The specialist fund type that’s come up trumps

20th February 2023 13:57

by Douglas Chadwick from ii contributor

Over the past three years, funds investing in this area of the market have consistently delivered strong returns.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Every three months we generate our 6 x 6 report looking for funds that have consistently achieved gains of at least 5% in six months.

We are hoping to find funds that have managed to do this for six consecutive six-month periods, and sometimes we do. We appreciate that not everyone has the time, or inclination, to study the reports that we send out each week and make the necessary adjustments to their portfolios.

- Invest with ii: Top ISA Funds | FTSE Tracker Funds | Open a Stocks & Shares ISA

Instead of focusing on the last six months, like we usually do, this report highlights funds that have performed consistently well over the last three years.

In our latest analysis, no funds achieved the elusive six out of six, but we have found six funds that managed to achieve returns of over 5% in five out of the last six six-month periods. There are a further 67 that have managed it four times.

Here are the top six:

Saltydog Investor 6x6 Report - Feb 2022

| Feb 2020 | Aug 2020 | Feb 2021 | Aug 2021 | Feb 2022 | Aug 2022 | |

| to | to | to | to | to | to | |

| July 2020 | Jan 2021 | July 2021 | Jan 2022 | July 2022 | Jan 2023 | |

| Funds that has risen by 5% or more in 5 out of 6 periods | ||||||

| JPM Natural Resources | -5.9% | 13.6% | 14.1% | 12.9% | 11.1% | 17.2% |

| BlackRock Natural Resources | -6.3% | 15.5% | 15.1% | 19.0% | 9.6% | 16.5% |

| TB Guinness Global Energy | -35.7% | 14.3% | 17.0% | 36.7% | 13.6% | 15.9% |

| Schroder ISF Global Energy | -36.9% | 22.7% | 23.2% | 33.3% | 18.1% | 14.1% |

| BGF World Energy | -29.5% | 9.9% | 15.9% | 38.1% | 26.1% | 9.6% |

| BNY Mellon Global Income | -8.2% | 9.4% | 9.5% | 5.8% | 5.4% | 5.3% |

Data source: Morningstar. Past performance is not a guide to future performance.

The top two invest in natural resources and the next four invest in companies in the energy sector.

At the top of the table, based on its most recent six-month return, is the JPM Natural Resources fund.

This is a very well-established fund. It was launched in 1965 and its assets are currently worth around £1 billion.

Its investment objective is “to provide capital growth over the long term (five to 10 years) by investing at least 80% of the fund's assets in the shares of companies throughout the world engaged in the production and marketing of commodities”.

- 10 of the best mining shares for dividend investors

- ISA ideas: alternatives to the most-popular funds and trusts

- ISA tips: around the world in eight funds and trusts

Its largest holding is in Rio Tinto (LSE:RIO), the UK-based mining and metals company. Next is Shell (LSE:SHEL) and then Chevron (NYSE:CVX). In total, energy companies account for just over 50% of the funds value.

The BlackRock Natural Resources fund is smaller, around £300 million, and has a similar objective. Its largest holding is Glencore (LSE:GLEN, followed by Shell and Exxon Mobil (NYSE:XOM). It has 35% invested in energy companies.

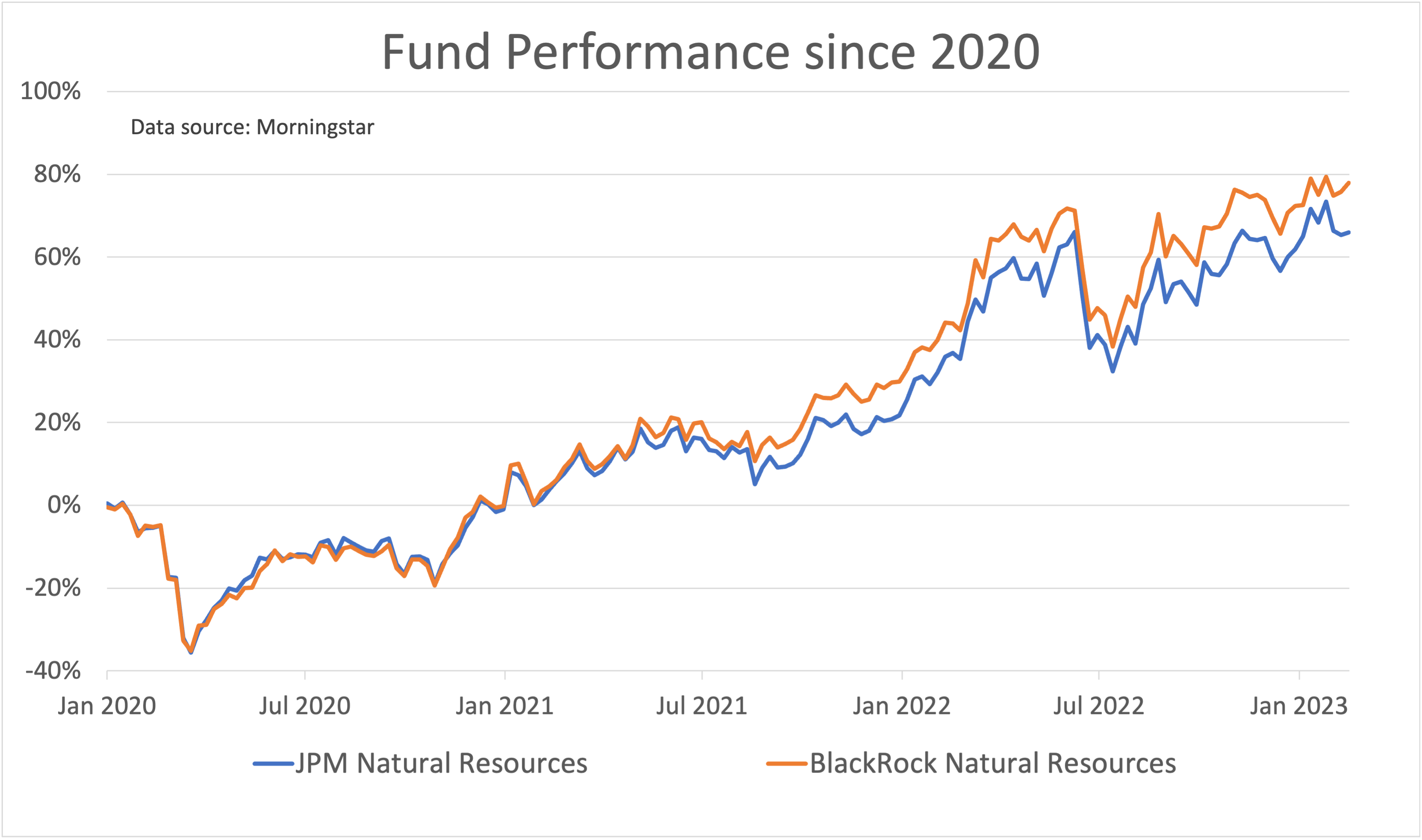

This graph shows how these two funds have performed since the beginning of 2020.

Past performance is not a guide to future performance.

They fell dramatically in the first quarter of 2020, following the outbreak of Covid-19 when international travel slowed, and countries around the world went into lockdown. However, by the end of the year they had recovered and started going up. Last year, they performed particularly well making healthy gains when most funds went down. This was partly a result of industry starting to get back to normal after the pandemic, but also because of the massive increase in energy costs following the Russian invasion of Ukraine.

There was a sharp decline in June/July 2022, as fears of an economic recession grew, but these funds soon recovered. Although the US and other developed economies could still go into recession, the current expectation is that if they do it will not be as severe, or last as long, as had originally been thought.

This time last year both of our demonstration portfolios were holding the JPM Natural Resources fund, but we sold it in the summer. We are not considering investing in it at the moment because its recent performance is not great, down 2.5% in the last month, and we have the luxury of fine-tuning our portfolios every week.

However, based on its performance over the last three years, it might be appealing to people who review their holdings less frequently.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.