Share Sleuth: with three firms to choose from, here’s the one I bought

4th August 2022 09:00

by Richard Beddard from interactive investor

Richard Beddard has added a new share to the portfolio. He explains why the firm beat two other companies on his shortlist.

By the time I got around to deciding what, if anything, to trade this month, the month had almost run out.

It was Thursday 28 July and my Decision Engine presented me with three potential additions to the Share Sleuth portfolio: Churchill China (LSE:CHH), Garmin (NYSE:GRMN), and Marks Electrical (LSE:MRK).

Unfortunately, the portfolio could not afford any of them. Its cash balance stood at just over £2,600, and as a rule I do not trade less than 2.5% of the total value of the portfolio, which I call the minimum trade size. The minimum trade size was about £4,400.

To make any of these trades I would have to liquidate shares in an existing holding, but that raised another problem. According to the Decision Engine, there was nothing wrong with any of the portfolio’s existing holdings.

- Find out about: Trading Account | Share prices today | Top UK shares

None of the shares in the Share Sleuth portfolio scored less than five out of nine, my arbitrary lower bound for holding a share, and none of the portfolio’s holdings were egregiously outsized.

The ideal size of a holding is determined by a company’s score (the higher the score, the bigger the ideal value of the holding as a percentage of the portfolio’s total value).

Since I do not like to trade below the minimum trade size, a holding is only too big if it is worth more than its ideal size plus the minimum trade size.

- Shares for the future: my five best shares for long-term investment

- Shares for the future: our own Warren Buffett names 23 shares in his ‘buy’ zone

Reduce Bloomsbury

This month, I made an exception. The Decision Engine told me that the Share Sleuth Portfolio’s holding in Bloomsbury Publishing (LSE:BMY) was £4,000 higher than its ideal size, which is only £400 less than my minimum trade size.

I think very highly of Bloomsbury, but I also think highly of Churchill China, Marks Electrical, and Garmin.

If they are under-represented in the portfolio and Bloomsbury is over-represented, I could improve the portfolio by bending my minimum trade size rule very slightly.

I decided to reduce the portfolio’s holding in Bloomsbury by £4,000 to its ideal size, which would raise more than enough money to invest in one of the others.

Add Churchill China, or Garmin, or Marks Electrical

The question was, which one?

With a score of eight out of nine, the highest-ranked share was already held in the portfolio. It was Churchill China, which makes tableware for restaurants.

The other two shares, which both ranked seven out of nine, offered something else: the opportunity to diversify.

Marks Electrical sells washing machines, cookers and TVs, mostly online in the UK. Garmin manufactures a wide range of GPS-enabled devices from fitness watches to aeroplane cockpit instrumentation.

Share Sleuth already has 28 diverse holdings, so there is no great imperative to diversify. Nevertheless, that is my instinct.

I have already decided these are good businesses and they are attractively priced so it seems sensible to own as many of them as I can keep track of.

In a process destined to be considerably shorter than a Conservative Party leadership contest, Churchill China was the first to drop out.

Coincidentally, I have had recent experience as a customer of both finalists, but it did not help me to choose between them. My Garmin watch is terrific and when our washing machine broke down, Marks Electrical efficiently delivered a new one free the next day.

These are not high-stakes decisions, so I prefer not to take too long over them. I would be happy to invest in either company, if it were the only option.

Even though I think Marks Electrical’s specialist and vertically integrated business model is uniquely potent in the UK, and its modest market share gives it the capability to grow, I chose Garmin.

Garmin’s research and development heavy strategy probably gives it more opportunity to add value, and it has been listed a lot longer. Its highly profitable record offers more evidence of this ability to create value over the long term.

I reached this conclusion with my eyes set on the far horizon. In the year to December 2022, Garmin expects to make less profit than it did in 2021, when it was still benefiting from a pandemic boom in fitness equipment and the dollar was not riding as high as it is now.

Trades

As always, I slept on the decision to reduce Bloomsbury and add Garmin.

Then, on Friday 29 July, I reduced the portfolio’s holding in Bloomsbury by 995 shares at a shade over £4.00 per share, a price quoted by my broker. After deducting £10 in lieu of broker fees, the trade netted the portfolio a few pence more than £3,987.

I added 83 shares in Garmin at a price of just over £83, the price quoted by my broker and converted into pounds at the broker’s exchange rate of a fraction over 1.19 dollars to the pound. The dollar price was just under $99.00.

After adding £10 in lieu of broker fees, the total cost of the transaction was just under £4,413.

Share Sleuth performance

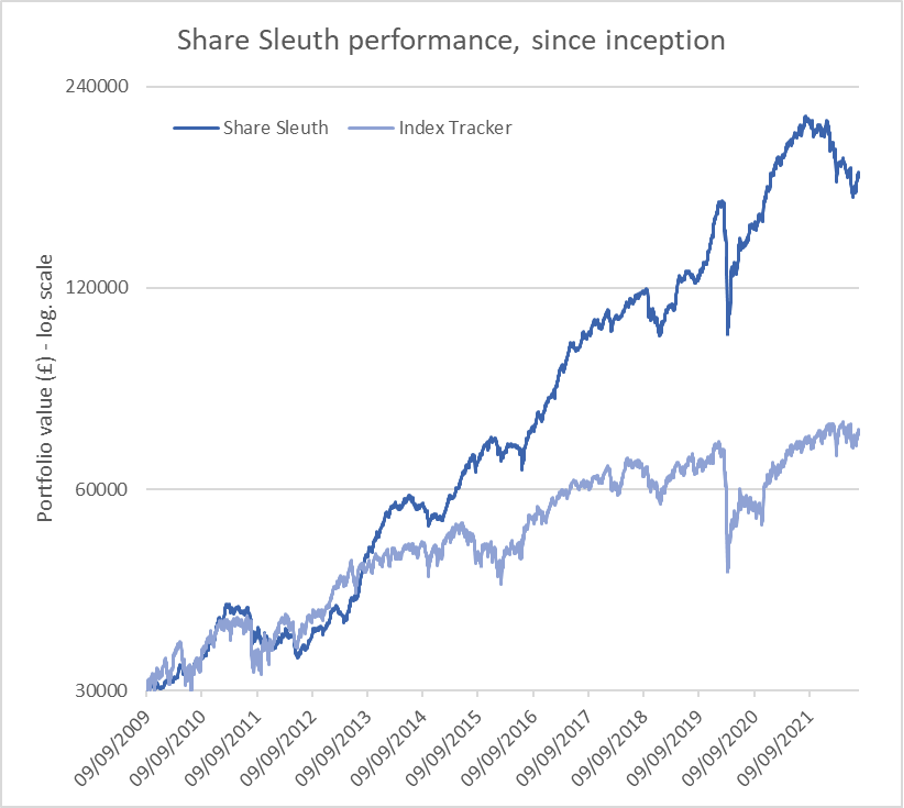

At the close on Monday 1 August, the Share Sleuth portfolio was worth £178,070, 494% more than the notional £30,000 invested in the portfolio’s first year, from September 2009.

Past performance is not a guide to future performance.

£30,000 invested in accumulation units of an index tracker fund would have increased in value to £73,615 over the same period, which is a return of 145%.

The portfolio’s cash balance is £2, which includes dividends paid since 30 June by Anpario (LSE:ANP), Bunzl (LSE:BNZL), Hollywood Bowl (LSE:BOWL), Judges Scientific (LSE:JDG), Next (LSE:NXT) and XP Power (LSE:XPP).

The portfolio does not have enough cash to fund new additions at my minimum trade size of 2.5% of its total value (about £4,400).

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 2,390 | ||||

Shares | 175,680 | ||||

Since 9 September 2009 | 30,000 | 178,070 | 494 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 6,362 | 57 |

BMY | Bloomsbury | 1,681 | 5,915 | 6,892 | 17 |

BNZL | Bunzl | 201 | 4,714 | 6,171 | 31 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,278 | -10 |

CHH | Churchill China | 341 | 3,751 | 4,467 | 19 |

CHRT | Cohort | 1,600 | 3,747 | 8,960 | 139 |

D4T4 | D4t4 | 1,528 | 3,509 | 3,591 | 2 |

DWHT | Dewhurst | 532 | 1,754 | 5,719 | 226 |

FOUR | 4Imprint | 190 | 3,688 | 5,995 | 63 |

GAW | Games Workshop | 148 | 4,709 | 11,507 | 144 |

GDWN | Goodwin | 266 | 6,646 | 6,610 | -1 |

GRMN | Garmin | 53 | 4,413 | 4,274 | -3 |

HWDN | Howden Joinery | 2,020 | 12,718 | 13,732 | 8 |

JDG | Judges Scientific | 85 | 2,082 | 7,268 | 249 |

JET2 | Jet2 | 456 | 250 | 4,165 | 1,566 |

LTHM | James Latham | 400 | 5,238 | 5,390 | 3 |

NXT | Next | 106 | 6,071 | 7,176 | 18 |

PRV | Porvair | 906 | 4,999 | 5,300 | 6 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,974 | 2 |

QTX | Quartix | 1,085 | 2,798 | 3,689 | 32 |

RSW | Renishaw | 92 | 1,739 | 3,950 | 127 |

RWS | RWS | 1,000 | 4,696 | 3,722 | -21 |

SOLI | Solid State | 986 | 2,847 | 10,945 | 284 |

TET | Treatt | 763 | 1,082 | 6,249 | 477 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,330 | 232 |

TSTL | Tristel | 750 | 268 | 2,700 | 906 |

TUNE | Focusrite | 400 | 4,530 | 4,410 | -3 |

VCT | Victrex | 292 | 6,432 | 5,639 | -12 |

XPP | XP Power | 240 | 4,589 | 6,216 | 35 |

Table notes:

July: Reduced Bloomsbury. Added Garmin

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £178,070 today

Objective: To beat the index tracker handsomely over five-year periods.

Source: SharePad, 2 August 2022.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the companies in the Share Sleuth portfolio.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.