Woodford Income Focus re-opens – what has changed?

The fund has reopened under the name ASI Income Focus fund, with a major portfolio shake-up.

14th February 2020 09:31

by Tom Bailey from interactive investor

The fund has reopened under the name ASI Income Focus fund, with a major portfolio shake-up.

LF ASI Income Focus fund, previously named Woodford Income Focus, has reopened, with investors now able to either buy or sell.

The fund was suspended on 15 October following the resignation and subsequent closure of Woodford Investment Management. Investors have since been trapped in the fund.

The takeover of the £268 million fund by Aberdeen Standard Life’s Thomas Moore and Charles Luke was announced in December.

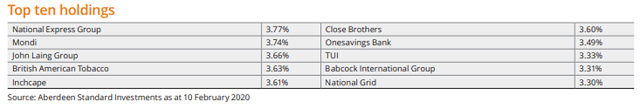

Since taking over the managers have made wholesale changes to the fund, evidenced by the fact that only two of Woodford’s top 10 holdings have been retained: British American Tobacco (LSE:BATS) and Babcock International (LSE:BAB).

What has changed?

According to a fund update published ahead of its suspension being lifted, the managers “have prioritised exposure to our highest conviction income ideas, improved the liquidity profile of the underlying holdings, increased the portfolio’s sector diversification and sold down structurally challenged companies.”

New holdings including UK-facing stocks such as Close Brothers (LSE:CBG), SSE (LSE:SSE) and Assura (LSE:AGR). Several international-facing companies have also been included, such as Coca-Cola Hellenic (LSE:CCH), TUI Group (LSE:TUI) and Ashmore (LSE:ASHM).

The fund’s top 10 holdings now look significantly different to the final days of the fund under Neil Woodford’s management.

As the tables below show, the fund’s top holdings listed in its August 2019 factsheet were heavily weighted towards housebuilding companies such as Barratt Developments (LSE:BDEV), Vistry Group (LSE:VTY) and Taylor Wimpey (LSE:TW.).

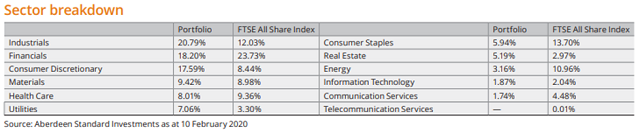

As the table below shows, this is no longer the case under new management. Indeed, none of the fund’s previous top holdings managed to keep a spot in the fund’s new top 10. Sector exposure has also seen big changes, with exposure to financials significantly increased to what it was before.

Another crucial change is that new management have lowered the income target of the fund.

Ryan Hughes, head of active portfolios at AJ Bell explains:

“Those investors who originally invested in the fund for income need to be aware that the fund has changed its income target from ‘5p per share per annum’ to ‘a yield higher than the average yield of the FTSE All Share index over a rolling three year period’. This means the income paid on the fund is likely to be lower going forwards than before.”

Performance so far

Since the start of the year, the fund has underperformed the FTSE All Share index by 4%.

Partly this was the result of the transaction costs of making changes to the portfolio. As well as introducing new holdings, the managers note “there were certain inherited stocks that proved relatively costly to dispose of.”

The new managers cite Honeycomb Investment Trust as a particular example. The sale of this top 10 holding is claimed to have created a drag on performance of roughly 0.64%. They explain:

“This is a highly illiquid stock with a significant ongoing overhang from large shareholders perceived by the market to be likely sellers. As such, it was necessary to place the stock at a discount to the prevailing market price.”

The new managers also argued that performance was held back by the poor performance of other inherited holdings such as Card Factory (LSE:CARD). They blame this holding for contributing roughly 1.23% of the fund’s underperformance due to poor Christmas trading. The stock has since been removed from the portfolio.

Meanwhile, the shock of the coronavirus has weighed on some of the fund’s new holdings such as TUI Group (LSE:TUI) and Inchcape (LSE:INCH).

The fund’s new managers say:

“With its repositioning now substantially complete, the portfolio is, we believe, now strongly positioned to provide attractive total returns”.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.