Wild’s Winter Portfolios 2024: a miserable February

There were a few bright spots in the aggressive winter portfolio last month, but even the good news struggled to translate to share price gains. Lee Wild runs through recent portfolio performance.

11th March 2025 08:59

by Lee Wild from interactive investor

For some years, the UK stock market has significantly underperformed its US counterparts and many other overseas exchanges. But 2025 has started very differently, with UK investors having plenty to cheer about.

As it did the month before, the FTSE 100 made a record high in February, this time reaching a peak of 8,820. Remember, it ended 2024 at 8,173, so the gain to last month was 8%. Other main UK indices also finished the month in positive territory, putting their American cousins in the shade. The S&P 500 fell 1.4%, the Dow Jones 1.6% and the Nasdaq Composite tech index 4.0%.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Rolls-Royce Holdings (LSE:RR.) was a star performer, adding 23% for the month following excellent annual results and a much-anticipated boom in defence spending. BAE Systems (LSE:BA.) joined the rally on military spending expectations, while the bank sector charged ahead, with Lloyds Banking Group (LSE:LLOY), Standard Chartered (LSE:STAN), NatWest Group (LSE:NWG) and HSBC Holdings (LSE:HSBA) all up over 10%.

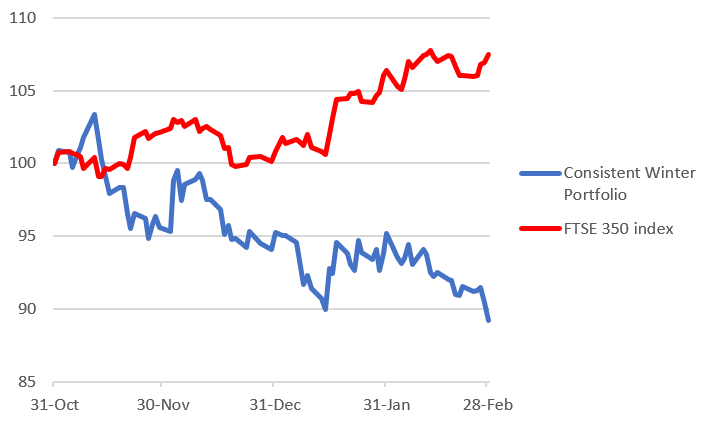

Wild’s Consistent Winter Portfolio, made up of the five FTSE 350 companies that have risen the most winters (between 1 November and 30 April) over the past decade, dropped 6.3% in February, extending losses for the first four months of this six-month strategy to almost 11%.

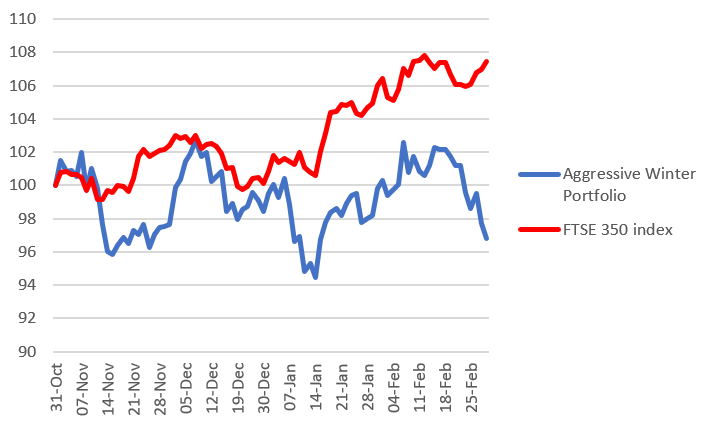

We relax the entry criteria slightly for Wild’s Aggressive Winter Portfolio, giving up some consistency in return for potentially bigger profits (all constituents are up at least 80% of winters over the past decade). This portfolio eased 3.4% over the month and is now down 3.2% since launch. The FTSE 350 benchmark index generated a monthly gain of 1% and is now up 7.5% this winter.

Wild’s Consistent Winter Portfolio 2024-25

Past performance is not a guide to future performance.

This is meant to be a reliable portfolio, but the first four months of this winter’s strategy have been disappointing. Now is normally the point where I blame Keller Group (LSE:KLR) for dragging the portfolio lower, but instead the dog of this month’s portfolio is discoverIE Group (LSE:DSCV).

Despite some volatility, the electronic components company had looked good until the third week of January, which is when the slide began. And it continued through February. Shares ended last month with a 15% loss and down almost 18% this winter.

- Shares round-up: reasons to be cheerful at Keller and Intertek

- Stockwatch: is talk of recession overly pessimistic or fair?

Analysts have blamed share price weakness on concerns about the impact of US tariffs on imports from Mexico and China, and maybe the EU at some point in the future. Deutsche Bank experts believe the direct impact is limited, but that tariff noise complicates recovery narrative. It still rates the shares a ‘hold’ and maintains a 765p price target. I hope they’re right.

Both engineering contractor Keller and precision instrumentation firm Spectris (LSE:SXS) lost 5.2%. The former dipped ahead of annual results at the start of March, although the numbers were well-received, which will hopefully be reflected in my report in a month’s time. There were positives in full-year figures from Spectris, but not enough to outweigh concerns about it being “too early to state that we are seeing a sustained recovery in end markets”.

Food packaging company Hilton Food Group (LSE:HFG) lost over 3% and self-storage provider Safestore Holdings Ordinary Shares (LSE:SAFE), the worst-performing winter stock so far, was actually the best performer this time with a modest 1.7% monthly decline.

Wild’s Aggressive Winter Portfolio 2024-25

Past performance is not a guide to future performance.

There were two risers in the aggressive portfolio last month - copper miner Antofagasta (LSE:ANTO) and hospitality real estate company PPHE Hotel Group Ltd (LSE:PPH), up 0.5% and 0.4% respectively.

Antofagasta’s annual results went down well. It’s benefiting from rising copper prices, has announced a smaller-than-feared decline in the dividend and is spending heavily on growth projects.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Trading Strategies: a FTSE 100 cyclical share to tuck away

Meanwhile, PPHE reported record annual revenue and an 8.7% increase in underlying profit on a like-for-like basis. While still early in the year, bosses expect results for 2025 to meet expectations, so watch out for revenue of between £448.7 million and £477.4 million, and an EBITDA range of £147.3 million to £158.6 million.

Intermediate Capital Group (LSE:ICG) shares fell 3.7%, trimming the winter gain to 10.7%, although there’s no company-specific news flow to affect the private equity investment.

With Keller appearing in both portfolios this year, it’s Morgan Sindall Group (LSE:MGNS) that brings things to a close this month. The construction and regeneration business fell 9.6% in February after announcing full-year results. Losses came despite record results and upgrades to medium-term targets. Ending the month at 3,330p, analysts at Deutsche Bank think they should be nearer 4,000p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.