The active funds with strong performance and low fees

We run through this data ranking of active funds based on a combination of performance and low charges.

12th November 2019 16:20

by Tom Bailey from interactive investor

We run through this data ranking of active funds based on a combination of performance and low charges.

Over the past decade investors have become much more fee conscious. This is in response to passive investment products, such as in index funds and ETFs becoming much more widely available to investors, while the providers of such products have pursued a strategy of aggressively cutting fees.

On top of this, the fees paid by active managers have come into much more scrutiny in recent years. Numerous studies pointed out that after fees many fund managers fail to consistently outperform the market. In addition, the compounding drag of high investment fees has received greater attention.

As a result, investors of active managed funds now expect a combination of strong performance and reasonable fees.

With this in mind, online broker Chelsea Financial Services has compiled data ranking active funds based on a combination of performance and low charges.

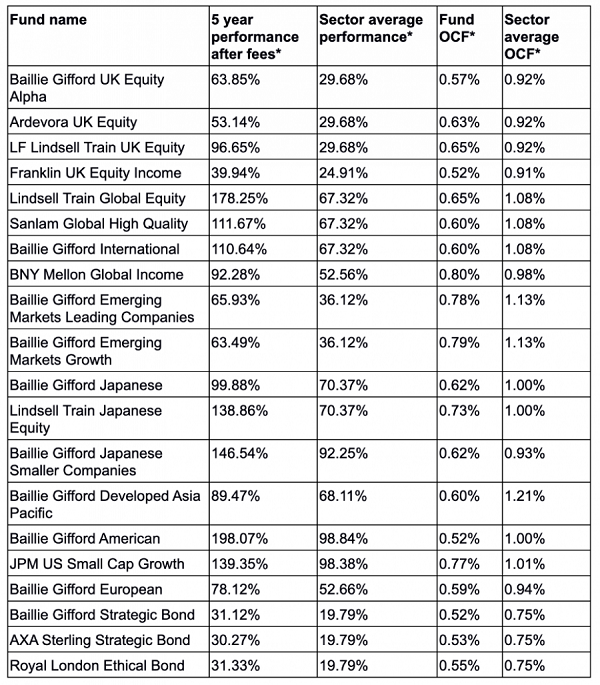

The table below ranks funds that are in the top 10% of performers (net of fees) of their respective Investment Association fund sector over a five-year time period; alongside also being in the bottom 10% for fees, as measured by the ongoing fund charge figure.

As can be seen, Baillie Gifford is the most represented fund group in the table, with a total of 10 out of the 20 funds included managed by the Edinburgh-based investment manager. Baillie Gifford UK Equity Alpha tops the table with its five-year performance over double that of the sector average with a fee almost 40% lower than the average fund in the sector.

Commenting on the data, Darius McDermott, managing director of Chelsea Financial Services, notes: "Some companies are able to provide the holy grail for investors: good active management at very reasonable prices. And those that are demonstrably passing on economies of scale to their investors – not only on funds that are hard to sell, but also those funds that are performing well and are popular – are to be commended.

"Baillie Gifford is a very good example of this, having cut the fees on a large number of its funds over the past year or so.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.