Seven trusts to play a UK stock-market recovery

UK equities have been despised for almost five years and could offer extreme rebound potential.

27th November 2020 15:25

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

UK equities have been despised for almost five years and could offer extreme rebound potential.

Cool Britannia?

Thomas McMahon, senior analyst at Kepler Trust Intelligence.

UK economy in dire straits

There is no question the UK economy is in dire straits. A fall of 12% in GDP in Q2, followed by a 16% rise, led to an economy 7% smaller in September. The recent imposition of a second lockdown will lead to a further decline. The Bank of England forecasts the UK economy will end the year 11% smaller than when it started. The OBR estimates it will be smaller than it was entering the current crisis until late 2022. One lagging indicator which is lagging even more than normal is the unemployment rate. Thanks to the furlough scheme, the scale of job destruction we have seen has not yet registered in the data. This will likely have a huge effect upon house prices, retail sales, consumer credit and other economic factors which will have knock-on effects for growth down the line.

As for the current state of affairs, last week the Office for National Statistics (ONS) published its ‘Business insights and impacts on the UK report for November. Almost 17% of businesses are not currently trading thanks to coronavirus restrictions, while 50% of those that are trading have seen decreased turnover from the same period last year. Only 9% have seen turnover rise year on year. Looking forward, 14% of those businesses still trading have no or low confidence in their ability to survive the next three months. A further 7% were not sure how confident they were. It is clear that the effect of the pandemic and the lockdowns has yet to be fully felt in the real economy.

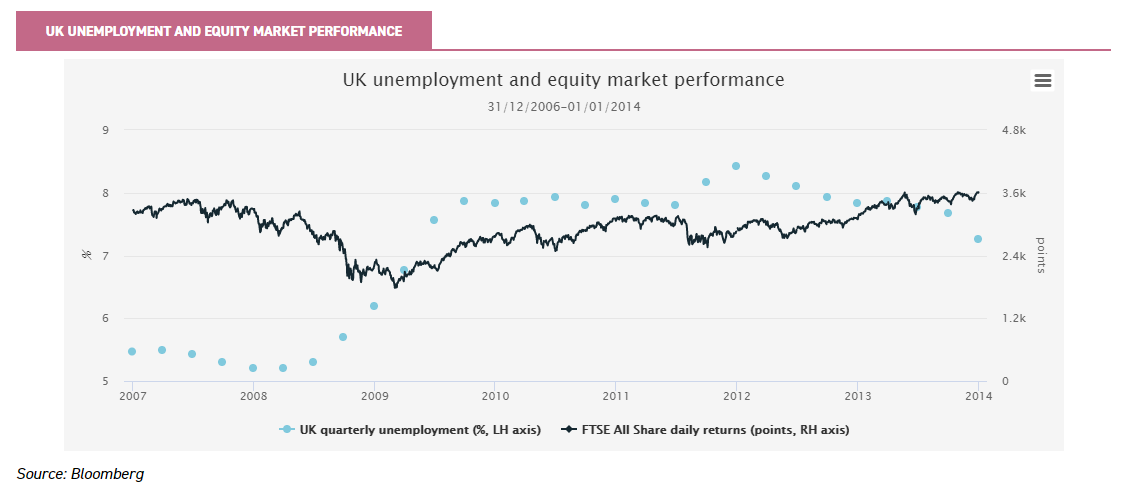

However, this does not mean that an investment in the UK stock market will necessarily do poorly. Stock markets tend to anticipate and price in expected events in the future. A look back at the last global crisis illustrates this well. The below graph shows the UK unemployment rate and the FTSE All-Share performance from the start of 2007 until the end of 2013. The index doubled between 09 March 2009 and 31 December 2013, with most of the returns coming while the unemployment rate was still rising.

The key point is that the stock market can do extremely well while an economy remains slow. A certain proportion of companies may fall into trouble, but as investors look to the winners and those benefitting from a cyclical upswing, they can make good returns in the stock market before the economic recovery has properly begun.

The UK has been widely shunned for years

Stock markets are often leading indicators. In recent weeks the UK market has rallied harder than international competitors as positive news on three vaccine candidates has emerged.

In hindsight, we can see signs of stronger performance from the end of September, as high-growth markets and sectors sold off. One critical factor behind this rebound was the low valuation of UK equities, which makes them more sensitive to an improvement in sentiment.

Another is the global sensitivity of the FTSE 100. With over 70% of revenues coming from abroad, when the global economy looks likely to improve (for example, thanks to the roll-out of COVID-19 vaccines), revenue forecasts for UK-listed large caps need to be revised up. That said, this recent uptick does nothing to change the bigger picture.

UK equities have been unloved since the June 2016 referendum result to leave the European Union more than four years ago. Anxiety about the UK’s ability to negotiate a deal and the country’s possible fate without one have weighed on sentiment. Although there was a brief rally in December 2019 following the election result, the UK once again became an unfavoured market following the emergence of the pandemic.

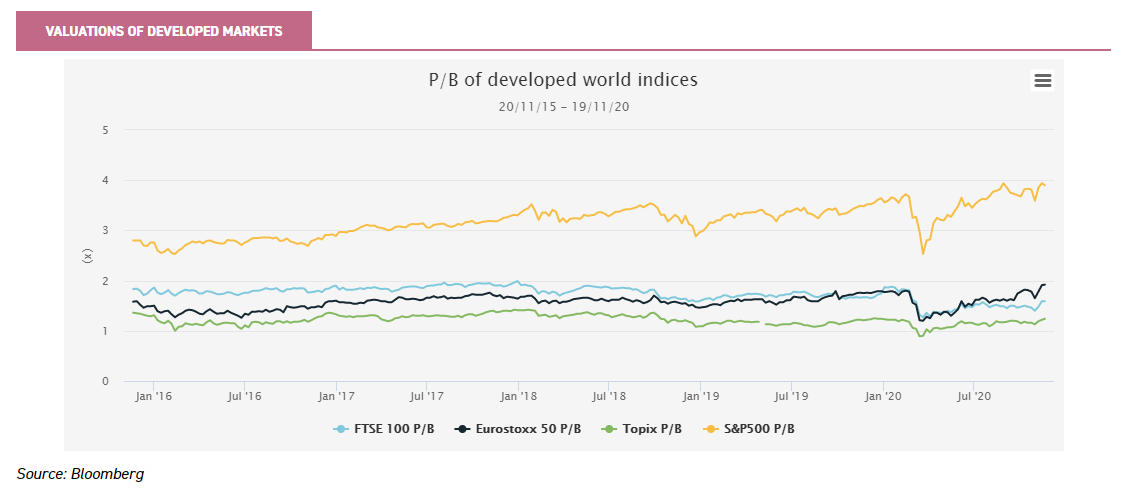

Below we show the price-to-book ratio of the UK versus other major developed markets over the past five years. While Japan’s TOPIX is trading more or less on its five-year average and the US and European markets are over two standard deviations above the mean, the UK is one standard deviation below its five-year average valuation. This is despite the uptick in the past month.

The UK’s low valuation looks even more exciting on a relative basis. Z-scores measure the number of standard deviations away from the mean a certain value is. The Z-score of the valuation differential between the UK and the other major markets is extremely negative in each case. For the UK versus Japan it is -1.39, for the UK versus the US -2.25, and for the UK versus the EU a whopping -2.95, meaning that the gap between the P/B of those two markets is almost three standard deviations below the mean.

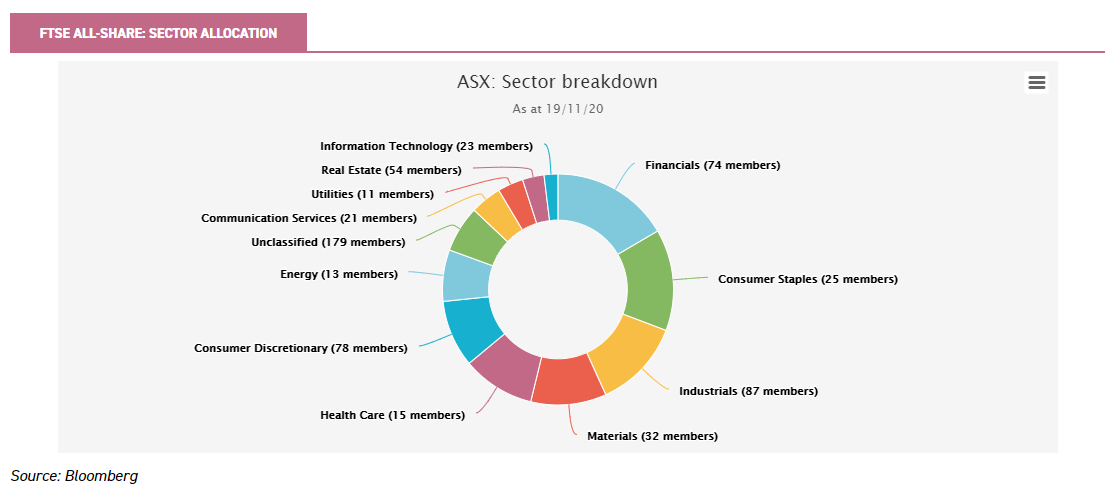

Concerns about Brexit have been one headwind affecting valuations. Another is to do with the structure of the UK market. The FTSE All-Share has less than 2% in the information technology sector, which has been in favour since 2017 globally. Meanwhile, the most successful e-commerce retailer in the country is US-listed Amazon (NASDAQ:AMZN).

Traditional value stocks such as banks and tobacco have significant weights, as do materials and oil & gas companies. As well as being out of favour in a growth-dominated environment, the economic sensitivity of many of these areas has weighed on the UK in 2020. However, this is one of the reasons the UK stock market could offer such significant upside in 2021: the cyclical nature of the largest quoted companies and the high dependence on overseas earnings should raise the beta to a global economic recovery.

The valuation gap between the UK stock market and other markets might not be entirely down to sector exposure. Nick Train, manager of Finsbury Growth & Income (LSE:FGT), believes asset allocators are placing a discount on London-listed shares even where they have strong growth prospects. He highlights the performance of Burberry (LSE:BRBY) versus Prada (SEHK:1913) this year, with the Italian company seeing strong share price gains while Burberry is down over 25%. Similarly, US-listed Equifax (NYSE:EFX) has outperformed UK-listed Experian (LSE:EXPN), even though they operate in similar areas. In the case of Experian, Nick says it could properly be considered as a technology stock, and yet has not fully participated in the gains made by its peers this year.

Nick thinks UK large caps offer excellent opportunities, but we think the UK small-cap space could offer some of the most exciting growth. Relative to their own history, UK valuations look modestly attractive, with a Z-score of -0.5.

However, on a relative basis the real value becomes evident: versus Japanese small caps the valuation differential is -0.8 standard deviations, versus the US it is -1.1 and versus the EU -1.2. While these numbers aren’t so extreme, the UK small-cap space offers much greater secular growth potential. While we would expect the large caps to do well in a reflationary rally, how far this could continue would depend on whether the global economy follows through into a full cyclical recovery or whether we end up back in the low-growth, low-inflation environment evident prior to the pandemic’s arrival. Sadly, we think the latter is the most likely outcome, given demographics still favour a lower global growth rate and significantly higher debt levels around the world will likely hamper growth.

What about Brexit?

Some of us are so old we can remember when the country was tearing itself apart over Brexit. Until the fateful meeting of bat and man along the banks of the Yangtze, a poor Brexit outcome was the greatest threat facing the UK economy. One key difference between the two threats is that any negative effects of a poor Brexit are likely to be drawn out rather than sudden. We would not put too much faith in any of the predictions of campaigning economists of either side, chiefly because the future is entirely unwritten and the UK’s wheels will keep on turning. Nevertheless, in our view any resolution is likely to be good for the stock market.

Remembering that the market is not the economy, whatever the outcome there will be companies with exciting growth potential, particularly in the small- and mid-cap space. Nick Train said:

“The UK, forgetting the last five years, has been a wonderful place for investors and there is a very entrepreneurial, innovative, shareholder-focussed society and economy.”

We would regard any pullback on a no-deal Brexit as a possible entry point for a high-quality portfolio run by bottom-up stockpickers. The second thing to bear in mind is that the valuation differential between the UK and the other major markets discussed above has arguably already incorporated a bad outcome.

The far more ‘dangerous’ risk to investors could be missing out on the upside: the announcement of any deal could lead to a rapid reversion in relative valuations. We argue that the ‘Boris bounce’ we saw in UK assets at the end of 2019 indicates that any resolution would be welcomed, not just a ‘good deal’.

Currency issues

We are strong believers that long-term investors need to look through currency moves. However, they can change the risk/reward calculation at any potential entry point.

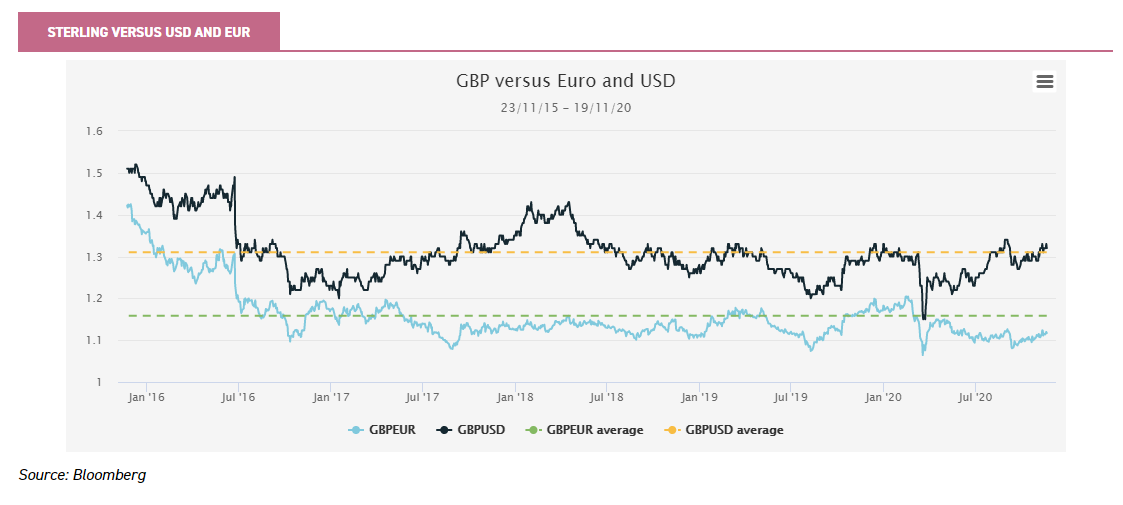

In late 2015, the IMF said the pound was overvalued by 5% to 15% versus the dollar. Interestingly, having sunk much lower than that it is now back at around 15% below its pre-referendum valuation versus the dollar.

March was really the moment of the greatest opportunity, with GBP trading one standard deviation below its five-year average against the euro, and two standard deviations below its five-year average against the dollar.

Valuations now look potentially attractive versus the euro and neutral versus the dollar. With the US expecting to deliver fiscal stimulus under a Biden administration, the dollar is widely expected to soften in 2021. Currency at least looks like it won’t be a headwind for UK investors (on a relative basis).

Where are the best opportunities?

UK investment trust buyers seem to have had the same idea as us at the same time. In September we began planning to write on the UK at this time, expecting November to be the darkness before the dawn, and that soon the market would start to look through Brexit and the second wave of coronavirus to a less gloomy future.

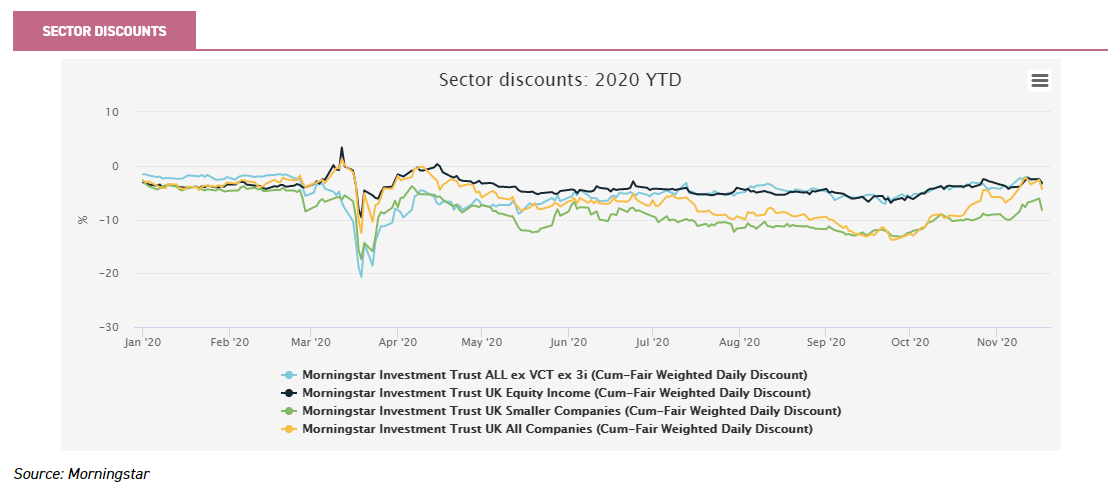

In fact, it is remarkable how unfazed the investment trust universe has been by the second lockdown. The graph below shows a rapid re-rating of the UK All Companies and UK Smaller Companies sector average discounts since the start of October.

Recent days have seen a small sell-off. It could well be we see some weakness in the coming weeks, as the reality of the timescale for vaccine roll-outs and the ongoing economic disruption comes to the forefront of investors’ minds again.

However, in our minds this is the start of a long overdue reversion to the mean for UK equities. As we discuss above, the valuations on the market level are still extremely attractive, even if investment trust discounts have closed somewhat.

Anecdotally, this narrowing of discounts has coincided with growing interest in UK assets from overseas buyers, as US institutional investors in particular look to take advantage of current low valuations before the direction of travel for earnings becomes clear.

The one sector that has not traded on a wide discount is the AIC UK Equity Income sector, which has seen strong demand all year as investors look to switch out of open-ended funds that do not have the luxury of revenue reserves to support dividend payments.

Choose your weapon

In our view the punchiest way to play the potential UK recovery is via Aberforth Split Level Income (LSE:ASIT) or Aberforth Smaller Companies (LSE:ASL). ASIT is geared through zero-dividend preference shares which have grown as a proportion of NAV thanks to the fall in the market in 2020. Gearing is now 56% (as of the end of October), which means that any rebound in the trust’s portfolio would translate into a massive boost for the ordinary shares’ NAV.

Of course, it also brings along with it greater exposure to a relapse. Investors may prefer the more modestly geared ASL, although as we discuss in our updated note published this week, the managers have raised the gearing on that trust too (to a much more modest 7%), illustrating how bullish they are on a UK recovery.

Both portfolios have a cyclical bias as a result of the managers’ disciplined value approach leading them into the most out-of-favour areas of the market. They are therefore highly exposed to a cyclical rebound in the UK and to a recovery in sentiment. Both trusts have seen their discounts come in in recent weeks as investors start to look through the current negative sentiment towards the UK, but ASIT still trades on a double-digit discount, perhaps reflecting the trust’s greater risks. To an optimist, there is also greater performance potential too.

The Aberforth portfolios are exposed to the success or failure of the value style over the long run. In our view, a recovery in value versus growth is unnecessary for them to do well in the short run, but over the long run it will be important for relative returns.

Investors might prefer to stick with a portfolio with a growth bias, such as that of BlackRock Throgmorton Trust (LSE:THRG). THRG is the top performer in its sector over five years, and the most exposed to the growth style (according to Morningstar data). It has tended to trade on a premium and has been issuing shares to keep the premium in check. While it does not offer the short-term catch-up potential of ASL or ASIT, manager Dan Whitestone’s style is flexible enough for THRG to continue to perform well in a cyclical rebound.

While he has been running with high exposure to growth names and is relatively sanguine about valuations, a recovery in sentiment to the UK should lift all boats, and Dan has the ability to short companies or switch rapidly into areas with greater growth potential. As we highlight in our updated note this week, THRG outperformed its peers in the last sustained period in which small-cap value outperformed small-cap growth too (although this was before Dan joined the management team).

Currently straddling both growth and value in terms of investment style is Invesco Perpetual UK Smaller Companies Trust (LSE:IPU). In line with its historic pattern of returns, it outperformed peers and the market in the Q1 market sell-off, and then underperformed in the rebound. The managers are unarguably growth investors, but in our view are more ‘valuation aware’ than their growthier peers – always looking to top slice their best performers and recycle capital back into more attractively valued opportunities.

For much of the time since the summer this has held them back relative to peers, and the discount slid out to levels not seen for many years. The managers have adopted a barbell approach currently, with around half the portfolio in ‘COVID winners’ and half exposed to high-quality recovery plays.

Now that the recovery is in view (or at least a vaccine is), performance has bounced back (the trust is currently third out of 16 in its sector in NAV terms over the past month). Offering a yield premium to peers, there is potential for the discount to narrow from the current 12.6%. We would argue that it ought rightfully to trade narrower than the peer group average (currently 6.4%).

A deep value option could be Downing Strategic Micro-Cap Investment Trust (LSE:DSM). DSM’s discount has come in a little, but it still trades 20% below par. The portfolio is a concentrated selection of micro-cap stocks (<£150m market cap), so there is added liquidity and stock-specific risk. This area might be expected to lag an initial recovery in sentiment to the UK but could potentially offer excellent returns. We calculate that the portfolio is trading on a double discount of c. 50% when taking into consideration the low valuations on the portfolio companies versus the market. DSM is held by Miton Global Opportunities (LSE:MIGO), whose manager Nick Greenwood looks for discount opportunities in the investment trust universe.

We have identified the UK as looking extremely attractive on a relative valuation basis. It is, however, not the only investment theme to have rallied since September. Trusts with a value approach or which are investing in cheap asset classes have tended to do well since vaccine hopes jumped. Seneca Global Income & Growth Trust (LSE:SIGT) is a global multi-asset trust with a structural tilt to the UK, viewing 35% as a neutral weight. The managers aim to avoid areas with momentum and those which are in fashion, preferring a contrarian investment style which means the trust should work as a good diversifier for many investors. SIGT has seen NAV total returns of 11% over the past month, and trades on a 2% premium.

Another diversified trust which stands to do well if the UK outperforms is Majedie Investments (LSE:MAJE). Unlike SIGT, MAJE trades on a wide discount, currently c. 17%. MAJE is structurally overweight to the UK versus a global equity index, which partly explains why it has underperformed in recent years.

However, the UK exposure and tilt to value rather than growth both mean it offers catch-up potential in a cyclical recovery in which the UK participates. It also offers a highly attractive yield of 5.3%, which is well covered by reserves. We think it may slip under the radar of income investors thanks to previously being listed in the AIC Global sector, but note that it has a higher yield than any of the trusts in the AIC Global Equity Income sector.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.