What a weird six months it’s been in the markets

Global markets have outpaced US ones so far this year, and with a falling dollar and rising AI tailwinds, JPMorgan says that momentum could keep going.

27th June 2025 09:30

by Theodora Lee Joseph from Finimize

- A resilient portfolio should include assets with low or negative correlations to each other, each with an intrinsic ability to outperform cash

- JPMorgan Private Bank sees stocks in the US, Europe, and Japan reaching new highs over the next 12 months, with certain assets like bonds and gold likely to produce uncorrelated returns

- Crypto may warrant a place in your portfolio, too: just don’t expect it to provide uncorrelated returns to other risky assets.

The first half of this year has been out of the ordinary, to say the least. After more than a decade of US market dominance, international stocks have charged ahead in the past six months to lead – and not by just a little. That’s had folks wondering whether this is merely a pause in US exceptionalism, or the start of something more permanent. And JPMorgan Private Bank’s just-released outlook for the rest of 2025 could help answer that burning question.

What’s the story with markets?

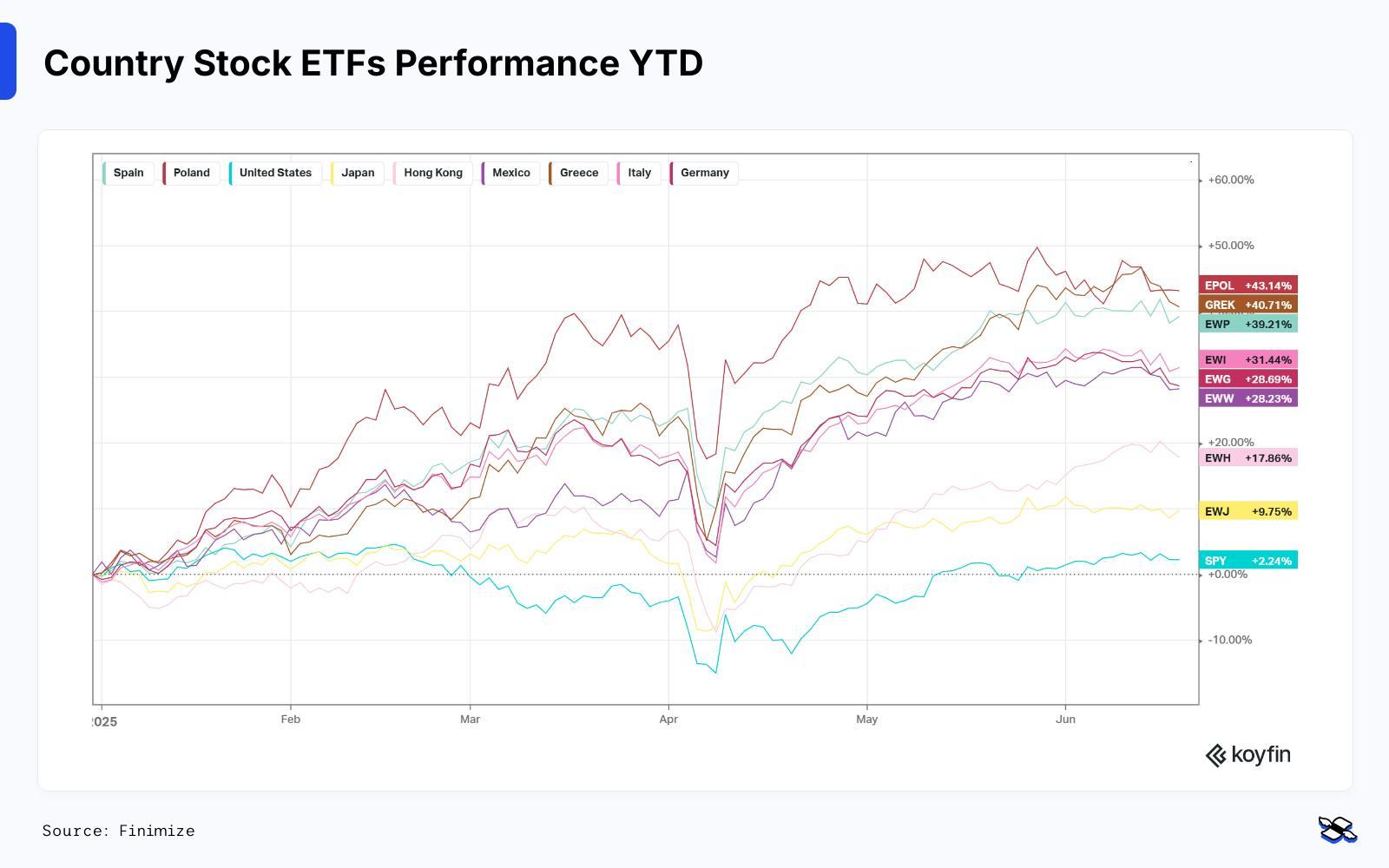

Spain’s key IBEX stock index gained 20%, Germany’s DAX 18%, and the Hang Seng (a bellwether for China) also 18%. Japan, cooled, meanwhile, falling 4%. Meanwhile, the US’s S&P 500 and Nasdaq both posted tiny gains.

The US market’s fall from dominance has been a major theme all year, as worries have grown about the country’s sky-high government debt and unpredictable government policy. Those things have helped drive down the value of the US dollar – it’s slipped about 9% against a basket of currencies, including the euro, Japanese yen, and UK pound. And that’s made returns in overseas markets look even more impressive for dollar-based investors, especially those holding country-specific ETFs.

Price performances for ETFs that focus on stocks from Spain, Poland, the US, Japan, Hong Kong, Mexico, Greece, Italy, and Germany, in percentages, so far this year. Source: Koyfin. Past performance is not a guide to future performance.

Commodities have had a pretty sparkly year so far: gold and silver rallied 28%, and copper 21%. Oil swung wildly, down 20% at one point before climbing back to notch a 7% gain.

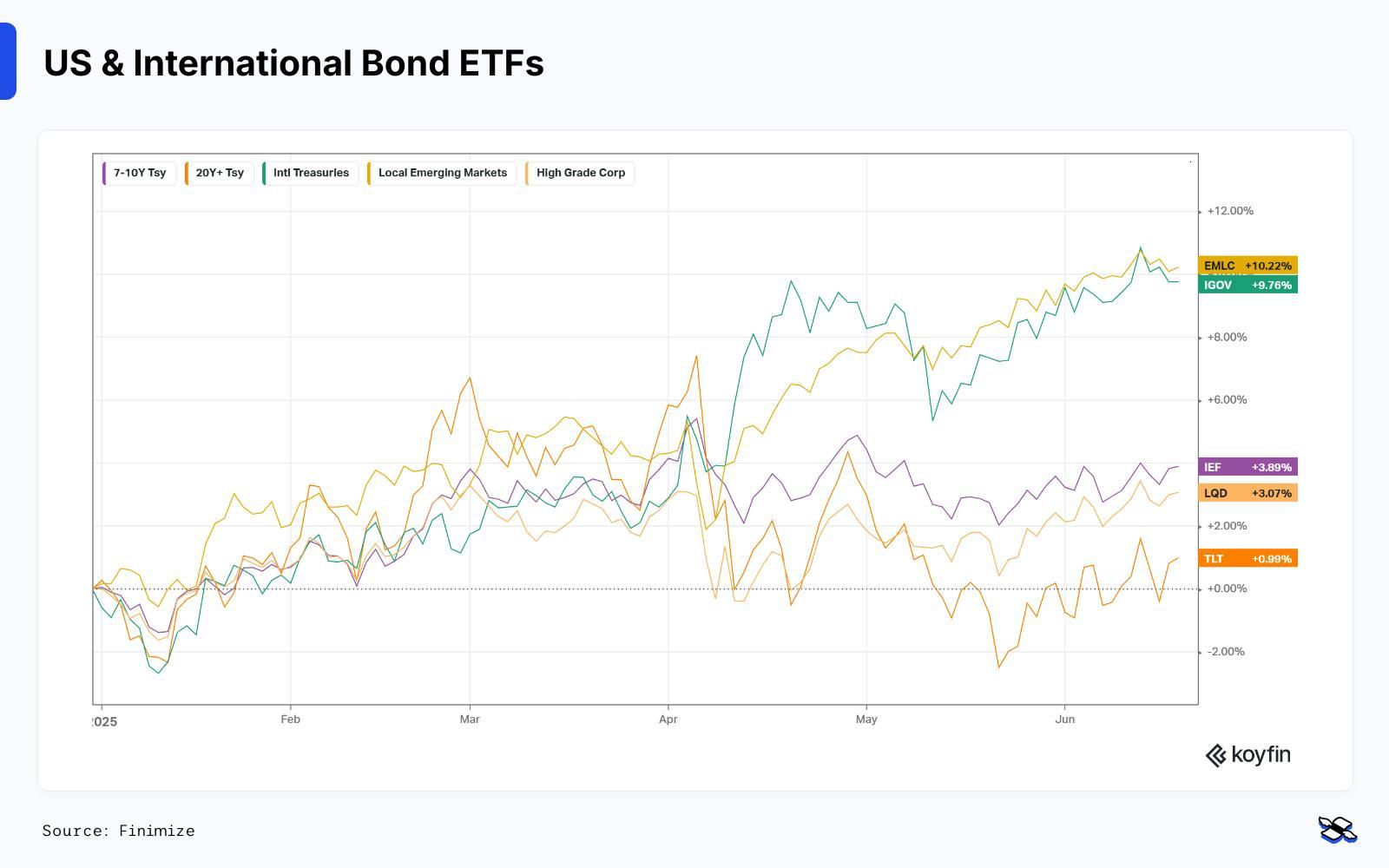

Bitcoin, meanwhile, posted a more subdued 12% rally in dollar terms. And US Treasuries delivered low single-digit returns, despite worries about the country’s unsustainable debt load. But here once again, thanks to the greenback’s decline, US-based investors would have benefited from investing in overseas bonds instead.

US and international ETFs’ year-to-date performance. Source: Koyfin. Past performance is not a guide to future performance.

So, what does JPMorgan Private Bank say about the second half of the year?

JPMorgan Private Bank sees better days ahead. The banking unit – whose clients are the high-net-worth type – is predicting that the US, Europe, and Japan will all hit new stock market highs over the next year. Meanwhile, on the currency front, it expects the US dollar to slip even further by year’s end, driven by the same-old worries.. And over the longer term, it’s forecasting that the greenback’s depreciation will add 1% to 2% annually to total returns of euro- and yen-denominated stocks for the next 10 to 15 years. That’s part of the reason why the firm is particularly bullish on gold, the euro, and the yen – they’ve got size, liquidity, and longstanding roles as alternatives to the dollar for central bank reserves.

My take. Increasing your exposure away from the US dollar and stocks right now seems sensible. The only aspect of the recent pivot away from the greenback that makes me nervous is that it seems like almost all investors, strategists, economists, and fund managers are bearish on the dollar. And, hey, maybe they’re all going to be proved right, but when the majority of investors all have the same view, the markets have a habit of proving the herd wrong. Nonetheless, diving a bit deeper into European and Japanese stocks seems like a rational enough idea.

What other assets does the private bank like now?

Savvy investors know that a resilient portfolio includes assets that have low (or opposing) correlations with one another, each with an intrinsic ability to outperform cash. After all, those kinds of relationships between assets can help build the kind of authentic diversity that can protect returns over the long haul.

Diving a little deeper into the private bank’s report, you can see it follows a similar wisdom. The firm highlights four assets that fit the bill for diversification.

1. Bonds. Trusty, safe-haven assets are still the primary source of portfolio resilience in a downturn. And in the current environment, having a mix of US and international bonds may be the best bet.

2. Gold. The yellow metal is already up 28% this year, but the private bank sees that rally continuing. Many central banks (Saudi Arabia, Taiwan, Japan, China, Singapore, Brazil, and Korea) still have less than 7% of their foreign reserves in gold, and that means they have plenty more buying to do. (By comparison, Germany and the United States each hold over 75% of their reserves in gold.)

Here’s my take. Gold really has proved its worth again this year – both because of those central bank purchases and safe-haven demand. Sure, some contrarian investors say the trade has gone too far. But, let’s face it, those central banks won’t be selling anytime soon, and if the US continues its erratic policymaking, the safe-haven flows are likely to persist.

3. Infrastructure. This investing area has long-term potential, as demand for energy and data servers amps up. Aging assets and growing evergreen funds will create opportunities in private markets.

Here’s my take. Retail investors should tread carefully: there’s been a clear shift to push these private equity opportunities on individual investors – ever since the big institutional investors stopped buying. But many of these assets lack transparency, liquidity, and easy exit routes.

4. Equity-linked structured notes and hedge funds. These assets could help weather market volatility, particularly the ones that focus on relative value or big-picture strategies that thrive when markets are weird.

And though it didn’t make the bank’s four, it’s worth mentioning bitcoin (a.k.a. digital gold). The bank says the OG crypto is much more volatile than gold – and, yep, it’s right. So, a 5% addition of bitcoin to a balanced portfolio can result in a significantly higher risk contribution than a 5% addition to gold.

Here’s my take. When risk assets (think stocks) sell off, bitcoin often does too. That doesn’t mean it shouldn’t have a place in your portfolio – I personally think the increasingly favorable regulatory environment toward crypto suggests it probably deserves one. Just don’t expect it to be uncorrelated to other risk assets.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.