Wild’s Winter Portfolios 2023-24: a 23% profit in two months

Just a third of the way into this six-month seasonal investment strategy and it’s looking good. We review the companies driving the outperformance and discuss a significant event for the higher-risk portfolio.

8th January 2024 10:28

by Lee Wild from interactive investor

Global stock markets had a great November. December was pretty good too. The sharp upturn in fortunes was reflected in the performance of both Wild’s Winter Portfolios, although these data-based baskets of shares did significantly better than the wider stock market.

We’ve already written at length about the drivers behind the market rally. Lower inflation has got investors betting that interest rates will begin to fall within months, while central banks manage economies well enough to ensure a so-called soft landing. It’s the Goldilocks scenario for equities.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

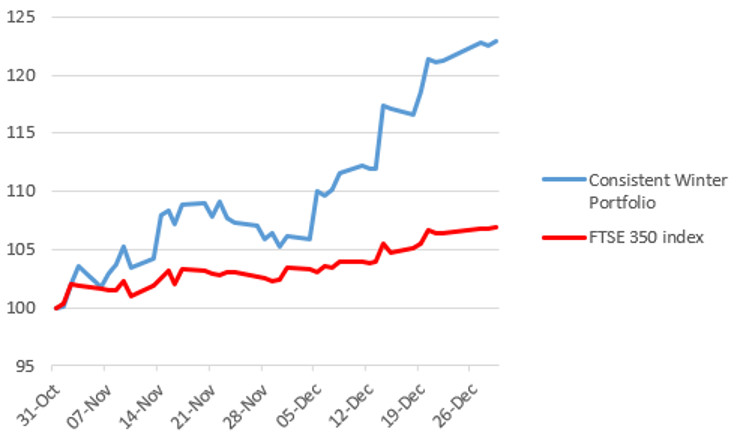

Wild’s Consistent Winter Portfolio, made up of the five FTSE 350 companies that have risen the most winters (between 1 November and 30 April) over the past decade, surged 16.8% in December. Add that to the 5.2% gain in November and this more historically reliable basket of shares has returned an incredible 22.9% in just two months.

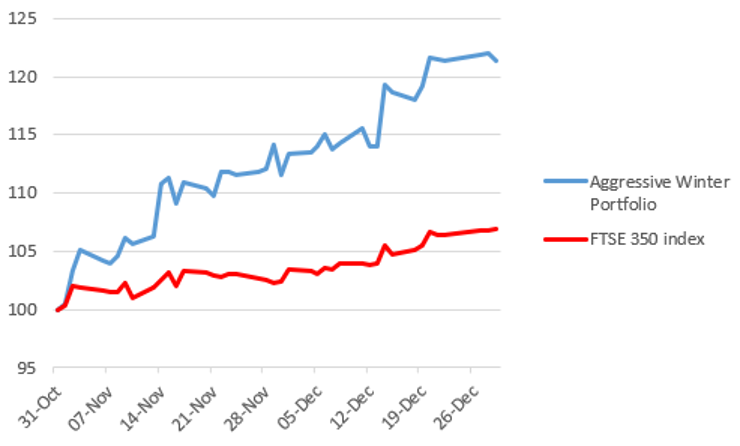

We relax the entry criteria slightly for Wild’s Aggressive Winter Portfolio, giving up some consistency in return for potentially bigger profits. However, all constituents must have risen in at least 80% of winters over the past decade. The portfolio ended the month up an impressive 21.3%, although growth slowed to 8.8% from 16.8% in November.

For context, the FTSE 350 benchmark index rose 4.3% in December following a 2.5% increase the month before. It’s now up 6.9% so far this winter.

You can find more information about the ‘consistent’ and ‘aggressive’ portfolios on our Winter Portfolio page.

Every one of the companies that appear in Wild’s Winter Portfolios this year posted big gains in December, but some did better than others.

Wild’s Consistent Winter Portfolio 2023-24

Past performance is not a guide to future performance.

There was one standout performer in December - discoverIE Group (LSE:DSCV). After a flat start to the winter, the £700 million electronic components supplier delivered a 28% profit in the final month of 2023. A combination of better-than-expected half-year margin performance, bullish broker comment, and improved market sentiment triggered a surge in the share price to levels not seen since the summer.

Liontrust Asset Management (LSE:LIO), always the major concern in this year’s crop of winter winners, finally demonstrated why it should be in this year’s portfolio. As I mentioned in October, Liontrust shares had fallen sharply over the summer and were the only constituent stock to fall in November – down 4%.

However, investors put concerns about fund outflows and performance to one side, preferring instead to predict a boost for the finance sector in 2024 as falling interest rates convince investors to switch out of cash into equities. Liontrust shares returned 17.4% in December for a two-month gain of 12.7%.

Close behind were InterContinental Hotels Group (LSE:IHG) and Safestore Holdings (LSE:SAFE), making 15.9% and 15.5% respectively last month. The pair have now contributed positive returns of 22% and 29.3% this winter, with the hotel giant now at an all-time high. Self-storage firm Safestore was a beneficiary of wider market enthusiasm generated mid-month by the clearest signal yet from US policymakers that interest rates will fall in 2024.

The consistent portfolio’s star stock in November rose 8.5% last month, but that was the smallest gain of the five constituents. A repair job is underway at food packaging firm Hilton Food Group (LSE:HFG) whose shares are still a long way below the 960p traded at prior to a devastating profit warning in September 2022. However, the shares are up 22.5% this winter and the recovery remains on track.

Wild’s Aggressive Winter Portfolio 2023-24

Past performance is not a guide to future performance.

This year’s aggressive portfolio is not packed with the type of growth companies you might expect, three of them making money from construction, engineering or manufacturing. They’ve all done brilliantly this winter and delivered big profits in December, just not as big as their consistent cousins.

All three - Morgan Sindall Group (LSE:MGNS), Keller Group (LSE:KLR) and Hill & Smith (LSE:HILS) – had only recently issued trading updates, but despite no fresh news, shares in construction and regeneration firm Morgan Sindall still added 8.8% last month. And the UK’s second-largest contractor has just topped the contracts league rankings with an estimated £2.14 billion of work following a strong second half of 2023. Its share price is now up 17.8% in the past two months.

Engineering contractor Keller jumped 8% in December, taking gains this winter to 13.5%, while infrastructure products company Hill & Smith’s 6% monthly return means it has generated a profit of 15.8% since the end of October.

JD Sports Fashion (LSE:JD.) brings up the rear with a 5.7% increase in the past month. More modest gains are perhaps no surprise given the sports clothing chain rocketed 23% in November. That was especially true because the company had been preparing its peak season trading update. If that went well, the share price would surely go even higher, while any disappointment would be punished severely.

Unfortunately for JD, it was the latter. Alongside weaker-than-expected results for the 22 weeks to 30 December 2023, the company warned on 4 January that full-year gross margin rate will be “slightly lower than last year”, and that adjusted pre-tax profit for the year to 3 February 2024 will be between £915 million and £935 million. It had been tipped to hit £1.04 billion.

Once a shocked City had factored in the news, JD’s share price sat 25% lower at levels not seen since the end of 2022. It means that while JD shares ended December with a winter gain of 30.2%, a drop in price from 166p to 120p at the beginning of 2024 equates to a decline of 5.9% since the end of October.

However, it’s not terrible news for owners of the aggressive portfolio. Even if we run the numbers using JD’s knockdown price, the aggressive portfolio still returns 14.1% for the past two months.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.