Why things could get substantially worse for sterling

A continued slump for the pound is looking more likely as the charts flash red.

15th August 2019 09:12

by Alistair Strang from Trends and Targets

A continued slump for the pound is looking more likely as the charts flash red.

GBP/USD. The pound/dollar shambles

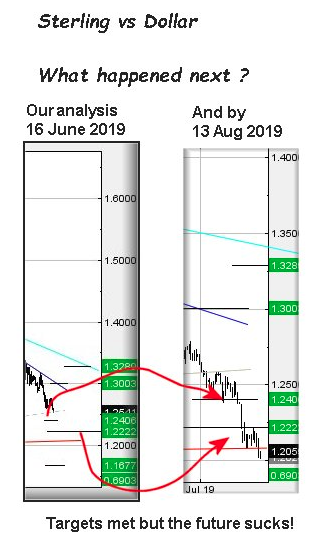

Our previous report proved accurate and now we're a little gloomy.

After Brexit, the US is bound to find UK imports quite competitive. If only the UK still had a reasonable manufacturing industry!

The immediate problem that sterling now faces is an expectation of a "bottom" on the current cycle at $1.1677.

Unfortunately, there's a heck of an argument suggesting things could get worse, substantially worse, as the big picture indicates a real bottom should occur at $0.9922 eventually.

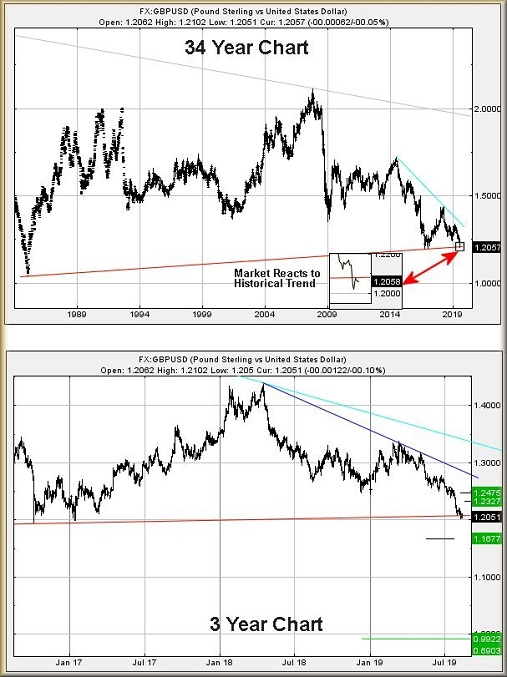

In addition, there's the issue of the red uptrend which ridiculously dates back to 1985.

We're perfectly aware some readers were not even born when this uptrend commenced 34 years ago but unfortunately the market appears not to care about the age of a faded red line.

The inset on the chart highlights what has happened in the last few days since the trend broke. Visually, there can be little doubt the market is perfectly aware of this line.

At time of writing, it is at $1.20807 (roughly) with the currency pairing requiring to close a session above this to indicate it has all been a dreadful mistake.

Visually, this appears unlikely, thanks to the market acknowledging this historical trend.

On the plus side, anyone opening a short and hoping for the best (or worst) can emplace a fairly tight stop at $1.2106, this being the highest achieved since the trend broke.

In theory, moves above this level allow for $1.2327 initially with secondary, if bettered, calculating at $1.2475.

When a major trend such as this breaks, we recommend not holding your breath while awaiting recovery!

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.