Share Sleuth: the big ballsy contrarian decision I’ve made

Richard Beddard has turned his attention to removing or reducing holdings to have a cash pile in order to take advantage of various opportunities he's sizing up. He explains why he's gone against the crowd and sold a firm that’s favoured by analysts.

5th October 2023 09:55

by Richard Beddard from interactive investor

While 28 of the 40 shares in the Decision Engine scored 7 out of 9 or more, aka the buy zone, when I sat down on Thursday 15 Sept to consider Share Sleuth’s monthly trade, there was no point in thinking about them.

The portfolio only had a little more than £1,800 in cash, far less than the minimum trade size of 2.5% of its total value (just over £4,500 on the day).

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

Since I could not afford to add more shares to the portfolio, my attention turned to removing or reducing holdings, which would liberate funds to invest in the high-scoring shares that abound.

Disappointingly though, the Decision Engine did not suggest any shares to sell.

Two came very close, Jet2 (LSE:JET2) and Next (LSE:NXT). Both score 5 out of 9, which is the lower bound of a hold. Jet2, though, is out of the frame, because it has been a year since I last evaluated it and it is next on my list of shares to re-score.

I re-evaluated fashion and homewares retailer Next, though, in June, and changed my opinion on the company. In some respects I still admire Next. It has prospered as other retail chains have withered, and although it has not yet worked out how to grow during many challenging years retailers, it is experimenting with many different strategies.

This year’s annual report freaked me out though. There were too many initiatives and there was not enough direction. While Next is very good at communicating its short-term prospects to investors and analysts, that is not something I value highly.

I want to see how a company expects to grow in the long term, so I can judge whether its strategies are pulling together to make that happen. Next’s communications leave me somewhat bewildered, and I gave its strategy 0 marks out of 2.

I do not blame Next for that. Taking an experimental, iterative, evolutionary approach to growing may be the best way forward in an industry that is so competitive now much of it has moved online. But, unlike Next, the Share Sleuth portfolio does not need to participate in that adventure.

- Next issues another profit upgrade alongside strategy insight

- UK retail sector: stocks to watch

- ii view: Next finds more space in its online wardrobe

Reducing the portfolio’s holding in Next would be a big ballsy contrarian decision, and that is the decision I took.

Big because if I reduced the portfolio’s holding of approximately £7,600 by the portfolio’s minimum trade size of just over £4,500 I would be left with a holding worth about £3,000, less than the minimum holding size, which was also about £4,500 or 2.5% of the portfolio’s total value. This means I should sell the entire holding or not sell any at all.

Ballsy because, although I make no claims to be able to read people’s minds, presumably traders are positive about the share. It has risen strongly in price in recent months. City analysts like it too. According to SharePad, of 22 analysts, one rated Next a “sell”, one rated it “underperform”, 9 rated it “hold”, 3 rated it “outperform”, and 8 rated it a “buy”. That’s 20 for buying or holding, and two for selling, although one of them was a bit wishy-washy about it.

Contrarian, because the decision to liquidate the holding goes against price momentum and the consensus of analysts.

- Shares for the future: what do you think of my best idea so far?

- Richard Beddard: why I own shares in this 265-year-old company

I do not pay attention to either. The point of having a Decision Engine is to make myself rely on my own analysis, which is embedded in the scores, and Next scores badly in comparison to most of the other 40 shares I think make good long-term investments.

That is not to say, everybody else is wrong, one or more of Next’s many strategies may succeed wildly and many traders are probably thinking about where to put their money for days, weeks, or months. I am thinking about shares to hold for the next decade.

We disagree, because we are doing something different.

Liquidating Next

This month, I gave my editor an easy headline and made my big, ballsy, contrarian trade.

Having slept on the decision, on Friday 15 September 2023, I liquidated the portfolio’s holding of 106 Next shares at a price just shy of £72.00. The trade netted the portfolio just over £7,600 after deducting £10.00 in lieu of broker fees.

The Next trade was not a disaster, even though I lost confidence in the investment. I first added the shares in 2016 at just over £48 per share, when traders were still chasing online insurgents ASOS (LSE:ASC) and Boohoo Group (LSE:BOO) (that would not have worked out well for long-term investors). I added some more in 2018, at just over £63.

Source: SharePad. A ‘b’ indicates an addition to the portfolio and the ‘s’ marks the liquidation of Share Sleuth’s holding. Past performance is not a guide to future performance.

According to SharePad, the total return on investment was 44%, which is just over 5% annualised.

Share Sleuth performance

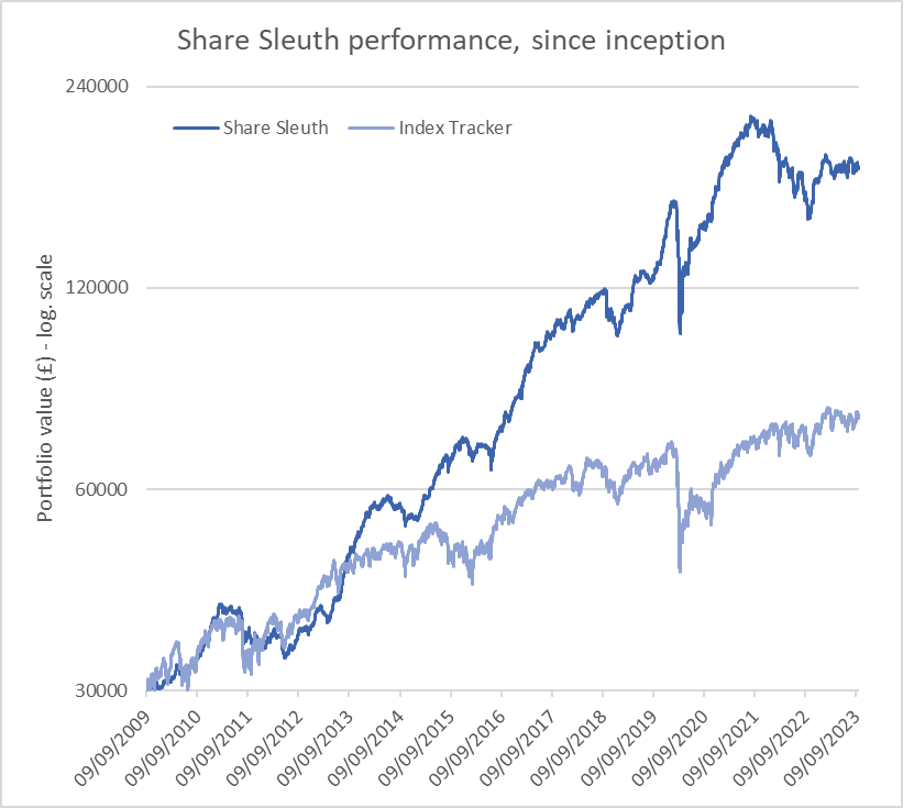

At the close on 29 September, Share Sleuth was worth £181,985, 507% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £77,595, an increase of 159%.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 9,603 | ||||

Shares | 172,372 | ||||

Since 9 September 2009 | 30,000 | 181,985 | 507 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 2,979 | -27 |

BMY | Bloomsbury | 1,681 | 5,915 | 6,741 | 14 |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 3,950 | -12 |

BNZL | Bunzl | 201 | 4,714 | 5,881 | 25 |

CHH | Churchill China | 682 | 8,013 | 8,696 | 9 |

CHRT | Cohort | 1,600 | 3,747 | 7,872 | 110 |

D4T4 | D4t4 | 1,528 | 3,509 | 2,785 | -21 |

DWHT | Dewhurst | 532 | 1,754 | 4,096 | 134 |

FOUR | 4Imprint | 190 | 3,688 | 9,975 | 170 |

GAW | Games Workshop | 100 | 4,571 | 10,570 | 131 |

GDWN | Goodwin | 266 | 6,646 | 13,672 | 106 |

GRMN | Garmin | 53 | 4,413 | 4,575 | 4 |

HWDN | Howden Joinery | 2,020 | 12,718 | 14,875 | 17 |

JDG | Judges Scientific | 34 | 833 | 2,999 | 260 |

JET2 | Jet2 | 456 | 250 | 4,938 | 1,875 |

LTHM | James Latham | 750 | 9,235 | 8,438 | -9 |

PRV | Porvair | 906 | 4,999 | 5,255 | 5 |

PZC | PZ Cussons | 1,870 | 3,878 | 2,648 | -32 |

QTX | Quartix | 3,285 | 7,296 | 6,570 | -10 |

RSW | Renishaw | 92 | 1,739 | 3,240 | 86 |

RWS | RWS | 2,790 | 9,199 | 6,690 | -27 |

SOLI | Solid State | 356 | 1,028 | 4,219 | 310 |

TET | Treatt | 763 | 1,082 | 3,868 | 257 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 8,360 | 279 |

TSTL | Tristel | 750 | 268 | 3,338 | 1,144 |

TUNE | Focusrite | 1,050 | 9,123 | 5,376 | -41 |

VCT | Victrex | 292 | 6,432 | 4,103 | -36 |

XPP | XP Power | 240 | 4,589 | 5,664 | 23 |

Notes

September Liquidated holding in Next

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £181,985 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £77,595 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 29 September 2023.

After the Next trade and dividends paid during the month from 4imprint Group (LSE:FOUR), Games Workshop Group (LSE:GAW), Garmin Ltd (NYSE:GRMN) and Solid State (LSE:SOLI), Share Sleuth’s cash pile is £9,603. It is almost enough to fund two new additions.

The minimum trade size, 2.5% of the portfolio’s value, is £4,550.

Past performance is not a guide to future performance.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.