AIM market's General Election winners and losers

Our award-winning AIM writer explains which stocks could profit from promises made in party manifestos.

29th November 2019 15:38

by Andrew Hore from interactive investor

Our award-winning AIM writer explains which stocks could profit from promises made in party manifestos.

All the political parties have published their manifestos for the 2019 General Election, and they could have a significant effect on some AIM companies.

Conservatives and Labour are trying to outbid each other in terms of how much they would spend on capital projects. Although the other parties may not form a government on their own, they also have policies that they may want to persuade a potential government partner to take on.

Some policies have been mentioned during the election but have not been included in the manifestos.

Tax incentives

Tax incentives are important to AIM and they have helped to improve demand for shares on the junior market. Any changes to the existing incentives could have a significant effect on AIM and individual companies’ ability to raise money.

Inheritance tax (IHT) relief, Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCT) are all important for AIM.

There has been talk of getting rid of IHT relief on quoted companies, or at least rejigging it so that the benefits are more targeted and not received by outside investors with no historic link to a business.

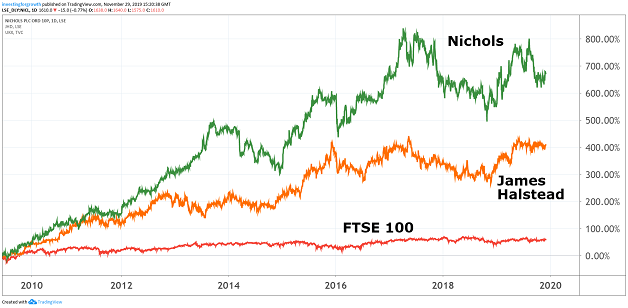

If IHT relief were removed, then it would have a knock-on effect on the share prices of companies, such as Nichols (LSE:NICL) and James Halstead (LSE:JHD), whose high valuations can partly be put down to IHT portfolios investing in the shares.

Source: TradingView Past performance is not a guide to future performance

It could also hamper the flow of new money into AIM companies.

Labour talks about reforming the "inefficient system of tax reliefs". Previous plans for replacing IHT with a lifetime gift tax were not included in the manifesto, but have been mentioned during the campaign. This statement could also cover EIS and VCTs, but it is not clear.

Generally, EIS and VCTs do not come up in the manifestos, except the Conservatives saying that Seed EIS and EIS will continue in the next Parliament.

Capital gains tax

The Conservative Party says that it will review entrepreneurs’ relief. Labour and Liberal Democrats want to scrap the capital gains tax allowance. Labour plans to tax gains at the marginal tax rate.

This may change the relative attractiveness of income (dividends) and gains. Although Labour plans to scrap the lower rate of tax for dividends. That could affect the dividend decisions of companies.

Corporation tax

The Conservatives no longer intend to reduce the corporation tax rate from 19%. Liberal Democrats want to move it back to 20%, while Labour would put the rate up, but it would be at a rate lower than in 2010. The starting level was 21% and profit over £1.5 million was taxed at 28%.

- AIM stocks, elections and what to expect on December 12th

- Like AIM and small-company shares? Check out ii’s Super 60 recommended funds

The tax losses of companies could increase in value on the balance sheet if the corporation tax is higher.

Retail

Business rates are a particular burden for high street retailers. Labour says that it would “review the option of a land value tax on commercial landlords as an alternative”, but that appears likely to increase rents.

Liberal Democrats want to do something similar and replace business rates in England with a commercial landowner levy based on the land value of commercial sites.

The Conservatives mention that they will cut business rates for small retail businesses and pubs. There will also be a “fundamental review” of the system of business rates.

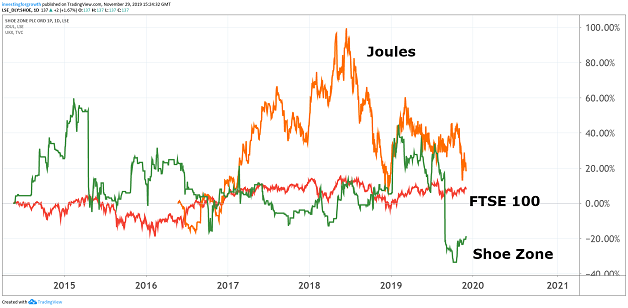

Depending on the knock-on effect, changes to business rates could help retailers such as Shoe Zone (LSE:SHOE) and Joules (LSE:JOUL).

Source: TradingView Past performance is not a guide to future performance

Housing

All the parties want more homes built, with differences in the mix of social and private housing. That should be good news for housebuilders, although higher energy efficiency and other standards could mean higher costs and greater regulation.

The Liberal Democrats want longer tenancies in the private rental sector – three years or more – with rent rises linked to inflation. They also want to establish a help to rent scheme to provide tenancy deposit loans for the under 30s.

Sigma Capital (LSE:SGM) is involved in the private rental sector and demand for rental housing will remain strong, whichever policies are actioned. Watkin Jones (LSE:WJG) is increasing its exposure to private rental construction. Three-year contracts for tenants should not necessarily be an impediment to investment in the sector.

Energy

Conservatives reaffirmed their pledge of a net zero economy by 2050. Liberal Democrats talk of generating 80% of electricity from renewables by 2030.

Labour says it will deliver nearly 90% of electricity and 50% of heat from renewable and low-carbon sources by 2030. There will be investment in wind, solar and nuclear power. Greens are against nuclear power and want wind to produce 70% of energy by 2030 and other renewable sources, including solar and tidal, most of the rest.

- 10 high-quality AIM shares for growth company investors

- The Woodford AIM shares patient investors should monitor

Labour also talks about potential for tidal energy, as does the SNP. This would be good news for SIMEC Atlantis Energy (LSE:SAE), which already has the MeyGen project up and running in Scotland. It is Energy storage is another area where many of the parties want to invest in developing technologies. That could be good news for advanced materials developer Ilika (LSE:IKA), which is involved in research in batteries and energy storage.

Broadband

Labour wants to provide free fibre broadband by 2030, beginning with those that are currently worst served by broadband. This involves nationalising the broadband interests of BT (LSE:BT.A).

The Liberal Democrats want to prioritise small and medium-sized businesses in the roll-out of hyper-fast broadband.

The SNP says it will work with broadband providers to make more affordable tariffs. The Brexit party talks about free basic internet for the deprived.

The Bigblu Broadband (LSE:BBB) share price has hardly moved since the Labour nationalisation proposal was announced. It supplies satellite-based broadband to people who are not easy to connect. Bigblu is likely to remain the best option for these hard to reach areas. There are already government grants to finance installation and more are promised.

Subsidiary Quickline is also investing in fixed wireless broadband in areas where fibre is considered uneconomic.

It should be noted that Bigblu is an international business, so it is not dependent on the UK, which is 30% of revenues.

Oil and gas

Labour is proposing a windfall tax for oil companies. There is no indication what level this will be, but any AIM company with UK interests could be hit. Serica Energy (LSE:SQZ) and Hurricane Energy (LSE:HUR) are two of the larger AIM-quoted UK-focused oil and gas companies. Both are moving into profit, but it is uncertain whether the tax would be based on profit, production levels or some other measure.

Greens want a carbon tax on oil extraction in the UK and on imports.

The Conservatives are supportive of North Sea oil & gas and talks about “a transformational sector deal” for the move to a net zero carbon economy. There is no detail about what this means.

The SNP wants government oil and gas revenues to be ring-fenced and used for a net zero fund for the transition, including finance to diversify cities, such as Aberdeen, which are currently dependent on the oil and gas sector.

The Conservatives have put a moratorium on fracking and say that they will not support it “unless the science shows categorically that it can be done safely”. Labour, Liberal Democrats and Greens want to ban fracking and the SNP says that they will not issue licences or support development of unconventional oil and gas – that is coal bed methane as well as fracking.

That is not good news for UK Oil & Gas (LSE:UKOG), IGas (LSE:IGAS) and Egdon Resources (LSE:EDR), which have fracking-based potential projects. However, they do have other non-fracking projects they can develop.

Training

Labour will make it easier for employers to spend the apprenticeship levy on a wider range of accredited training, but one quarter would have to be spent on climate apprenticeships for developing skills in clean technology.

The Conservatives will set up a national skills fund to finance training for individuals and small companies.

Liberal Democrats would introduce skills wallets giving each individual £10,000 to spend on training and education, with an initial £4,000 at 25-years-old. The money would have to be spent on approved courses. They would also evolve the apprenticeship levy into a skills and training levy with one-quarter of the funds going to those with the greatest need for skills.

Staffline (LSE:STAF) has had problems over the past year, but training was profitable in the first half of 2019 and its margins are higher than the recruitment operations. It is in a good position to benefit from additional spending on training.

Nationalisation

Nationalisation of water and rail would not directly affect any AIM companies, but there are suppliers of services to these industries. Engineering services provider Renew Holdings (LSE:RNWH)has significant business in the water and rail sectors.

Renew chief executive Paul Scott does not believe that this is a concern for the business. In fact, the level of capital investment promised by the political parties will be difficult to spend on new projects, at least initially, and Renew is likely to benefit if the spend goes into maintenance projects.

Gambling

Labour will introduce a new Gambling Act with a levy for problem gambling and ways to enable consumer compensation. They would also curb advertising in sport. The Liberal Democrats want to ban the use of credit cards for gambling, introduce a levy on gambling companies to research and treat problem gambling and restrict advertising.

Most of the AIM-quoted online gaming businesses have been taken over or moved to the Main Market. GAN (LSE:GAN) is focused on the US online opportunity so won’t be hampered by changes in the UK.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.