10 small-cap dividend stocks to bounce after the election

After years of negative sentiment, UK small-cap shares could rally if the Tories win a majority.

11th December 2019 13:19

by Ben Hobson from Stockopedia

After years of negative sentiment, UK small-cap shares could rally if the Tories win a majority.

If you believe the polls, the outcome of this week’s General Election will see Boris Johnson back in Number 10 in time for Christmas. If the current PM does retain power and wins a majority for the Conservatives (which is far from certain), how might the stock market react and which shares might benefit?

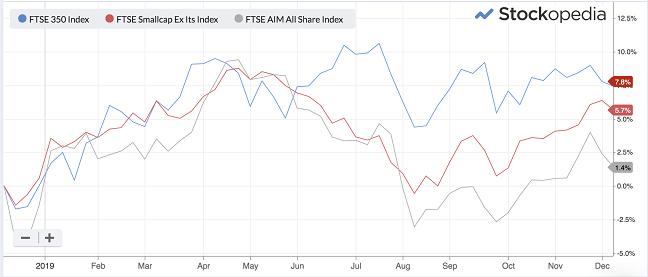

Among the potential winners of this scenario playing out are British small-caps. Since last autumn, when the market fell sharply, mid- and large-cap indices have done a decent job of recovering, but not so the small-caps. Both the AIM All-Share and FTSE Small-Cap have underperformed a more resilient FTSE 350:

Past performance is not a guide to future performance

Arguably, small-caps have suffered more acutely from a haze of uncertainty caused by the election itself and the all-consuming issue of Brexit. At the smaller, riskier and more unpredictable end of the market, this kind of heightened concern spooks investors. Many will be watching and waiting to see how events unfold.

A regular theme in press commentary about what will happen next is what is being called the “Boris Brexit bounce”. The argument is that equity prices have suffered from several years of negative sentiment and that a Conservative majority could offer enough clarity to trigger a market rebound.

Brexit - like it or not - would be more likely to progress unimpeded and the economic outlook for smaller UK-oriented companies would arguably be more certain. In turn, a strengthening of the pound and an improvement in consumer confidence would also boost domestic-facing companies.

So how can you go about finding these kinds of shares?

One option is to focus on higher-quality, small-cap dividend payers. Dividends aren’t often associated with fast-growing smaller shares, but the landscape on this front has changed a lot in recent years. More than £1.1 billion was paid out in dividends by AIM companies in 2018, and the payouts have tripled since 2012. The prospective yield on AIM stocks stands at around 1.5% - not exactly eye-catching for income hunters, but, if you dig around, it is possible to find higher forward yields without making too many compromises.

With this in mind, this week’s screen looks for AIM and FTSE SmallCap shares with a minimum forward dividend yield of 4%. Each needs a track record of dividend growth and forecasts needed to show further dividend growth next year.

In addition, each company needs a Quality Rank of more than 80, putting it in the top 20% of the market for financial strength. The one-year relative price strength of each stock should also be positive (to minimise the chances of finding dividend traps).

Headlam (LSE:HEAD) and Morgan Sindall (LSE:MGNS) are the only FTSE SmallCap shares to pass the rules, with the rest being AIM companies.

| Name | Mkt Cap £m | Quality Rank | 1-Year Relative Strength % | Forward Yield % | 1-Year Forecast Dividend Growth | Sector |

|---|---|---|---|---|---|---|

| Polar Capital (LSE:POLR) | 515.9 | 97 | 5 | 6.5 | 1.9 | Financials |

| Belvoir (LSE:BLV) | 42.5 | 87 | 22.7 | 6.3 | 2.9 | Financials |

| Epwin (LSE:EPWN) | 137.2 | 86 | 10.9 | 5.8 | 4.1 | Cyclicals |

| Headlam (LSE:HEAD) | 410.9 | 87 | 8.6 | 5.3 | 0.2 | Cyclicals |

| Gateley (LSE:GTLY) | 197.3 | 82 | 21 | 5.2 | 8.2 | Industrials |

| Property Franchise (LSE:TPFG) | 50.5 | 99 | 52.5 | 4.4 | 1.2 | Financials |

| H&T (LSE:HAT) | 129.1 | 90 | 22.1 | 4.2 | 7.7 | Financials |

| Frenkel Topping (LSE:FEN) | 26.4 | 98 | 6.77 | 4.18 | 8.53 | Financials |

| Morgan Sindall (LSE:MGNS) | 673.1 | 81 | 26.2 | 4.1 | 8.49 | Industrials |

| Mortgage Advice Bureau (LSE:MAB1) | 364.9 | 99 | 28.4 | 4.09 | 7.15 | Financials |

There’s an interesting weighting towards financial stocks here, particularly in the lettings and home-buying space, with Belvoir (LSE:BLV), Property Franchise (LSE:TPFG) and Mortgage Advice Bureau (LSE:MAB1) passing the rules. All three have highlighted the effects of “Brexit uncertainty” over the past year - likewise, the flooring distributor Headlam (LSE:HEAD) blamed Brexit for a lacklustre performance in its home market last year.

Others seem perturbed, with building products business Epwin (LSE:EPWN) and engineering contractor Morgan Sindall (LSE:MGNS) seeing no impact on their businesses.

Will there be a Boris Brexit bounce?

Making forecasts about politics and stock markets is perilous. With the outcome of the election (and Brexit) far from certain, it’s tricky to predict how things might go. But in the event that the Conservatives win a majority, it will be fascinating to see whether it lifts the haze of uncertainty over British small-caps and how the market will respond.

About Stockopedia

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

- Interactive Investor readers can enjoy a two-week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.