Sirius Minerals: How traders profited from fresh collapse

In an extraordinary morning, a dive to nine-year lows provided a huge opportunity for alert traders.

17th September 2019 12:48

by Graeme Evans from interactive investor

In an extraordinary morning, a dive to nine-year lows provided a huge opportunity for alert traders.

Retail investors at Sirius Minerals (LSE:SXX) were at the mercy of speculators today as the company's fundraising woes triggered a remarkable yo-yo session for the FTSE 250 stock.

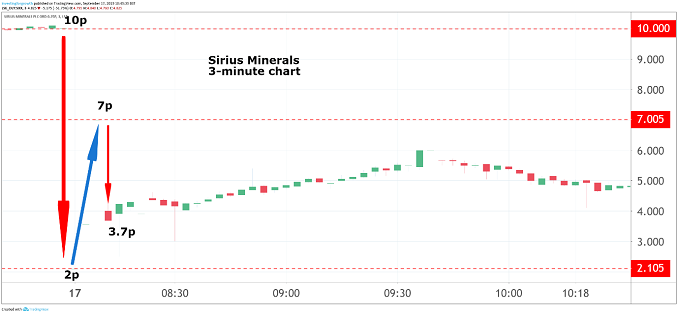

Shares collapsed from 10p to as low as 2p as Sirius confirmed that market conditions had derailed a $500 million bond sale that would have been key to completing the second stage of financing for its polyhalite mine in North Yorkshire. Construction activities will now be scaled back while the company explores its strategic options over the next six months.

That's another blow for the estimated 85,000 retail backers of the stock, who have seen shares slide from last summer's 37p as funding uncertainty on the ambitious project grew.

While they appear to be standing closer to the abyss, the funding crisis failed to stop a wave of buying interest in the opening minutes of trading. From the low of 2p, the stock jumped all the way back to 7p before settling at around 5p for a decline of 50% across the session.

Source: TradingView Past performance is not a guide to future performance

Sirius is now valued at some £350 million, whereas it has been trying to raise $3.8 billion through its second stage financing plan. A share placing at 15p raised $425 million in May, but the bond issue for unlocking a $2.5 billion credit facility from JP Morgan Cazenove was stymied by market turbulence and a reluctance by the US bank to allow warrants as part of the offering.

Support from the UK government has also not been forthcoming, with Sirius hoping for a commitment from Whitehall to enable the issue of up to $1 billion of guaranteed bonds.

The company still had £180 million of cash reserves at the end of August, which it believes will provide sufficient liquidity to explore alternative financing options for up to six months. But that's only because it's reducing the pace of development to preserve value. Sirius CEO Chris Fraser had previously indicated that the company would run out of money without the latest financing.

"The group will need to secure additional external financing in order to allow it to continue operations after 31 March 2020,” Sirius confirmed today.

As well as looking for a new funding approach, the Sirius board will also consider whether a major strategic partner can be found to buy some of the project.

Fraser said:

"The process will incorporate feedback from prospective credit providers around the risks associated with construction and will include seeking a major strategic partner for the project."

Today's announcement is the latest development in an epic, decade-old story in which it had been hoped the Woodsmith mine would be producing polyhalite by the end of 2021. From there it is due to be transported in a 23-mile tunnel to a materials handling facility at Teesside.

The company believes the Woodsmith mine, located south of Whitby, has the potential to reach output of up to 20 million tonnes per annum.

In interim results published today, Sirius said significant progress had been made across all construction sites after $240 million was deployed in the six months for the purpose of developing the project. It also reported success in sales and marketing of POLY4, with aggregate peak contracted supply agreements for the polyhalite fertilizer product now up to 11.7 million tonnes per year.

Polyhalite is an evaporite mineral comprising a natural combination of four of the six macro-nutrients that are essential to plant growth - potassium, sulphur, magnesium and calcium. The North York Moors area is believed to be the largest high-grade known resource of polyhalite to be found anywhere in the world.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.