Stockwatch: a bullish or bearish Budget for these four stocks?

Now things have settled down following the Budget announcement, analyst Edmond Jackson assesses the potential impact on UK profits, the economy and some popular companies.

2nd December 2025 11:57

by Edmond Jackson from interactive investor

A subsequent 1.25% rise in share indices from last Wednesday to Friday elicited hopes of a “Santa rally” starting, although relief from a key aspect of UK uncertainty has proven short-lived as markets start this week cautiously.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Beyond this short-term noise, what might this Autumn Budget contribute to or detract from the economy, and which companies might benefit?

It worries me how a £73 billion increase in the welfare budget to £406 billion over the next five years is being paid by yet higher record levels in taxation. Nearly 700,000 people left the UK in the last year, the highest level of emigration since the end of the First World War. It’s likely that many are talented go-getters contributing the most tax (or will do so as they mature).

However, in terms of this Budget, The Institute for Fiscal Studies (IFS) estimates that by 2030-31 its net impact will improve the incomes of the lowest 20% of earners by £220 to £290, whereas the incomes of the top 10% will be lower by around £700. It is a significant, though not deciding, factor for emigrants, perhaps simply affirming their suspicion of the direction the UK is heading.

On the other hand, I also get a left-wing economic view of how redistribution, especially of wealth tied up in static property, to low-income and younger people, means that such capital is far more likely to get spent, and soon. This can have a “multiplier effect” where the knock-on is supportive, most likely for essential goods and services, hence those businesses.

Conversely, rises in the National Minimum Wage from 4% to 8.5% are liable also to check their employment prospects, especially within smaller private firms more sensitive to change.

Reinforces stagnation in UK labour productivity

This is the crux, and why, on a longer-term view, I give this Budget a thumbs-down. The chancellor appears simply to have been caught between Labour backbencher demands for more benefits and the need to appease financial markets with the semblance that debt is coming under control, hence the emphasis on a major tax raise. But it is not going to spur initiative.

- 2026 look ahead: CHAOS or CALM?

- eyeQ: a stock that’s 24% cheap to fair value

- Insider: ex-FTSE 100 chief buys stock with re-rating potential

This is on top of uninspiring projections from the Office for Budget Responsibility (OBR) – the government’s own forecaster – before the chancellor even stood at the dispatch box.

Its downgrades are marginal, but the tone is stagflation. While the OBR has raised its estimate of 2025 GDP growth from 1% last March to 1.5%, it has downgraded each of the following four years by 0.3% to 1.4% for 2026 then 1.5% in each of the next three years.

While that doesn’t seem much of a downgrade – possibly even within a margin for forecasting error – it is materially below October’s 3.6% UK inflation rate and the Bank of England’s forecast for 3.0% in early 2026, and still below the Bank’s expectation for a decline to just below 2% by mid-2027.

Even the OBR – hardly rabid right-wingers – cites higher taxes as contributing to “subdued” UK business and consumer confidence, amid global uncertainties emanating from conflicts and trade tariffs.

The way Labour has scheduled tax rises is canny – most of the fiscal pain coming after the next general election. Higher near-term government expenditure should, however, reduce the risk of recession and possibly help Labour’s narrative on the economy when it comes to voting.

Slight net boost for retail, hospitality and leisure?

Given the British Retail Consortium (BRC) warned in September that any large rise in business rates bills could lead 400 big stores to close and put 100,000 jobs at risk, the Budget reality is mixed.

While 3,480 retail properties in England with a higher rateable value will pay an extra £112 million from April 2026, there will anyway be transitional relief for those facing a big increase in bills (for what that is worth in the longer term). The government says around 750,000 properties will see their bills set below the current standard level, with deeper discounts for smaller operators.

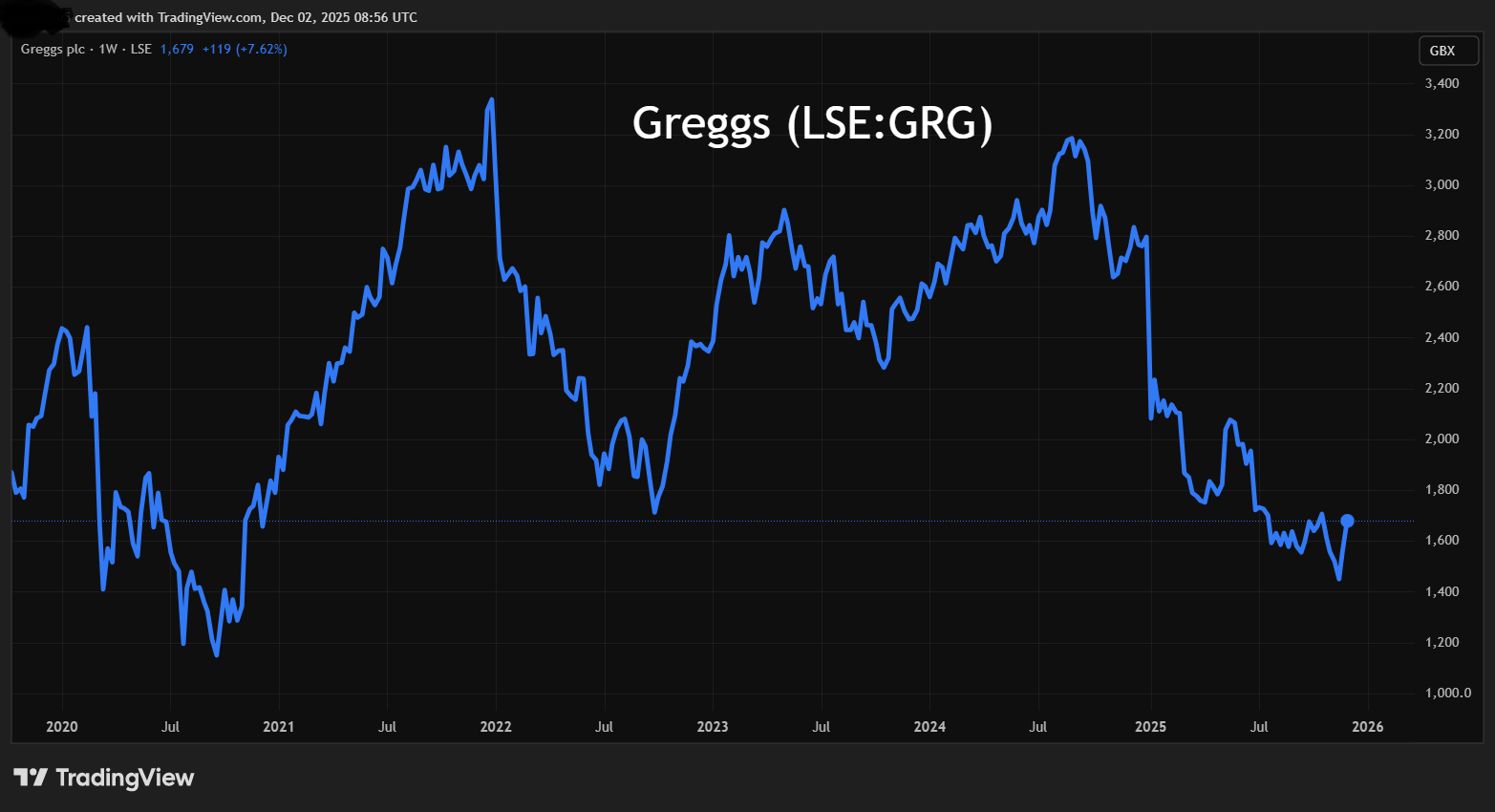

Thus, Greggs (LSE:GRG) is up 11% to 1,637p in response as the market digested the overall package including the likelihood of a splurge on cheaper pastries and coffee.

Anyway, I think the shares have engaged a thorough de-rate – effectively a mean-reversion to the lower end of their five-year range. You can see from the chart how this is now being tested:

Source: TradingView. Past performance is not a guide to future performance.

On a forward price/earnings (PE) ratio around 12x and 4.4% prospective yield, Greggs more likely is now in “buy” territory on a value basis, although from a growth perspective it seems to me that its best years for rolling out (unintended pun) the concept seem past. This is often a factor for retail shares, but the way Greggs has responded to the Budget shows that investors continue to regard it as a sound business despite a lack of growth appeal.

- Insider: three CEOs exploit weak share prices

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

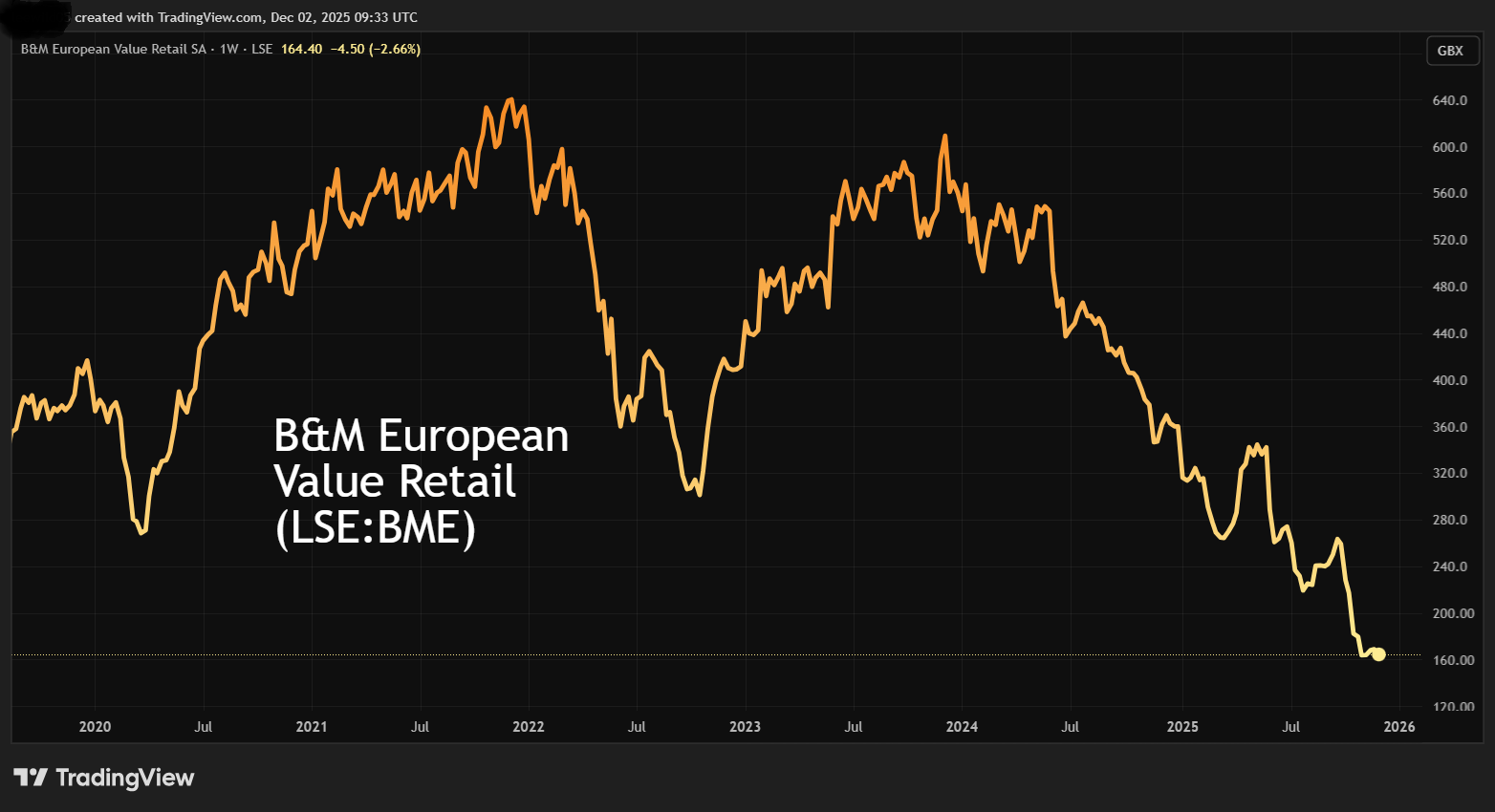

Yet B&M European Value Retail SA (LSE:BME) is overall unchanged at 165p despite Labour’s boost to lower-income people implicitly helping the new CEO’s turnaround initiatives. It shows the market focusing – entirely reasonably – on whether they deliver revenue traction, and if cash generation mitigates 325% net gearing, hence my “hold” stance.

Source: TradingView. Past performance is not a guide to future performance.

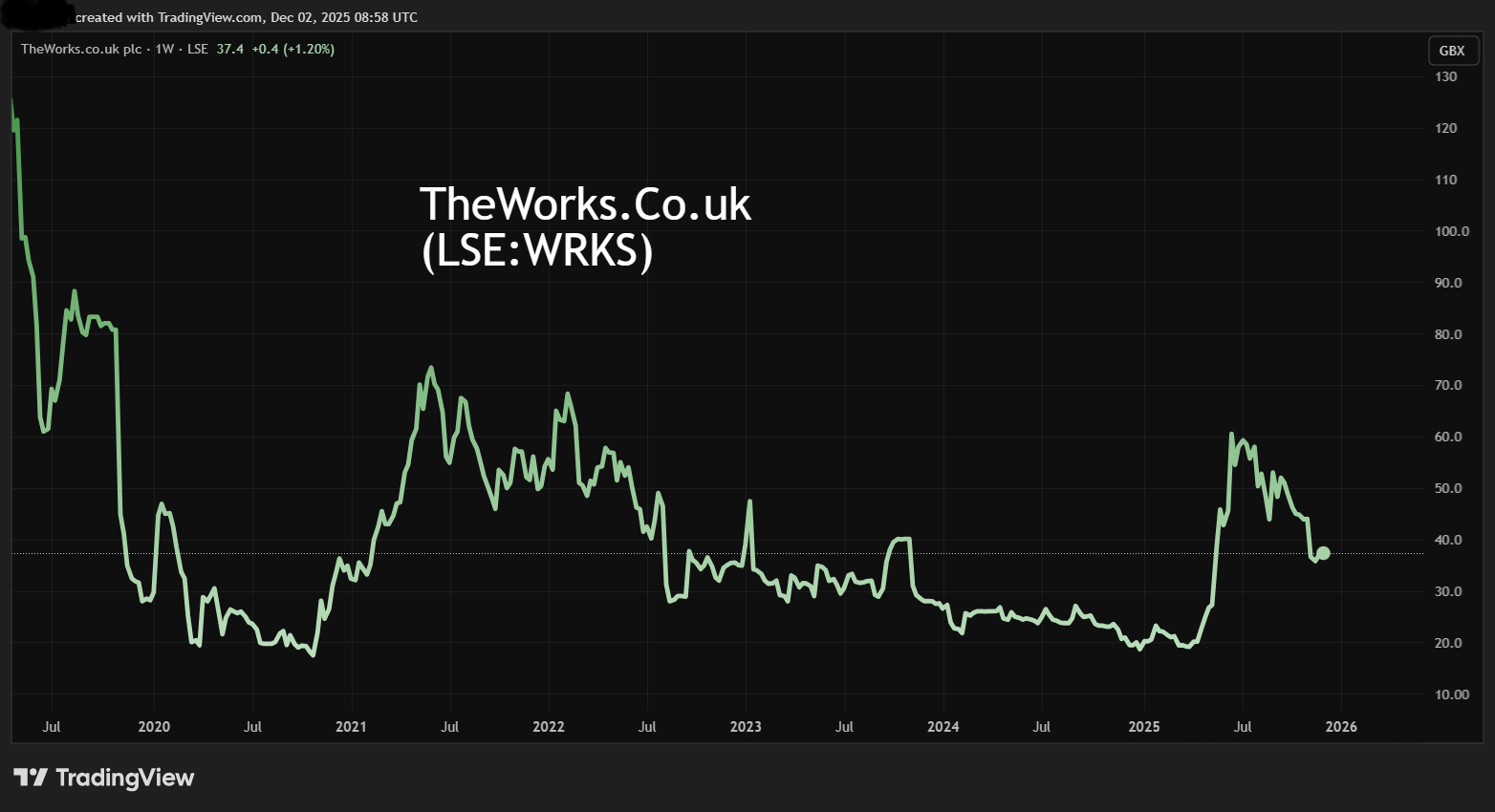

A relatively more advanced albeit smaller turnaround is TheWorks.Co.uk (LSE:WRKS), a value retailer of stationery, toys, games and books. While it seems to me more a source of Christmas stocking-fillers than having perennial appeal, an update three weeks ago showed it outperforming weak consumer conditions.

Like-for-like store sales rose 4% and margin/cost actions have more than offset cost headwinds. On a forward PE around 5x at 37p, the Budget would appear to help tilt risk/reward positively, hence a “buy” stance is justified.

Source: TradingView. Past performance is not a guide to future performance.

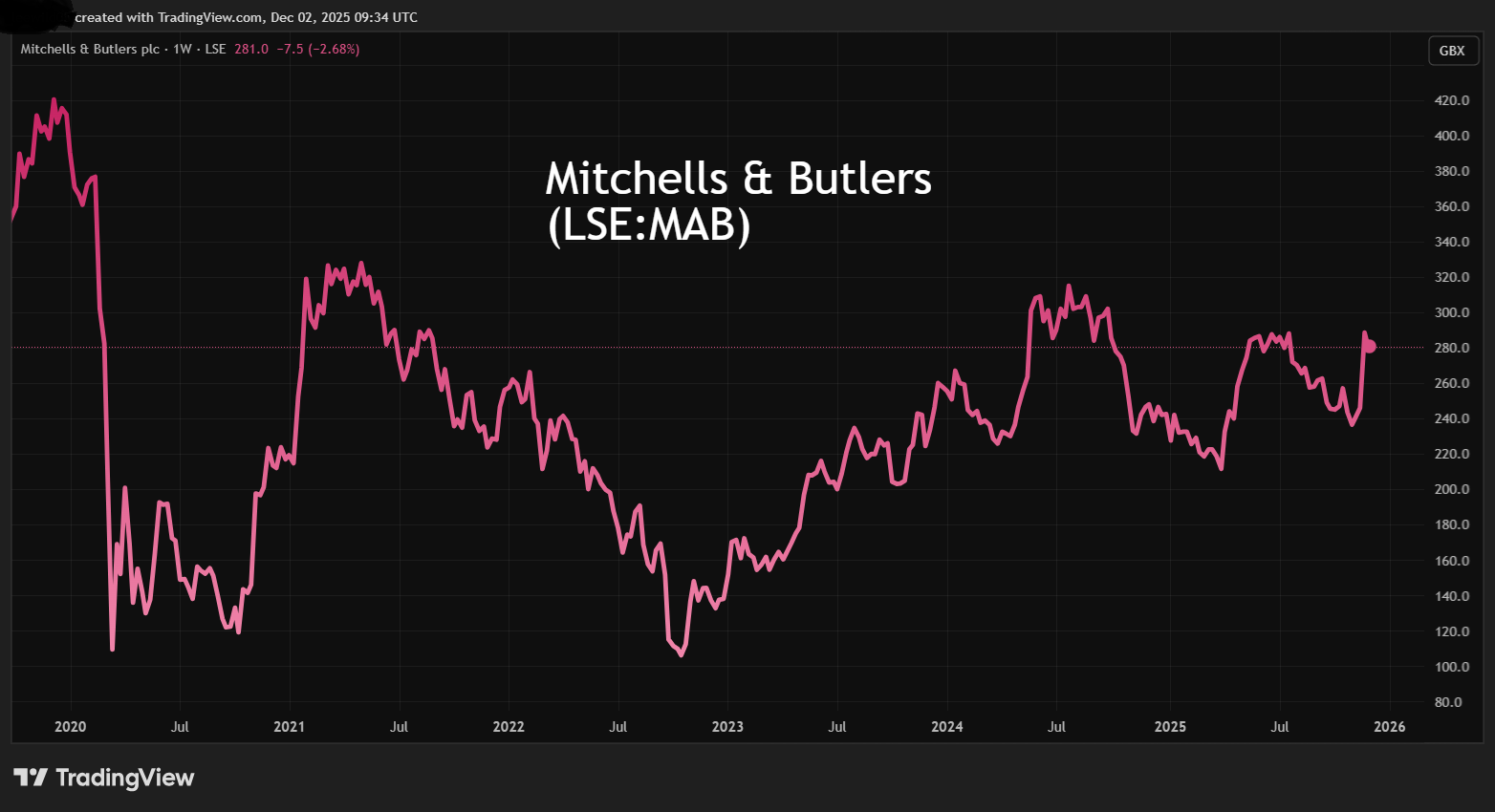

Further to my analysis of Marston's (LSE:MARS) last time, shares in Mitchells & Butlers (LSE:MAB) spiked after Friday’s annual results were ahead of expectations and net debt eased to 30% or 47%, including leases.

Like-for-like sales growth of 3.8% is better than Marston’s if slightly down on last year, but there was no mention of Christmas bookings, a bull point for Marston’s, up 11%. Labour cost increases are estimated to impact Mitchells’ September 2026 year, which is an estimated £130 million headwind including the effects of the last Budget.

That would seem to make it challenging to maintain recent profit levels despite consensus for 3% earnings per share (EPS) growth this current financial year. As with Marston’s, however, well-managed pubs in a relative value-retail space may attract people trading down from elsewhere. At 283p, Mitchells is coming off its spike from 256p to 259p and I’m inclined towards a near-term “hold” stance lest this continues.

Source: TradingView. Past performance is not a guide to future performance.

No real upshot for flotations of growth companies

I don’t see the Budget’s temporary exemption of stamp duty as much affecting the supply of high-quality businesses to buy into. The chief problem is such firms nowadays being far more reliant on private equity.

The stock market is left overwhelmingly as a means to trade in the secondary not “primary” market where capital is raised. Moreover, by far the most common regulatory news announcement doesn’t involve (raising capital for) growth plans but “transaction in shares” – namely share buybacks – as if the London stock market is overall in a contracting rather than expansionary phase.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.