Share Sleuth spots two 'substantially undervalued' shares

30th January 2019 11:49

by Richard Beddard from interactive investor

After selling two stocks at the beginning of 2019, Richard Beddard has beefed up his stake in this pair.

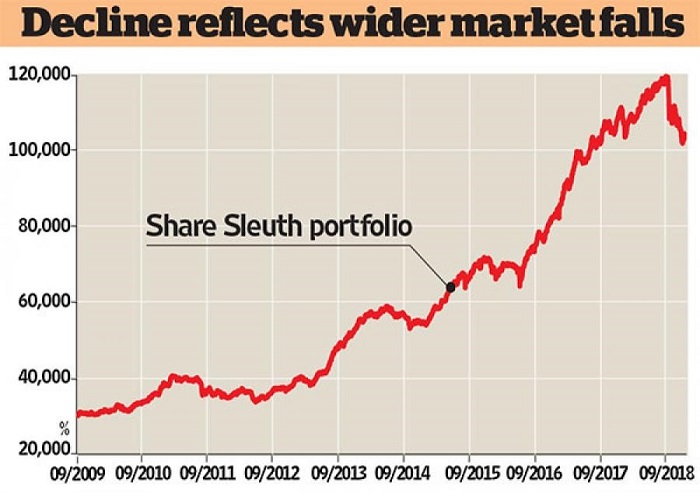

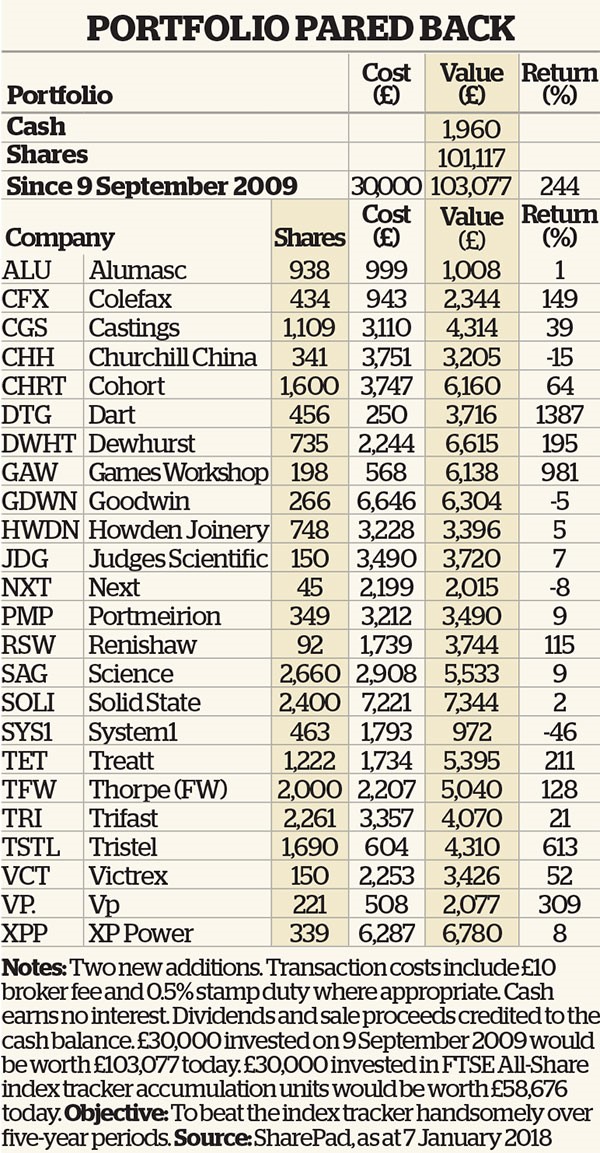

A few days into 2019, I removed Finsbury Food (LSE:FIF) and MS International (LSE:MSI) from the Share Sleuth portfolio and recycled the loot into XP Power (LSE:XPP) and Goodwin (LSE:GDWN), two existing constituents I believe are substantially undervalued. It is the first stage in a minor restructuring of the portfolio.

I liquidated Finsbury Food at a share price of 102p, which raised £2,070 after a £10 charge in lieu of broker fees. The removal of MS International raised a little more: £3,774 after fees. The share price was 206p.

Both sales were the result of conclusions drawn last year. As I wrote in January's Share Watch column, I believe Finsbury needs to grow bigger to drive down the cost of baking cake and bread, but the quickest way to acquire scale is to buy other bakeries, which is expensive. Since I do not see a way out of this bind, I think there are probably better places for the portfolio’s cash, even though the shares are cheaply valued.

Finsbury was a profitable trade. I added the shares in January 2014, five years ago, but reduced the portfolio's shareholding in December 2015. According to SharePad, the service I use to track performance, the investment earned an annualised return of a little more than 17% over the whole period.

MS International was not a successful trade, despite my adding to the shares three times: in September 2012, March 2013 and January 2014. The shares did contribute an annualised return of about 2%, but that was thanks entirely to dividends. The company is a supplier of naval cannons, petrol station signs and structures, and fork arms for forklift trucks. It operates in capricious and, possibly, declining markets, and I am not confident that it will be as profitable in future as it has been in the past.

The money raised from its sale, together with some cash that has collected in the portfolio from dividends, has funded the addition of 117 shares in XP Power. The share price was £21, and the total cost of the transaction was £2,479, including £10 in lieu of a broker fee and £12 in lieu of stamp duty.

It has also funded the addition of 103 shares in Goodwin at a price of £23.97 a share. The total cost of the transaction was £2,591, taking into account similar charges in lieu of broker fees and stamp duty.

Source: interactive investor Past performance is not a guide to future performance

Substantial holdings

I briefly profiled both companies in last month's magazine, when I chose them as two of my six favourite shares for 2019 and beyond. The trades mean XP Power is the portfolio's second-biggest holding (7% of its total value) and Goodwin is its fourth (6%), which reflects my confidence in their long-term prospects and the attractiveness of their current valuations.

I had other options: Avon Rubber (LSE:AVON) and Softcat (LSE:SCT), profiled in this month's Share Watch column, and Computacenter (LSE:CCC), profiled in last month's, would have made worthy new additions. I also think existing holdings Howden Joinery (LSE:HWDN), Victrex (LSE:VCT) and Next (LSE:NXT) are good value and under-represented in the portfolio.

However, I have already broken a self-imposed rule that allows me only one trade a month. In fact, I have refashioned this rule so that it is more flexible, allowing myself one big trade of up to 5% of the value of the portfolio or two smaller ones of 2.5% of its value. These limits are arbitrary, but sensible I think. An upper limit of 5% restricts the amount of risk I take in any given month. A lower limit of 2.5% ensures my trades are, nevertheless, meaningful. This month I have taken the second option, and by liquidating two holdings and not adding any new ones, I have reduced the portfolio from 26 to 24 constituents.

I would not be unhappy if it shrank further, to around 20 holdings. This would mean I spent less time analysing shares that are already in the portfolio and more time assessing new candidates. More competition for membership could increase the quality of the investments in the portfolio, without reducing its diversity significantly.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.