularly for the higher end products which the group provides.

Investors have taken a sanguine view on recent developments, with the market consensus having edged up to a buy since the final results. Even so, the share price remains under pressure, having lost 16% in the last three months alone.

Over the last year the picture is brighter, with the shares having dipped 1.5% as compared to a 3.4% gain for the wider FTSE 250. Ahead of the next update in December, there remains much for management to do under the bonnet.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.