Wild’s Winter Portfolios 2021: reliable stocks beat the market

3rd December 2021 15:02

by Lee Wild from interactive investor

One of Wild’s new winter portfolios delivered a profit in its first month and easily outperformed its benchmark index. Here’s how it did it and also what happened to the other portfolio.

It was almost a case of déjà vu writing this first monthly round-up for the 2021-22 edition of Wild’s Winter Portfolios. One of the two portfolios started slowly in 2020 but finished the six-month strategy with significant gains. It’s way too soon to write off any of these star stocks, and one of the portfolios is already thrashing the benchmark index.

To recap, 12 months ago our high-quality constituents had outperformed over the summer, so failed to join November’s post-Pfizer vaccine rally. This year, valuations and a mixed reaction to financial results meant some stocks, which had also done well in the months leading up to the launch of the winter portfolios on 29 October, dragged on performance.

We’d seen the FTSE 100 resume its upward trend following the summer break, adding about 150 points in October. Then, in November, the index traded back at levels not seen since February 2020, before the pandemic crash.

But that seems like a distant memory, as a new Covid variant – Omicron – sent shivers down the spines of global stock markets. Traders quickly priced in the threat of further travel restrictions and even possible lockdowns. Given little is known about the new strain and its possible impact on economies, markets have been and remain volatile.

- Don’t be shy, ask ii…what is a 'Santa rally' in the investing world?

- Will stock markets be full of festive cheer in December?

- Find out what Wild’s Winter Portfolios are, how they work and why

- Visit the Wild's Winter Portfolios home page here

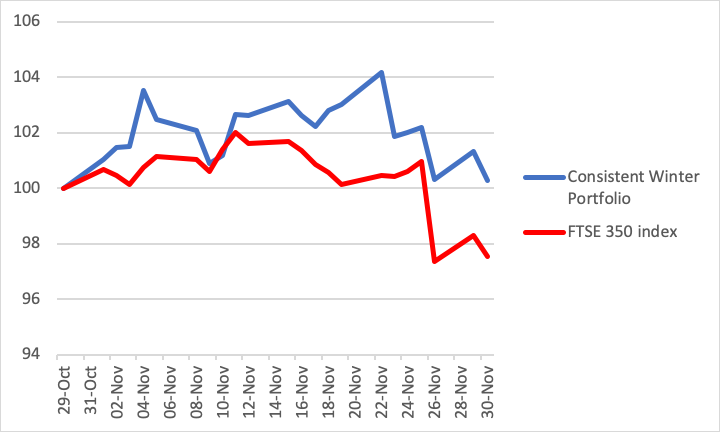

However, our Consistent Winter Portfolio, made up of the five most reliable stocks in the FTSE 350 index over the past 10 years, finished the month in positive territory.

It got off to a cracking start, gaining 3.5% within days of launch, and was up as much as 4.2% in the second half of November. Despite suffering during the Omicron sell-off, the portfolio still ended November up 0.3%. That compares with a 2.5% decline for the FTSE 350 benchmark index.

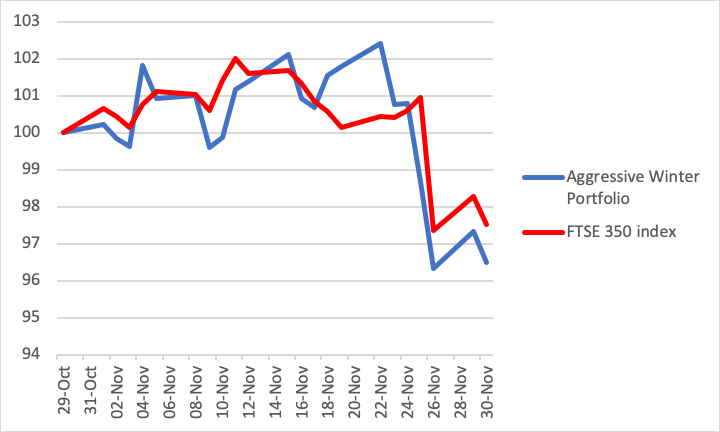

The Aggressive Winter Portfolio is higher risk, so gains can be much greater, just as they were last year, but losses can also be more significant. After peaking with a 2.4% gain late November, the aggressive portfolio ended the month down 3.5%. To be fair, we can’t blame the Omicron variant for that. All but one of the portfolio’s constituents was already struggling before the mini crash on Friday 26 November.

With all that in mind, it’s worth updating a table I ran this time last year, just to emphasise that it’s still early days in this six-month strategy.

Historic Winter Portfolio Performance each November | |||

Year | Consistent Portfolio (%) | Aggressive Portfolio (%) | FTSE 350 benchmark index (%) |

2021-22 | 0.3 | -3.5 | -2.5 |

2020-21 | -2.03 | 2.1 | 12.34 |

2019-20 | 7.25 | 7.34 | 1.79 |

2018-19 | 6.48 | -4.44 | -2.11 |

2017-18 | -3.97 | -2.9 | -2.06 |

2016-17 | 4.97 | 4.49 | -2.06 |

2015-16 | 6.42 | 1.31 | 0.23 |

2014-15 | -1.69 | 5.04 | 3.98 |

Source: interactive investor using Morningstar prices data

Consistent Winter Portfolio 2021-22

There are two stocks in this year’s winter portfolios and, thankfully, one of them excelled in November. Self-storage firm Safestore (LSE:SAFE) returned 10.7% following a mid-month update on fourth-quarter trading and news of a record-breaking year. Revenue jumped 21% in the three months to end-October and 15.5% for the full year. Annual profit will also be “slightly ahead” of guidance.

Insurer Admiral (LSE:ADM) has big boots to fill, having replaced winter portfolio ever-present Croda. A 3% gain for the month was a great start and, while there are no scheduled updates until March, this remains a recovery story and focus will be on progress there.

- Check out our award-winning stocks and shares ISA

- Examine our great investment strategies series here

Technology conglomerate Halma (LSE:HLMA) also did well, ending the month up 1.3%. It published record first-half results and kept its annual outlook unchanged despite a string of potential threats, including supply chain issues and labour market disruption. The shares retreated from a record high but fought back to end in positive territory and ahead of the wider market.

There were two laggards in this year’s consistent portfolio, and Liontrust Asset Management (LSE:LIO) let the side down in November. The shares had already reacted well to an October trading update and were over 4% higher within the first week of November, but they just ran out of steam. The market crash clearly did not help and ahead of half-year results on 1 December.

XP Power (LSE:XPP), a manufacturer of power adapters, also hit multi-month highs following third-quarter results, but a retreat was accelerated by the Omicron Covid variant.

Aggressive Winter Portfolio 2021-22

Safestore and Liontrust appear in the aggressive portfolio too, but even Safestore couldn’t prevent losses for this basket of shares. And the three stocks you would hope to step up didn’t.

Infrastructure products company Hill & Smith (LSE:HILS) never looked convincing. Numbers in a trading update issued towards the end of the month were fine, but there are concerns about supply chain headwinds and staff shortages. That triggered a share price fall that ended with the stock down 8%.

- Read more of our content on UK shares here

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

Precision instrumentation expert Spectris (LSE:SXS), a star stock of 2020’s winter portfolios, shone very briefly in November, up over 4% at one stage. But it had begun to fade even before broker Morgan Stanley downgraded the shares to “underweight” near month-end, given China exposure and risk from issues around supply chains, logistics and inventories. The shares ended the month down 6.9%.

Synthomer (LSE:SYNT) had already risen sharply just before the winter portfolios launched, driven by news it had agreed to pay $1 billion in cash for the adhesive resins business of Eastman Chemical Company. Having been relatively steady for much of November, the Omicron crash gave investors an excuse to take profits and the shares ended the month down 7.1% at their lowest point.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.